Big picture macro risks are fading: Panel

While investor sentiment teeters on the whim of central banks that may or may not be on the cusp of cutting interest rates en masse, investment committee members at The Inside Network’s Investment Leaders Forum in New Zealand largely agreed that the macro-economic environment is relatively benign – regardless of the next direction interest rates take.

Kicking off a panel discussion around the current market sentiment and macro conditions, Evans & Partners chief investment officer Tim Rocks set the tone by venturing that a lot of the risks keeping investors awake over the last few years have effectively dissipated.

“Over the last couple of years we’ve been so focused on what could go wrong, but I think by any objective consideration the big picture risks are actually fading,” Rocks said. “If we go back two or three years, inflation persistence [and] some kind of China financial meltdown were the big events that could have led to long-term market consequences and affected returns. I actually think those big picture risks have faded, and it’s actually a pretty good environment for investing now.”

While a lot of people remain focused on “20 different ways the world could end”, Rocks continued, company profitability levels are “pretty strong” and the global outlook is “broadening”. That China meltdown is off the table, at least for now, and Europe “as well as parts of emerging markets” are in more robust shape.

Of course, there are always risks swirling in the macroeconomic environment, he said, highlighting the concentration of tech stocks at the top end of the US index and questions around bond duration. “These are some of the things we’re going to be talking about,” Rocks added. “But as a whole I think the macro is actually unrecognised for how good it is.”

Not higher for longer

Providing a local perspective, Forsyth Barr Investment Services head of wealth management research Matt Henry said he “largely agrees” with Rocks’ positive view on a global level, despite a “pretty dire” domestic economic environment.

“Hopefully we get a rate cut tomorrow and that trajectory changes,” he said (a wish that was subsequently obliged by the New Zealand central bank).

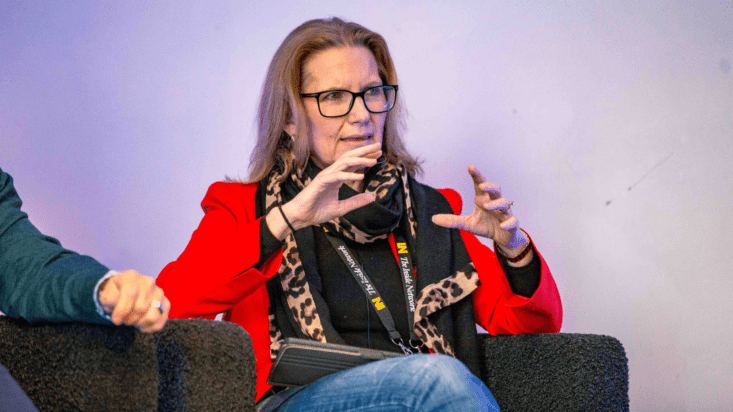

Escala Partners chief investment officer Tracey McNaughton (pictured) took a balanced view, saying there were arguments for global rates going both north or south. She fell on the side of falling rates, however, remaining “unconvinced” they would stay higher for longer due to “extraordinarily high” government debt, which is starting to impinge upon growth in some countries.

It may take a little longer in Australia than elsewhere, she said, but there are reasons to believe rates will fall back faster than some believe.

“The other deflationary force is the productivity improvements that are going to come from artificial intelligence,” McNaughton added. “I know it’s hard to measure, but that’s a deflationary force. So I’m not convinced, I think inflation actually is coming down reasonably quickly. I think it’s coming down faster than expected.”

Sign of confidence

Craig Emanuel, co-founder and managing partner at Sydney wealth managers Emanuel, Whybourne & Loehr, said he was “in camp” with both McNaughton’s view on the rates coming down sooner rather than later, and the broader perspective that the global macroeconomic position was relatively robust.

“Australian Retirement Trust, which manages about $300 billion, announced yesterday that every single member under the age of 50, moving forward, will be set at a high growth profile, which is pretty incredible,” he said. “I think it really shows that in the long term, clients will do a lot better in growth assets.”