Bond surge sends ASX lower, ANZ profits soar

ASX weakens on energy sell off, Boral jumps as Pointsbet tanks

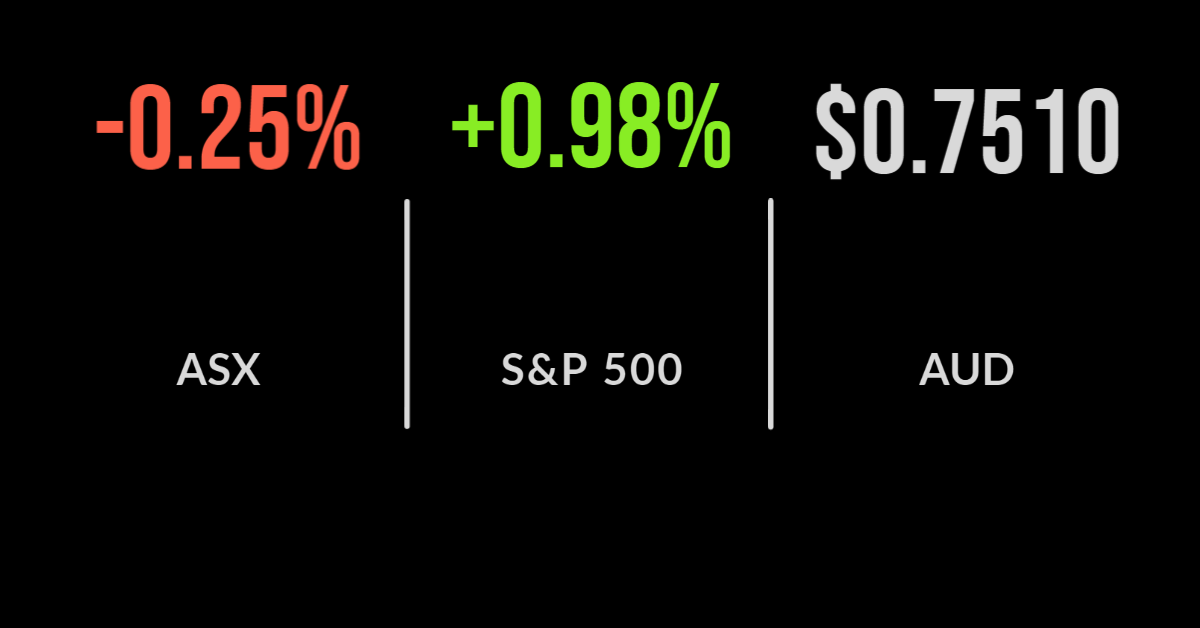

The S&P/ASX200 (ASX: XJO) finished 0.2% lower on Thursday dragged down by the energy sector, which fell by 2% after the coal price continued to fall significantly.

A nuclear accord between the EU and Iran was also cited as a reasoning for the weaker oil price.

Boral (ASX: BLD) overcame weakness in the materials sector, which fell 1.2%, gaining 4.6% after management announced that the pandemic hit to asphalt and concrete sales was less than expected.

The group took a $33 million hit to earnings, well below the $50 million anticipated with group revenue falling just 1%.

The financial sector gained 0.2% after ANZ Bank (ASX: ANZ) delivered a 65% increase in profit, which hit $6.2 billion.

The result benefitted from the reversal of $500 million in debt provisions and sees the group’s equity level back to 12.3%.

The dividend was more than doubled to 72 cents per share but it wasn’t all good news with management reporting that loan growth was barely positive as the group struggled to deal with and process an influx of loan applications.

IOOF outflows grow, Reece sales upgrade, Fortescue’s new record

Asset management and financial advisory group, IOOF Ltd (ASX: IFL) was among the worst performers on the market, falling close to 9% after delivering a weaker than expected update.

The group which acquired MLC’s wealth division in 2020 reported $2.3 billion in outflows from their various businesses.

Whilst these were offset by some $5 billion in market gains it continues the story of investors deserting the major financial institutions.

Funds under management in their in-house products hit $98 billion whilst funds under advice on their platforms reached $222 billion.

The group has finally broken out their reporting given the risk of double counting.

Reece Plumbing (ASX: REH) offered a positive update to the market, confirming sales were up 13% in the September quarter, with the US growing at a rate closer to 20%.

Management was quick to warn that this is unlikely to be illustrative of the conditions for the full financial year, rather a short-term jump as lockdowns came to an end.

Shares in Pointsbet (ASX: PBH) tanked by over 18% after the company reported larger than expected losses as their massive US expansion of online gambling gathers steam.

US markets rally despite weak GDP, Ford upgrades outlook, Amazon, Apple earnings ahead

US markets all approach all-time highs again on Thursday as earnings season continues to confirm the health of the corporate economy, ultimately being supported by a deleveraged global consumer.

Ford and Tesla (NYSE: TSLA) were among the biggest contributors to a rally in consumer stocks after the former upgraded guidance.

The Nasdaq continues to lead, adding 1.4% as Facebook (NYSE: FB) jumped 1.5% after announcing the decision to change the parent company’s name to Meta in a reference to the metaverse; their next sector of growth.

The S&P 500 and Dow Jones were 1.0 and 0.7% higher after initial estimates showed GDP grew at an annual rate of just 2% in the quarter well below forecasts.

The ECB kept rates and bond buying on hold at current levels.

Shares in Ford (NYSE: F) gained over 8% after the company upgraded guidance for the financial year despite reporting vehicle sales were down nearly 18% on the prior year.

The dividend was reinstated and markets took heart from confirmation that the chip shortage may be slowing.