-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Appointments

-

Custody

-

ESG

-

Funds Management

-

Super

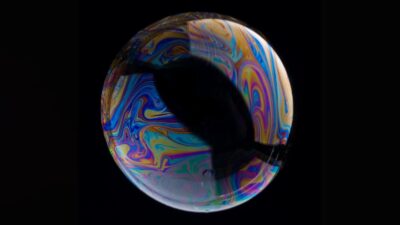

In the first half of 2022 the market fell almost as much as it did when Europe tumbled into World War Two. Then it reversed course – and famed bubble spotter Jeremy Grantham says a new artificial intelligence bubble is the cause.

Australia’s biggest super fund has slashed the headcount in its Melbourne-based global equities team as it prepares to build out a new crew in its rapidly expanding London office.

It’s tempting to think of the latest review into Your Future Your Super as just more regulatory tinkering, but experts think there’s a good chance it will give the industry a real solution to the unintended consequences of the performance test.

The $82 billion fund has picked up a new head of investment execution with a “wealth of expertise” from Citi Securities Services as it looks to enhance its own investment operation platform.

War and plague have disrupted the geopolitical peace over the last three years with far-reaching consequences for international trade and economic growth.

Australia’s biggest super fund is set to increase its investment in the UK to around $35 billion by 2030 and expand its already 100-strong on the ground presence in Kings Cross.

Super funds should start looking in their own region for private debt investments, according to Muzinich and Co., but the lower-middle market in the US also presents a “once in a decade” opportunity.

The return of the Future Fund to active equity management has seen it dip its toes into Japanese equities as decades of low growth and corporate stagnation comes to an end.

The EM story of economic growth and portfolio diversification should work in theory – but what’s worked in practice has been altogether different. Still, gloom around China obscures the many bright spots in a diverse market.

BNP Paribas’ securities services division has done well for itself in the NAB Asset Servicing feeding frenzy, adding a fistful of managers and insurers to its platform in addition to its big Insignia Financial win.

The custodian has leapt up the league tables off the back of its big Australian Retirement Trust win, and it’s now getting ready to transfer a number of former NAS clients to its platform even as it beds down the megafund integration.

The MySuper reforms have seen costs come down and members getting a better deal, according to a decade of data compiled by Chant West, but the laser focus on fees from government and the regulators mean the industry’s opinion is “generally less sanguine”.