-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Appointments

-

Custody

-

ESG

-

Funds Management

-

Super

NZ Super and Australia’s Perpetual Investments have joined a group of global investors in an engagement program involving human rights and the use of facial recognition technology. They are the only Australasian members of a group of 50 fiduciary investors which speak for about US$4.5 trillion (A$5.9 trillion) under management. The initiative was launched by…

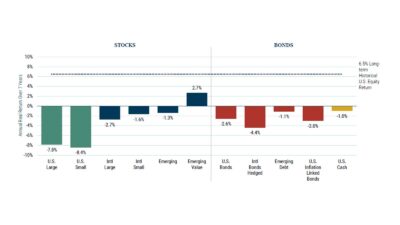

GMO has released its latest borderline-apocalyptic seven-year forecast for stocks and bonds as it warns clients to “concentrate assets where the bubble ain’t”. GMO’s extraordinarily bearish forecasts predict a negative annual real return over seven years across the majority of both stocks and bonds, with only emerging markets value stocks getting a positive, if slim,…

Joseph Lai, the top-performing Asia equities manager who resigned from Platinum Asset Management on December 29 last year, is set to join Fidante’s new boutique, Ox Capital. He will reportedly link up with another long-term emerging markets specialist, Doug Huey. The two had worked together at Platinum, where Huey was an investment analyst, prior to…

Mingshi Investment Management, a staff-owned Shanghai-based China ‘A’ shares specialist, has opened an Australian office with the recruitment of experienced marketer Michael Negline. Mingshi is unusual in several respects. It was founded by two academics, professors Yu Yuan and Robert Stambaugh, who met at the Wharton School at the University of Pennsylvania. It is a…

The long-awaited mega-merger between two global financial services giants, Aon and Willis Towers Watson, has hit a major snag as the US Department of Justice moved to block the transaction. In a statement last week (June 16), the Department of Justice (DOJ) says it had “filed a civil antitrust lawsuit today to block Aon’s [US]$30…

The Australian Council of Superannuation Investors has found that company boards are failing to address sexual harassment despite the issue surging in importance through 2020. ACSI surveyed 118 S&P/ASX 200 companies and conducted in-depth interviews with representatives of 16 of them, finding “a range of maturity” across respondents in managing the material risk of sexual…

Evergreen Ratings has singled out the iPartners for wholesale investors for providing ‘appropriate’ liquidity in an inherently illiquid private debt market. In its latest ratings for the burgeoning private debt asset class, where non-institutional products are starting to take hold for smaller investors, the new ratings service which concentrates on alternatives offerings for wholesale, has…

The main focus for ESG investors, as with many of world’s policy makers and influencers, over recent years has been on the ‘E’. The ‘S’, though, is far from forgotten. The impact of climate change and the measures aimed at achieving net zero carbon emissions will also cause massive disruptions to societies as a whole,…

Martin Currie has launched an inhouse institute to broaden research and the exploration of ideas around asset management stewardship. Super funds and other clients will have input into the topics studied. The global equities manager, a subsidiary of Franklin Templeton, has about US$22 billion (A$28.5 billion) under management across various products, including a big Australian…

With the passage of Your Future Your Super through the Senate, the Morrison Government won a key victory against the superannuation industry. A bigger fight looms over the scheduled SG increase. While it wasn’t quite the utter dismemberment faced by the Government’s industrial relations Bill in April 2021, the YFYS reforms were significantly altered by…

Little known in the broader Australian market, GQG Partners has become a manager of choice for some of the country’s largest investors. The firm is preparing for a push into the wholesale market. When talking to GQG, the name of CIO and founder Rajiv Jain is always a part of the conversation. He and co-founder…

Fiona Reynolds is coming home for good. A visit back to Australia last summer, extended because of covid-19, was not enough. The former chief executive of AIST, who stepped up big time to take the top job at UN PRI in London in 2013, announced last week (June 7) her intention to retire once a replacement…