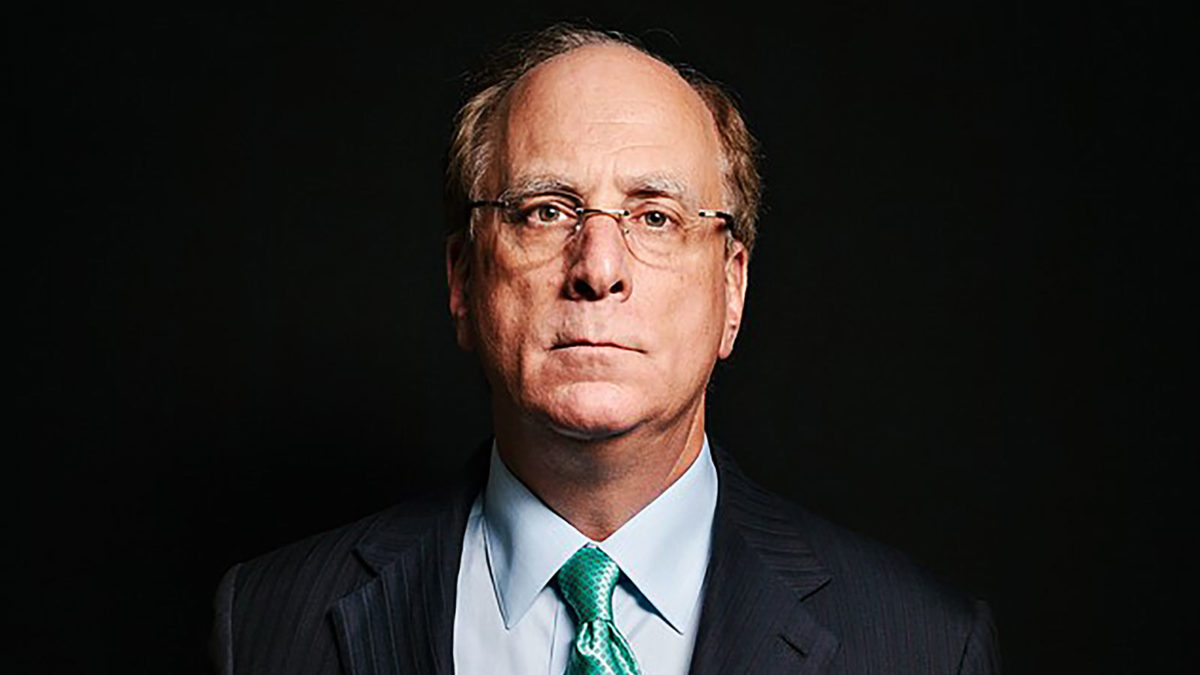

Fink conducts cultural purge at BlackRock

Larry Fink, BlackRock’s outspoken chief executive, has committed the firm to a cultural cleansing in the wake of alleged sexual and racial discrimination at the world’s largest fund manager.

In an annual shareholder letter published last week, Fink says “certain employees have not upheld BlackRock’s standards”, putting the manager’s environmental, social and governance (ESG) credentials at risk.

Earlier in March, BlackRock hired top-notch New York law firm Paul, Weiss, Rifkind, Wharton & Garrison to investigate allegations of employee misconduct – turning the tables on the US$8.7 trillion asset manager just a couple of months after Fink had urged corporate leaders to lift ESG standards.

The BlackRock chief told shareholders last week: “I know our culture is not perfect. It depends on the contribution of 16,500 individuals… Rooting out misconduct – and ensuring an environment that doesn’t allow it – is critical to building the culture we all aspire to and ensuring everyone can experience BlackRock at its best.

“That is why we are taking a number of actions internally to promote an environment of respect and inclusivity and making enhancements to our processes for investigating employee complaints. At the same time, we have retained an external law firm to conduct a review of recent reports of employee-workplace matters and to provide recommendations on how we might further enhance our processes and procedures.”

Despite the ESG own-goal, Fink laid out a rosy future for BlackRock with the business celebrating a healthy 2020 annual result featuring net asset growth of almost US$400 billion and a 13 per cent bump up in operating income.

BlackRock reported strong growth across both its investment arm – comprising active and passive strategies – and risk management platform, Aladdin.

“We built the industry’s most comprehensive investment platform across active and index, asset classes, geographies and exposures, all unified by one culture and one technology platform so we can focus on clients and support them with solutions no matter their objective or risk preference,” Fink says in the letter. “BlackRock’s ability to be a whole-portfolio partner for clients has proven to be critical as more institutional and wealth clients are turning to us for help to build more resilient portfolios.”

He says the firm’s 2009 purchase of the iShares exchange traded fund (ETF) business from UK-based Barclays Global Investors for US$13.5 billion has also paid off with both individuals and institutions flocking to the suite of what now numbers over 1,100 products.

“This has driven the growth of our iShares assets under management from US$500 billion in 2009 to US$2.7 trillion today,” Fink says. “To drive the next leg of growth for iShares, we are investing in new product innovation in areas like Fixed Income and Sustainable ETFs, offering value and quality across all our products and helping more people use iShares ETFs in more ways.”

BlackRock also plans to target a greater exposure to private markets, which are “becoming a critical component for alpha”, he says.

“More and more clients I speak with are looking to increase their allocations to illiquid alternatives for the yield and uncorrelated returns they offer, and we believe there is no manager better positioned to partner with clients than BlackRock,” Fink says.

“We are investing in product innovation, such as our Long Term Private Capital strategy, that seeks to better align incentives and meets client needs for longer duration solutions.”

As well, the business was forging deeper links with Chinese capital markets, he says, with a deal close to establishing “a wholly-owned fund management company and an asset management joint venture with China Construction Bank and Temasek”.

BlackRock should be able to sustain “our 5 per cent organic base fee growth target”, Fink says. The global behemoth has attracted substantial support from NZ retail investors – including via a range of Smartshares ETFs – and institutional clients such as the recently inked arrangement to manage about $9 billion on behalf of the AMP NZ wealth division.