China weakness sends market lower, Brambles confirms takeover talks, Qube jumps

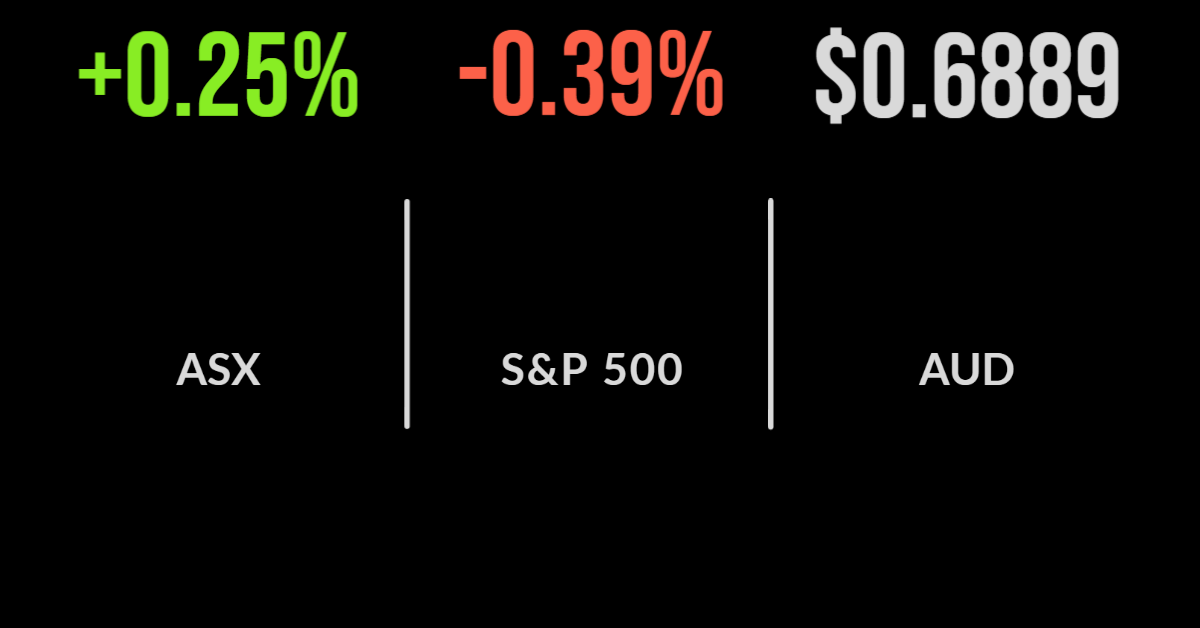

The local market commenced the week on a more positive note, with the S&P/ASX200 gaining 0.3 per cent on the back of a strong performance from the industrials sector, which finished 2.4 per cent higher.

Technology shares also rallied behind the likes of Xero (ASX: XRO) up 2.1 and 4.4 per cent as falling bond yields supported the sector.

Three sectors finished in the red, with healthcare the worst falling 0.6 per cent.

The standout was Brambles (ASX: BXB) which gained 11.2 per cent after management confirmed rumours that they had been approached by private equity firm CVC Capital Partners regarding a potential takeover offer.

It is another in a long line of private equity firms stalking Australia’s old-world businesses.

The company confirmed nothing formal had commenced, as they remain focused on their ‘shaping our future’ campaign to return to growth.

Shares in Infomedia (ASX: IFM) gained more than 28 per cent after the company confirmed they had received a bid from private equity firm Viburnum Funds for $1.70 per share.

China retail sales fall, rates on hold, Cooper upgrades, Qube completes buyback

All eyes were on the Chinese economy as experts around the world reduce growth expectations on the back of extended lockdowns.

Retail sales were confirmed to have fallen 11.1 per cent in April from 2021 as lockdowns hit heavily, almost double the 5.9 per cent contraction expected.

Industrial output also fell 2.9 per cent whilst the bank lending rate was held at lows of 2.85 per cent.

Qube Holdings (ASX: QUB), the vertically integrated ports and stevedoring provider, surged 5.8 per cent after management confirmed the success of their offer amid a bumper year for exports.

Both Calix (ASX: CLX) and Boral (ASX: BLD) finished in the black, after both secured $30 million loans from the Federal Government under their Carbon Capture, Use and Storage project funding.

Smaller oil and gas player Cooper Energy (ASX: COE) gained close to 6 per cent after management increased earnings expectations to $57 to $68 million, a 10 per cent upgrade, whilst Goodman Group (ASX: GMG) did the same, forecasting 23 per cent earnings growth despite supply chain pressures.

Markets mixed on little direction, Aramco usurps Apple, business conditions tank

US markets looked to be recovering lost ground on Monday, with the S&P500 and Dow Jones trading higher but only the latter managing to finish that way, gaining 0.1 per cent on another surge in the oil price.

The S&P500 fell 0.4 and the Nasdaq 1.2 per cent as investors digested the weaker than expected Chinese retail and industrial results.

Of greatest concern was a major shift in the New York Business Conditions index, which plummeted from 36.2 to negative 11.6 points following the latest rate hike.

Investment banks continue to cut growth expectations which now sit at 2.4 per cent in 2022.

The price of wheat is the latest to surge after India announced they would limit all exports amid a domestic shortage due to hot weather.

McDonald’s (NYSE: MCD) fell 0.4 per cent after announcing its exit from the Russian market would cost as much as USD$1.4 billion.

Corporate activity continued in the travel sector with Spirit Airlines (NYSE: SAVE) jumping more than 13 per cent after JetBlue (NYSE: JBLU) launched a bid for the group.