Four straight gains, iron ore surges, BlueScope upgrades, Boral downgrades

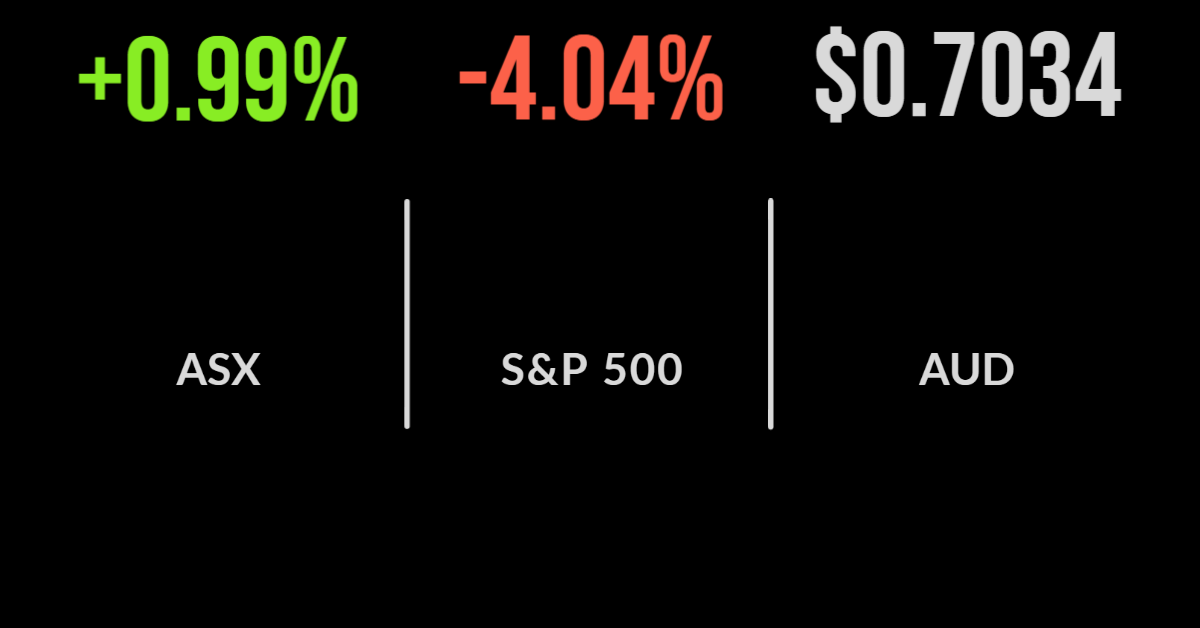

The domestic market was buoyed by a jump in the iron ore price as Chinese lockdowns continue to ease with the S&P/ASX200 gaining 1 per cent on the back of a 2.5 per cent jump in the materials sector.

Only the staples sector finished lower, falling 1 per cent behind a 1.1 per cent fall in Woolworths.

Champion Iron (ASX: CIA) and BHP (ASX: BHP) were among the leaders, up 5.3 and 3.2 per cent, as was Fortescue (ASX: FMG) after it was announced that Twiggy Forrest would re-join the firm as Executive Chairman with the CEO of both the traditional mining business and Fortescue Future Industries reporting directly to him.

Boral (ASX: BLD) was among the biggest detractors, falling 3.1 per cent after management flagged a $45 million hit to earnings due to the massive impact of exceptional rainfall on both volumes and delivery costs in Australia.

$15 million was attributed to the impact of higher energy costs and comes on the back of a prior downgrade amid COVID impacted operating conditions.

Barrenjoey value jumps, wage growth underwhelms,

Shares in Magellan (ASX: MFG) gained more than 3 per cent after news emerged that their investment in start-up investment bank Barrenjoey had nearly doubled in value to $750 million.

The result came after co-investor Barclays Bank confirmed they had invested a further $75 million into the fast-growing company, sending MFG’s share down to 36 per cent.

Market share gains continue to support BlueScope Steel (ASX: BSL) which upgraded earnings guidance by close to 10 per cent, now expecting $1.475 billion, driven by a continued recovery in the North American steel operations.

This was offsetting weakness in Australian products which have been hit by supply chain issues throughout Asia.

Once again, stronger steel spreads have benefited from their ability to pass on costs to consumers.

Australian wage growth underwhelmed, rising just 0.7 per cent in the March quarter for an annual rate of 2.4 per cent, this was below expectations of 0.8 and 2.5 per cent but gives the RBA plenty of scope for further rate hikes.

Eagers Automotive (ASX: APE) shares fell 3.3 per cent after warning that a shortage of new vehicles, driven by the lack of semiconductors, was crimping the ability to sell new cars, hitting margins and revenue.

Market suffers worst drop since 2020, stagflation fears rise, Target, Tesla slump

All three US benchmarks suffered their worst falls since the pandemic hit, led by the Nasdaq which finished 4.7 per cent lower.

The Dow Jones and S&P500 fell 3.6 and 4.0 per cent respectively amid growing concerns of a stalling economy and stagflation risk.

Every sector was lower, with consumer staples among the biggest detractors following a collapse in discount retailer Target (NYSE: TGT).

The company saw shares tumble by 25 per cent in a single session after reporting a quarterly profit that was well short of expectations, falling to USD$1 billion from $2.1 billion the year prior.

Revenue was higher, growing 4 per cent, however, the cost of sales surged amid an increase in fuel, transport and labour costs.

It was the opposite story for TJ Maxx operator TJX Co’s (NYSE: TJX) which gained 11 per cent on a 10 per cent jump in profits and a similar increase in revenue as consumers looked for discounted goods.

Tesla (NYSE: TSLA) also fell close to 7 per cent after the E&P Index provider dropped the company from their ESG universe on governance concerns.