-

Sort By

-

Newest

-

Newest

-

Oldest

With Cbus eyeing the $100 billion mark, it’s figuring out what it can do well and what should be left to everybody else. And while other funds can’t wait to head overseas, it’s decided to stay home.

One of Australia’s largest super funds is now also one of its largest owners of retirement living assets following the acquisition of 100 per cent of Oak Tree in a demographic play.

The $74 billion industry fund is now managing roughly 10 per cent of its assets in-house, with plans to get more bang for its buck in its sustainable strategies too. But it won’t be abandoning its hybrid model anytime soon.

Unlisted assets deliver high risk-adjusted returns across market cycles but come with inherent challenges, especially around valuation. For super fund trustees, the importance of ensuring accurate valuations to fairness and member equity can’t be overstated, says Frontier Advisors.

At a recent industry discussion of the Financial Stability Council’s new Retirement Income Policy Roadmap, industry leaders said putting greater emphasis on the drawdown phase of superannuation will be key to keeping accumulation balances in check and retirement savings flowing through the economy.

A joint review conducted by ASIC and APRA was scathing of funds’ collective attempts to meet their new legal obligation to help fund members plan for retirement, and urged them to “address, with urgency, the gaps in their approach”.

The prudential regulator is “rigorously targeting” areas of non-compliance it identifies during its massive study of cyber resilience among banks, insurers and superannuation trustees.

Some of the country’s biggest super funds have navigated volatile markets and write-downs in one of their favourite asset classes to deliver solid returns in a tough year.

Riding the equity market rally and significant diversification in its alternatives portfolio has delivered Australian Retirement Trust a 10 per cent return as it keeps both eyes on the end of the rate cycle.

The $72 billion fund has dumped Link Group and partnered with upstart administration services provider Grow Inc. as it navigates a “rapidly changing technology landscape”.

Super funds and other institutional investors are deeply unsatisfied with the nature of private markets fees, but cost-additive pressures are emerging across all asset classes when fees should be falling.

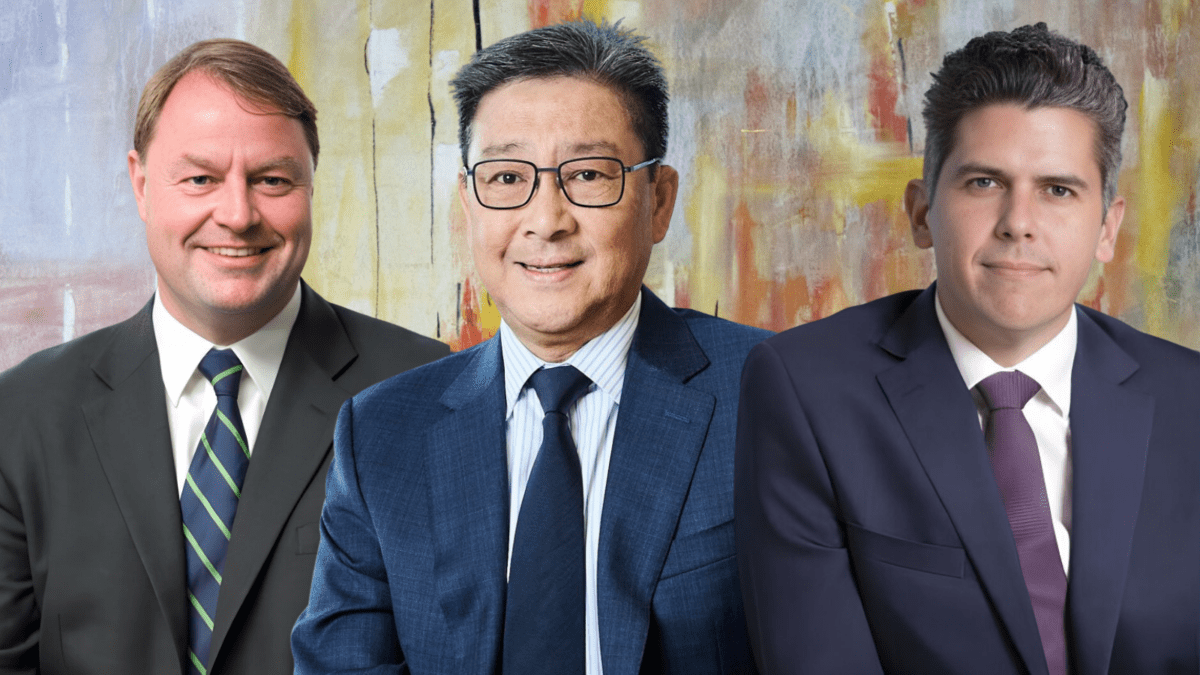

UniSuper’s pioneers of internalisation have set up their own firm providing investment management and advisory services to superannuation funds as competition picks up and the need for a helping hand grows.