Fossil fuels push market to fifth weekly gain, Ingham’s, TPS slump on weak earnings

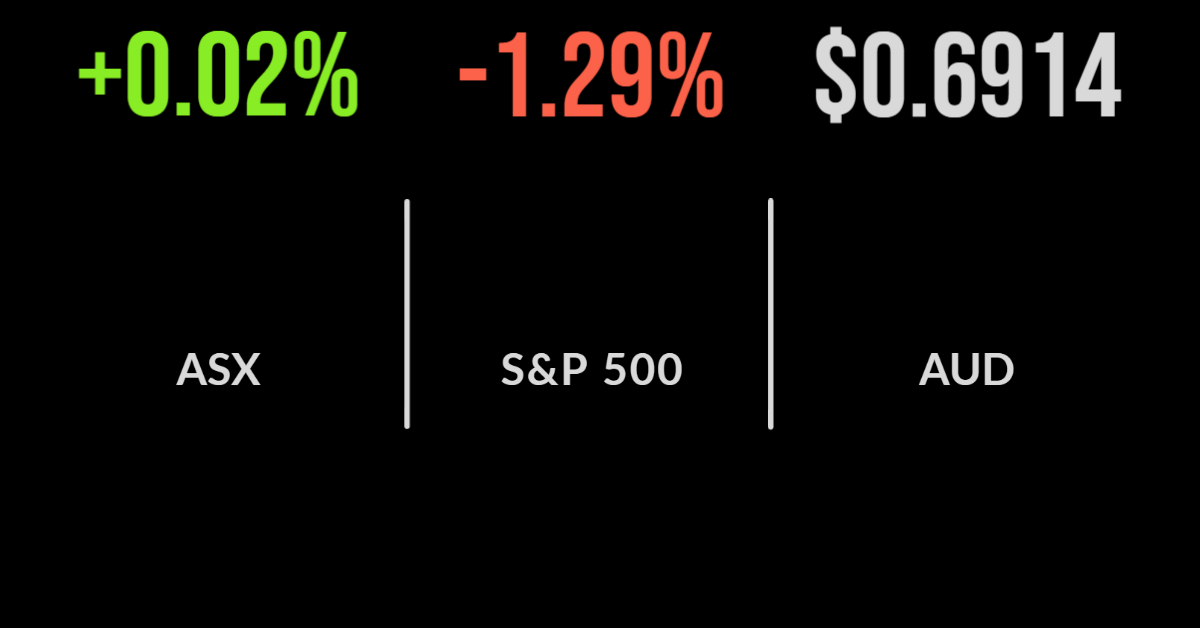

The local market brushed off a number of weaker earnings results to post the slimmest of gains, finishing 1.7 points higher on Friday.

This took the S&P/ASX200 to a fifth straight weekly gain of 1.2 per cent with the market now less than 10 per cent off the multi-year highs reached in January this year.

It was all about the fossil fuels on Friday with a surge in the price of oil and coal sending the sector up 4 per cent behind rallies in Santos (ASX: STO) and Whitehaven Coal (ASX: WHC), which both finished more than 6 per cent higher.

On the negative side were real estate and healthcare, down 1.3 and 0.9 per cent each after the likes of Vicinity and CSL reported this week.

TPG Telecom (ASX: TPG) fell hardest on Friday, with management blaming excessive expectations of the market.

Revenue was flat, earnings fell 5 per cent but profit doubled on the COVID-19 impacted years, however, the greatest concern was anaemic growth in average revenue per user and a slowing in mobile plan growth.

AGL (ASX: AGL) fell close to 4 per cent as the company followed Origin’s difficult report by highlighting coal plant outages and volatile energy prices as the key reason behind a halving of underlying profit.

The dividend was cut by 70 per cent despite a 20 per cent jump in revenue, with the result dragging the entire utilities sector down 2 per cent for the week.

US markets retreat on bond yields, Berkshire ups Occidental stake, GM dividends return

Global markets had an increasingly rare misstep on Friday, with all three US benchmarks falling led by the Nasdaq, down 2 per cent.

A widespread selloff encompassed consumer-facing business, technology and financials was triggered by a jump in the bond yield on comments that the Fed’s tightening may not be slowing as expected.

The Dow Jones and S&P500 were down 0.9 and 1.3 per cent respectively with Occidental Petroleum (NYSE: OXY) gaining close to 10 per cent after Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) was given authority to take their stake beyond 50 per cent in a positive sign for the energy sector.

Shares in General Motors (NYSE: GM) were more than 2 per cent higher after management announced the return of dividend payments, which many have seen as hope that the pandemic era conditions had come to an end.

Shares in retailer Footlocker (NYSE: FL) were the biggest standout though, with the company gaining 20 per cent after reporting a 10 per cent increase in sales but a fall in profit.

The company has seen inventories rise by more than 50 per cent, however, the result was better than the market was expecting.

Across the week all three benchmarks broke a four-week winning streak, with the Dow slipping 0.2, the Nasdaq 2.6 and the S&P500 1.2 per cent.

Divergence in retail, value recovery tires, recession, what recession?

The most popular predictions going into earnings season was those of doom and gloom, with businesses expected to struggle under the weight of inflation, labour costs and weaker demand.

Thus far the opposite has been the case with both US and Australian corporates in rude health despite the headlines.

Success, however, has generally been determined by the cohort of customers of each company, with those selling differentiated or monopoly products to customers less impacted by the higher cost of food and energy faring significantly better than those selling discounted goods.

In a similar vein, predicting a recession seemed to be the sport of choice for economists and other experts in June, yet if the actual economic and investment data is anything to go by, this is a long way off.

As is generally the case with predictions of market collapses, the truth is somewhere closer to the middle and less significant than most expect.

Value vs. growth has been a popular talking point this year, with value seemingly staging a significant recovery after more than a decade of underperforming growth companies.

The war in Ukraine, combined with a jump in bond yields, saw traditional value sectors like energy rally, while expensive tech companies rallied.

While many claimed this was the beginning of a decade-long outperformance for value, growth has staged a remarkable recovery in recent months that puts this into question.