Hammered Origin leads market lower

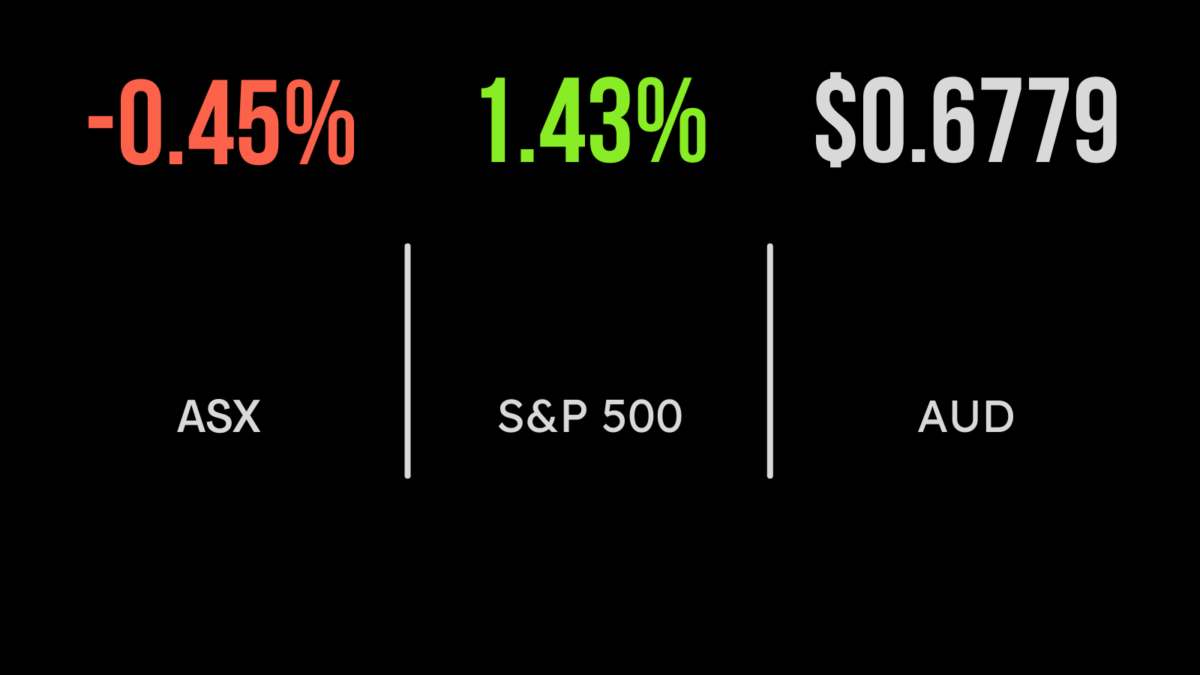

The S&P/ASX 200 fell 0.5 per cent, or 32.4 points, to 7180.8 on Monday, dragged lower by losses across the utilities sector, which contains Origin Energy – and the big electricity and gas supplier were hammered 61 cents, or 7.8 per cent, lower to $7.19, amid fears that the federal government’s intervention into the gas market could see Brookfield and EIG Group walk away from their $18.4 billion takeover bid for the company. In the same sector, AGL Energy dropped 21 cents, or 2.6 per cent, to $7.79.

But in the energy space, Woodside Energy rose 92 cents, or 2.7 per cent, to $35.10, and Santos gained 5 cents, or 0.7 per cent, to $7.11; however, Beach Energy, where the market is still worried about what the collapse of contractor Clough means for the company’s Waitsia gas project, lost 4 cents, or 2.4 per cent, to $1.62.

Takeover action was also roiling the fintech sector, where Tyro Payments plunged 29 cents, or 19.5 per cent to $1.20 after it rejected a revised takeover offer from buyout firm Potentia Capital, and a second potential bidder in Westpac Banking Corporation walked away.

Potential seen for Potentia

Potentia had been bidding for E-document platform Nitro Software, but looks to be out of that game after Nitro’s board unanimously recommended that shareholders back a revised takeover bid from KKR-owned digital productivity firm Alludo, of $2.15 a share, above Potentia’s $2.00 offer. Nitro pushed past that price, rising 10 cents, or 4.7 per cent, to $2.23, showing that some investors believe there is room for Potentia to come back with a higher bid.

Despite a slightly stronger iron ore price, Fortescue Metals Group lost 27 cents, or 1.3 per cent, to $21.12, while BHP was down 69 cents, or 1.4 per cent, to $46.79, and Rio Tinto shed 81 cents, or 0.7 per cent, to $116.35.

In the coal space, Whitehaven Coal lost 19 cents, or 2 per cent, to $9.50; New Hope Corporation retreated 8 cents, or 1.4 per cent, to $5.71; Coronado Global Resources dropped 11 cents, or 5.4 per cent, to $1.92; but Yancoal Australia managed to add 2 cents, to $5.77.

In the lithium arena, producer Pilbara Minerals added 6 cents, or 1.3 per cent, to $4.53, but fellow producer Allkem eased 6 cents, or 0.5 per cent, to $13.04. Project developer Liontown Resources retreated 4 cents, or 2.2 per cent, to $1.74, and Piedmont Lithium lost 2.5 cents, or 2.9 per cent, to 83 cents. Mineral Resources, which produces iron ore and lithium, gave up $2.20, or 2.4 per cent, to $88.30, while IGO, which mines nickel and lithium, fell 39 cents, or 2.6 per cent, to $14.65.

In gold, Silver Lake Resources fell 10 cents, or 7.5 per cent, to $1.23; Ramelius Resources was down 4.5 cents, or 4.6 per cent; Regis Resources lost 8.5 cents, or 4.1 per cent, to $1.98; Evolution Mining was down 11 cents, or 3.7 per cent, to $2.86; and Gold Road Resources dipped 6.5 cents, or 3.7 per cent, to $1.70.

Among the big banks, Westpac lost 8 cents, or 0.3 per cent, to $23.36; ANZ was down 10 cents, or 0.4 per cent, at $23.54; and National Australia Bank was flat at $30.19; but Commonwealth Bank gained 41 cents, or 0.4 per cent, to $105.39. Investment bank Macquarie Group advanced $3.46, or 2.1 per cent, to $171.50.

Infection prevention company Nanosonics closed down 48 cents, or 9.9 per cent, to $4.36, despite there being no announcement or news – but the stock is one of the most heavily shorted on the exchange.

Final hour revs up Wall Street

In the US overnight, a late surge saw the blue-chip Dow Jones Industrial Average gain 528.6 points, or 1.6 per cent, to 34,005, clawing back some of the steep losses from the previous week, as traders looked ahead to a highly anticipated Federal Reserve meeting and new inflation data.

The broader S&P 500 index gained 56.2 points, or 1.4 per cent, to 3,990.6 and the tech-heavy Nasdaq Composite index advanced 139.1 points, or 1.3 per cent, to 11,143.7.

The 10-year Treasury yield rose slightly to 3.617 per cent, while the inverted 2-year yield – which is considered more sensitive to Fed policy – lifted six basis points to 4.39 per cent.

Gold is down US$14.16, or 0.8 per cent, to US$1,780.85 an ounce, while the global benchmark Brent crude oil rallied US$2.13, or 2.8 per cent, to US$78.23 a barrel, and US West Texas Intermediate crude jumped US$2.43, or 3.4 per cent, to US$73.43 a barrel. The Australian dollar is buying 67.5 US cents.Hammered Origin leads market lower