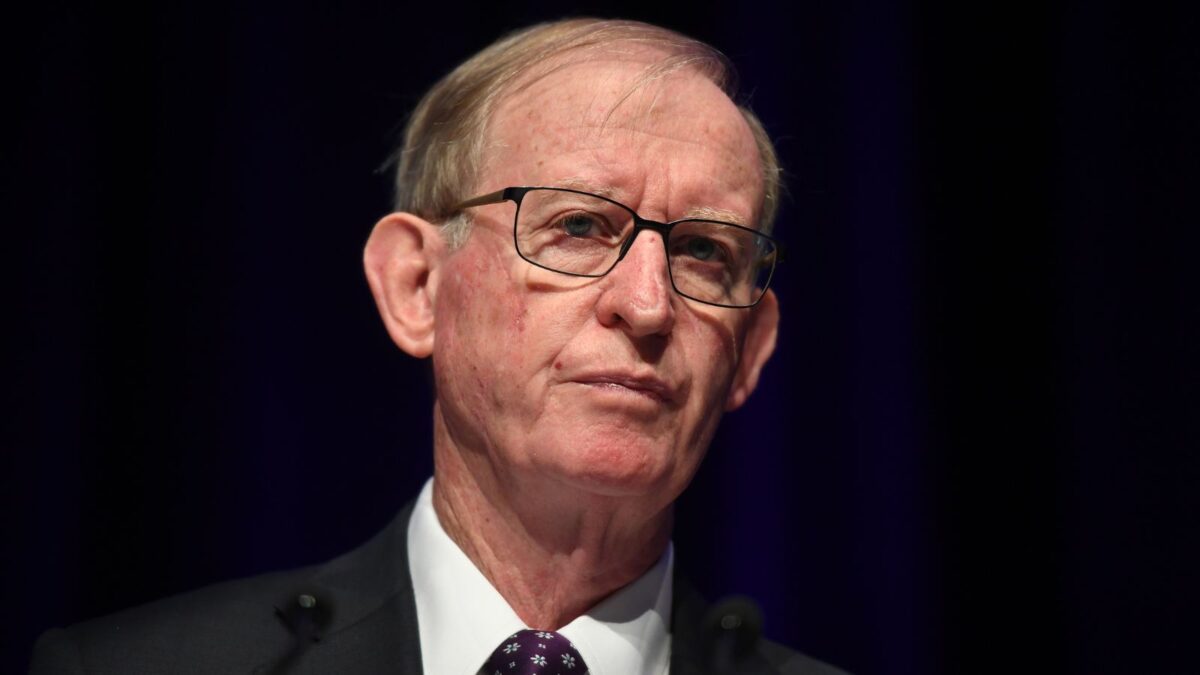

David Murray wades into Future Fund debate

In a paper for the Centre for Independent Studies titled “A Better Future with the Future Fund”, former Future Fund chairman David Murray warned against liquidating the fund to pay down government debt and called upon its management to resist political interference in the face of an increasing number of alternative proposals for the $250 billion of funds it manages.

“Attacks on the Future Fund without due regard for all the facts and proper context give rise to populist pleas to use the money for favourite causes — and distract debate from the issues underlying the national fiscal deterioration since the fund’s inception and what sensible policies might be considered,” Murray wrote. “Often these attacks are infused with an unrealistic optimism of the likelihood of success of alternative proposals.”

Murray’s piece is largely a rebuttal of Dimitri Burshtein’s controversial CIS paper “A Future Without Future Funds” and relies in part on WTW modelling commissioned by the Future Fund to argue the opportunity cost of liquidating it. But he also provides four reasons of his own for why the Future Fund shouldn’t be wound up.

The first is that the gradual depletion of Australia’s natural resources is best managed by reserving savings for future generations, which can only be done through “long-term patient investment”. Secondly, returns from these investments will likely be higher than the government’s cost of funds – and even if the Future Fund runs into significant headwinds, it’s faced them before during the GFC and the Covid pandemic.

Murray also argues that the existence of the Future Fund requires “continual examination of fiscal policy trade-offs for the community” which creates a de facto long-term budget framework, while also giving foreign investors in Australia confidence that they’re putting their money in the right country.

“While the circumstances in 2005 leading to the creation of the Fund have changed, Australia’s fundamental economic framework has not; meaning that the idea of the Fund is as good as ever,” Murray writes. “We could not do it today because net debt is too high and the fiscal position and outlook are too weak. As Peter Costello noted, once the Future Fund is liquidated there will never be another one. Keeping it will only help us through this next phase. We have more debt, more unfunded superannuation liabilities, and a remaining issue of intergenerational equity.”

Burshtein’s piece also questioned the strength of the barriers in place to prevent political interference in the Future Fund’s mandate, writing that it was possible for the government to indirectly effect influence through appointments to the Board of Guardian and that “personnel is, after all, policy”. While Murray concedes that a large pool of publicly-controlled assets is a tempting target for politicisation through “poorly chosen investments in public infrastructure”, he says that the performance of the Future Fund has not been diminished by attempts to exert influence.

“The combination of clarity of mandate, transparency, accountability to parliament and skilling of its staff has been successful,” Murray writes. “The simplicity of a target return above inflation is hard to avoid over the targeted timeframes. The board has no ‘ex-officio’ members and the criminal sanctions in the Future Fund Act for self-interested behaviour are explicit.

“This is not to say that political influence will not emerge in future. Ongoing calls for superannuation funds to invest in ‘nation-building’ assets could easily be echoed for the Future Fund. This would undoubtedly distort the optimum asset allocation resulting in lower returns, as the private sector would not invest on the same terms.”

But on the question of whether the Future Fund could continue to meet its return hurdle, Murray, while noting that Burshtein only used short-term historical performance figures, was more circumspect, saying that “forecasting is difficult and past performance should not be relied on as a reliable guide to future performance”.

“We can be confident though that risk and return are positively correlated and a long-term mandate which allows for risk taking should be rewarded. One risk that needs careful consideration is sequencing risk where short notice of liquidation of the fund would lead to considerable losses from forced sale of assets in a potentially weak market. This has implications for the way in which policy options are considered, including timing.

“On past experience, there is no justification for (Burshtein’s) prediction, it is just another person’s forecast. The fund has had to navigate significant negative events since inception — and we know that returns to equity will over time outperform returns to debt. If we have the patience and model to operate the Future Fund, we should do it.”