-

Sort By

-

Newest

-

Newest

-

Oldest

The NZ Superannuation Fund (NZS) has topped up its hedge fund exposure, handing US$100 million to trans-Atlantic global macro-strategy specialist Episteme Capital.

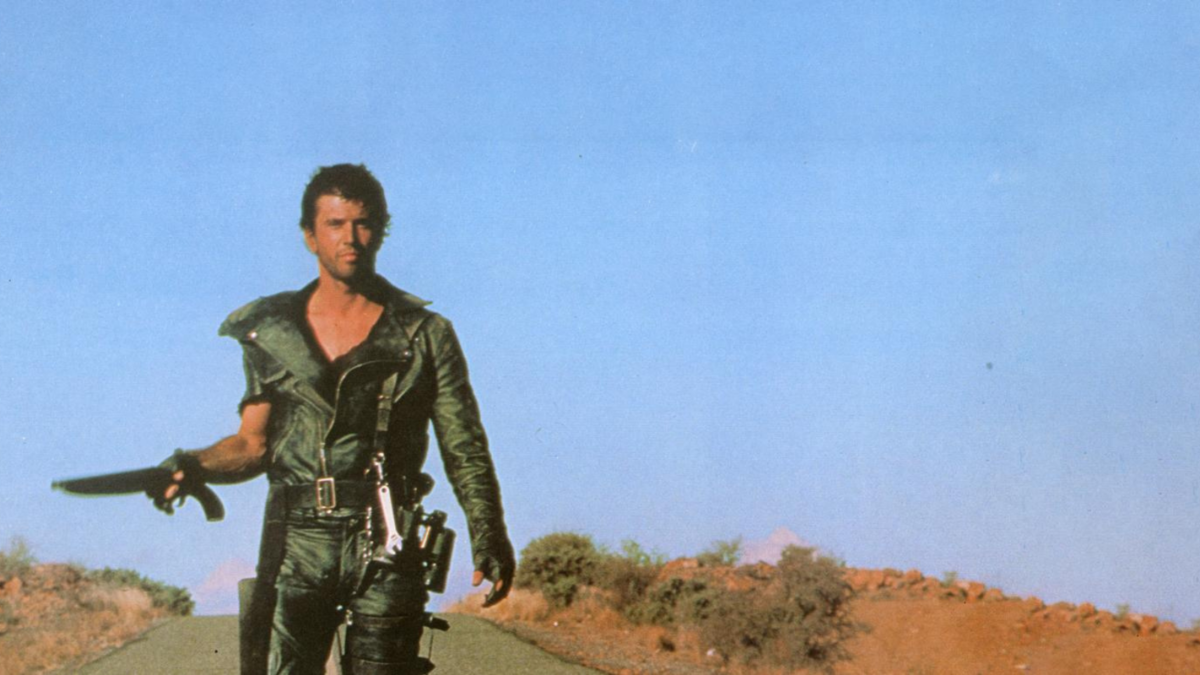

A new fund headed up by several entertainment and finance veterans will back film and television productions in Australia, taking advantage of “huge changes” in the industry that have made streaming content king.

While equities have been the first stop for institutional investors trying to decarbonise their portfolios and back the transition to renewables, fixed income is the next lever they want to pull.

A rethink of the classic 60/40 portfolio and the need to generate consistent income are driving global pension funds deeper into private debt. But this “best in a generation” vintage probably won’t last.

Comparing public and private market performance can be misleading, according to a new study from PGIM, and CIOs need to look deeper into the data.

The Future Fund is thinking of restarting its active equity programs with investments in small caps, according to CEO Raphael Arndt, but commentators are split on whether it will find the returns it needs.

Managed equity funds have experienced their worst outflows since the Covid downturn of early 2020, according to Calastone. Specialist sector funds are feeling the pain too.

Active management and diversification are “essential” in the emerging carbon credit market. TelstraSuper is getting both through a new strategy from Apostle Funds Management.

Private credit is experiencing massive growth at a time when the global economy is changing faster than ever. Investors need to look at where it’s going, rather than where it’s been.

Farming out sustainable investing to passive or low cost options isn’t “for the faint of heart”. In a new world where the winners aren’t as obvious, active management should thrive.

Active managers have been “getting it in the teeth” since the GFC, but that’s about to change as the massive misallocation of capital unwinds. The most valuable companies in the world are trading at a multiple that doesn’t befit their status.

Magellan has flagged acquisitions and the addition of alternatives strategies as part of a five-year plan to reclaim the $100 billion plus heights it last scaled in 2021.