In 2025, it’s MAGA versus the bond vigilantes: Ruffer

Forget Gladiator II, Wicked or even Paddington 3. Next year’s blockbuster action looks set to be not in the Colosseum, Oz or Peru, but in the bond markets as Trump’s new administration goes head-to-head with those mightiest of opponents – bond vigilantes.

Not only is this primed to be an epic battle of wills, directly impacting funding costs in the US economy and the sustainability of US equity valuations that are currently defying gravity, but its repercussions will be felt closer to home too – in the UK housing market.

Since mid-September, when bond markets started to price in a Trump victory, US Treasury bond yields have risen significantly, a move echoed in UK gilt yields. Whatever your view on the recent UK Budget, it’s US bond markets pushing up the cost of UK mortgages – and there’s good reason to fear that they’re not finished yet.

The US government’s budget deficit is currently running at 7.5 per cent of GDP, with overall federal government debt now 123 per cent of GDP, the biggest debt burden relative to national income since at least the late 18th century. A precarious fiscal position, which is likely to deteriorate.

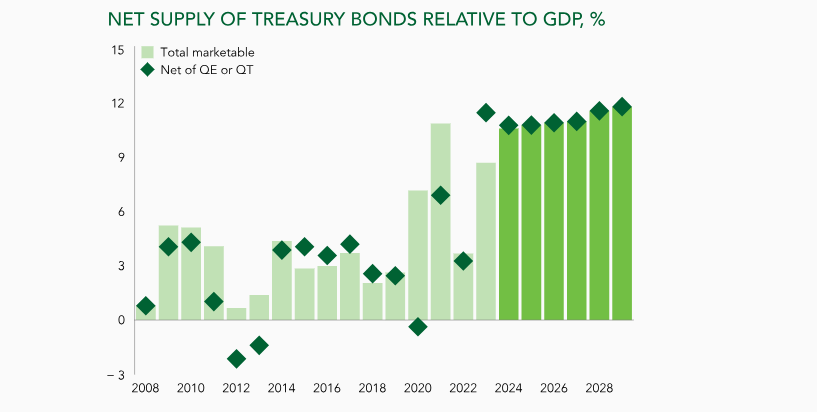

As this month’s chart shows, the IMF calculates that the net supply of bonds needing to be purchased by investors will be equivalent to more than 10 per cent of GDP this year, and for each of the subsequent five years. There is no comparable period outside wartime.

To be clear, these estimates do not include the fiscal promises Donald Trump made in the run up to the election. These are estimated to add $7.8 trillion to federal debt over the next decade – roughly a 25 per cent increase on current projections, even after including $2.7 trillion of additional revenue raised via import tariffs – a highly questionable revenue source. Unless Donald Trump reneges on his key campaign pledges, the supply of government bonds hitting the market in the years ahead will be even greater than the chart suggests.

Of course, Elon Musk might come to the rescue. He intends to cut at least $2 trillion (30 per cent of 2024 outlays) from federal spending. He might as well have said pigs can fly. Cuts on that scale would be economically dangerous and politically unacceptable to Trump. After all, the electoral coalition that has just returned him to power is the main beneficiary of the 60 per cent of total federal outlays the government transfers each year to pensioners and lower income households.

So what about the bond vigilantes? By the end of 2024, bond investors look likely to have suffered the fourth year of a bond bear market – enough to make anyone grumpy. Now they are being asked to buy record amounts of US government bonds for the next five years. Their likely price? Higher yields.

President Clinton’s adviser James Carville famously said in the 1990s: “I used to think that if there was reincarnation, I wanted to come back as the president or the pope… But now I would like to come back as the bond market. You can intimidate everybody.”

The vigilantes are not back – yet. But this time they would have a much stronger case. The fiscal position is worse and the spectre of inflation has returned. Cyclically, the economy is healthy, but the global order is under severe strain, and US stock market valuations look stretched even assuming falling interest rates and bond yields. Wouldn’t it be the great irony of US politics if Trump and the Republicans – the ideological torch bearers of a small state – preside over America’s first fiscal crisis since the Civil War?