-

Sort By

-

Newest

-

Newest

-

Oldest

Ruffer expects a sudden reversal in the smooth conditions that investors have enjoyed. The ubiquity of multi-strategy hedge funds, algorithmic market making and 0DTE options might make it much worse.

The crippling doom loop between the banks and the real economy we saw in 2008 is unlikely to feature in the coming recession, says Ruffer’s Jamie Dannhauser, who is more concerned about a violent liquidation in financial markets.

It isn’t 2008 all over again, but dismissing the broader risks of SVB’s demise would be a mistake for investors, writes Ruffer CIO Henry Maxey.

As a forty-year long bull run fuelled by cheap money screams to a stop, markets are at an inflection point. This time really could be different.

Central bankers are hoping to subdue the inflation beast by the end of the calendar year. But it will likely be around for decades to come.

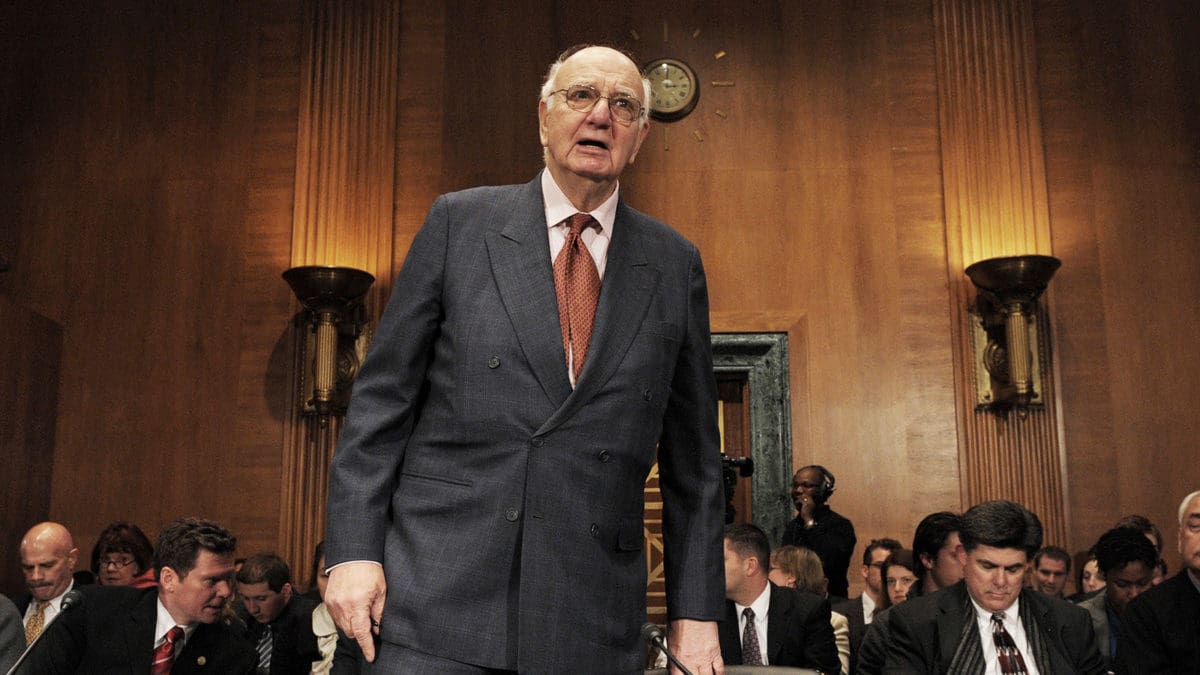

Inflation is making a latter day comeback, and a financial system “sanitized by 15 years of free money” is totally unprepared. It’s time, once again, for tough medicine.

All fund managers like to talk about protecting capital. At Ruffer Investment Management, it is a more embedded philosophy than most.

Everybody loves a good story – investors particularly so. But sometimes a good story can lead to a crowded trade, or one that defies reality. “In finance, behaviour is driven by expectations of future returns, and expectations are often driven by stories, particularly during times of heightened uncertainty,” Charalee Hoelzl, investment manager at Ruffer, wrote…

From Tulip Mania to the Tech Wreck, the history of bubbles shows that they’re harder to spot than investors might think. As Ruffer investment director Lauren French notes in the latest Ruffer Review, even the smartest can fall prey to a market bubble. Isaac Newton, one of the most brilliant mathematicians in history, still lost…

While proponents believe that cryptocurrencies will inevitably disrupt traditional finance, it’ll be harder than it seems – and less lucrative than they think. As cryptocurrencies like Bitcoin and Ethereum have shot to prominence in the last several years, it’s now being taken as a given that they will eventually disrupt traditional finance. Blockchain technology offers…