BHP ups bid for OZ Minerals, market flat, NIB Holdings jumps on sales

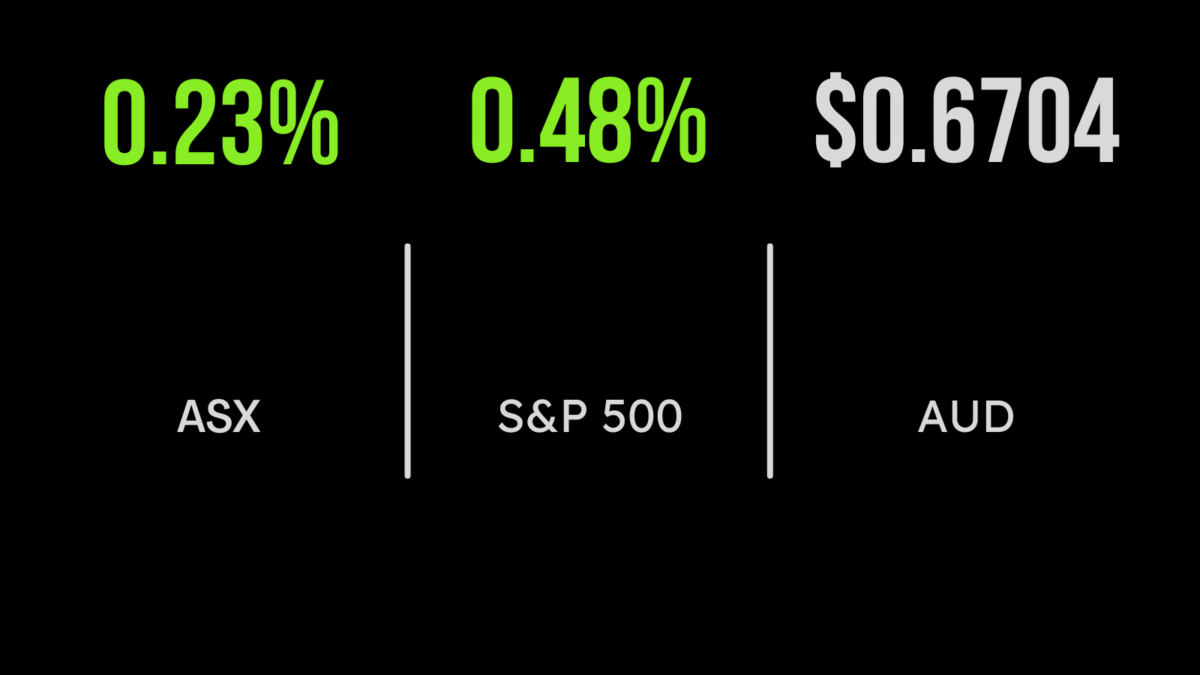

All eyes were on the materials sector on Friday, after BHP (ASX: BHP) lobbed a best and final bid for copper producer OZ Minerals (ASX: OZL). The offer of $28.25 per share was approved by the board and will now proceed to due diligence. Despite the size of the offer, the market barely moved with the S&P/ASX200 gaining 0.2 per but once again losing 0.1 per cent for the week after reaching a five month high on Monday. The largest detractor remains the energy sector as the threat of a slowdown in growth hits input prices, while the industrial sector led the way, gaining 0.9 per cent. Discount jeweller Lovisa (ASX: LOV) fell 7.1 per cent despite the company reporting a significant 16 per cent increase in same store sales for the prior quarter. Shares in troubled builder and engineering firm Lendlease (ASX: LLC) also fell by 1.6 per cent after the Chairman warned of deteriorating economic conditions and the potential impact on the company. Across the week to the two combatants in funds management’s most talked about merger went in opposite directions, with Perpetual (ASX: PPT) falling 22 per cent and Pendal (ASX: PDL) gaining 15 per cent following the revision of their deal.

S&P, Dow gain but down for the week, Gap reports strongly, economic data weakens

A swathe of weakening economic data wasn’t enough to push global markets lower on Friday, with the Dow Jones gaining 0.6 per cent, the S&P500 0.5 and the Nasdaq 0.1 per cent higher. A series of releases show the challenge facing policymakers with existing home sales falling 5.9 per cent in October, taking the 12-month fall to 28 per cent. The leading economic index, a predictor of future performance, fell 0.8 per cent, twice that predicted by leading economists. This news came as another Federal Reserve member suggested the cash rate could peak between 5 and 7 per cent, with either end of the spectrum having significantly different outcomes for investors. In company-specific news, retailer Gap Inc (NYSE: GAP) was the latest to post a strong result in difficult conditions, gaining more than 7 per cent. The company delivered a reversal of recent losses and reported growth of 1 per cent in same-store sales and 5 per cent from e-commerce. Chinese retailer JD.com (NYSE: JD) is also showing signs of improvement as revenue growth jumped 11 per cent and the company returned to profit. Across the week, all three benchmarks were lower, with the Dow Jones falling 0.1, the S&P500 0.7 and the Nasdaq 1.6 per cent.

AGL and ESG, Twiggy flexes private power, OZ Minerals and green metals

The power of private capital and lobbying was on show this week as the billionaire Mike Cannon-Brookes and a number of aligned investors were able to force change at Australia’s biggest carbon emitter, AGL Energy (ASX: AGL). Despite owning around 10 per cent of the company, the group lobbied for a significant change to the board which will set the company on the course to catch up with growing market expectations around decarbonisation and closing down its coal generation assets. It was a similar story for Andrew Forrest who this week committed to investing as much as US$500 million from his personal wealth towards the reconstruction of the Ukrainian economy in light of the impacts of the war with Russia. ESG or environmental, social and governance issues are intertwined through everything we do in 2022, something that was on show this week after BHP bid for OZ Minerals, the producer of ‘green metal’ copper, which is central to battery production. It remains to be seen how green the production of metals can become, but there is little doubt these commodities remain central to any shift.