Inflation figure taken as bringing rate relief

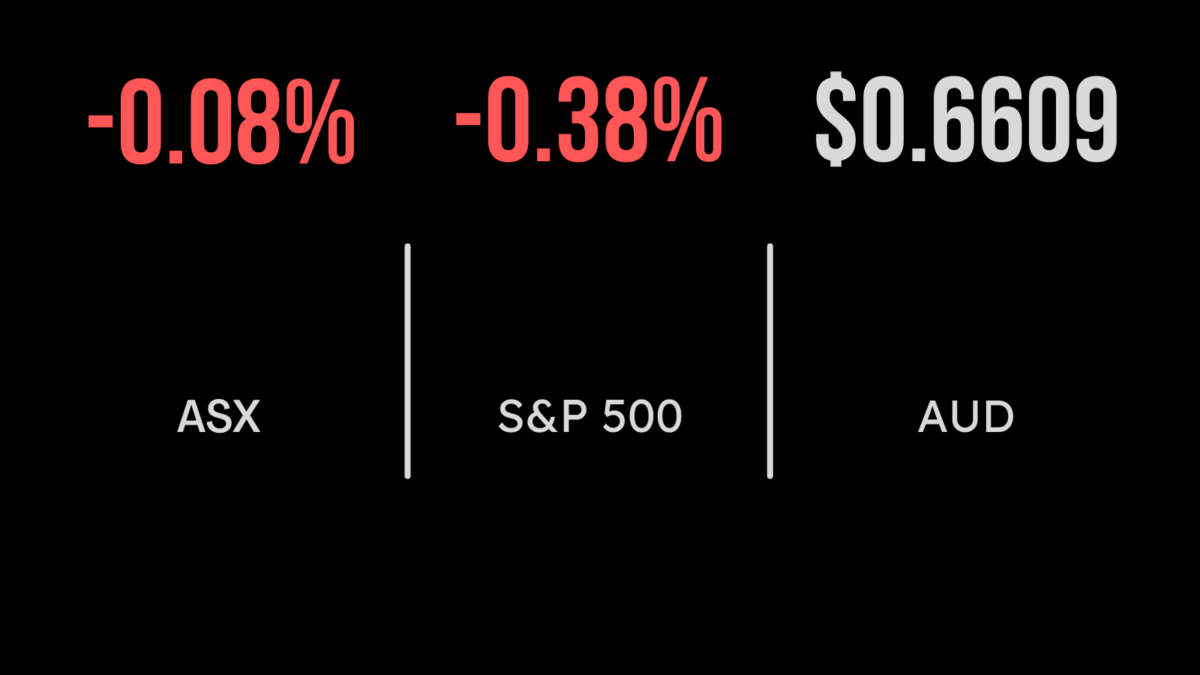

After a poor lead from Wall Street, the S&P/ASX 200 index recovered some of its early losses on Wednesday to close 5.7 points lower at 7316.3, after Australian core inflation for the first quarter came in weaker-than-expected. The broader All Ordinaries index was down 9.4 points, at 7,502.8.

Annual inflation fell to 7 per cent in the March quarter, and while that was a little stronger than market expectations for 6.9 per cent, the inflation reading of 1.4 per cent for the March quarter itself was the softest quarterly figure in a year. That was taken by investors as confirmation that the worst of Australia’s inflation outbreak has passed, and expectations that the RBA would raise the cash rate by 0.25 of a percentage point next Tuesday were quickly shelved.

RBA governor Philip Lowe had previously stated that the March quarter consumer price index (CPI) figure would play a decisive role in the decision to be announced at the May meeting; markets now appear to believe the central bank will keep rates on hold at 3.6 per cent.

The major miners continue to react to weaker iron ore prices. Rio Tinto lost $1.24, or 1.1 per cent, to $111.94; BHP retreated 17 cents, or 0.4 per cent, to $44; and Fortescue eased 10 cents, or 0.5 per cent, to $20.66. Diversified miner South32 gained 4 cents, or 1 per cent, to $4.16.

In coal, Whitehaven Coal shed 7 cents, or 1 per cent, to $7.15; and Stanmore Resources was down 8 cents, or 2.5 per cent, to $3.16; but New Hope Corporation gained 9 cents, or 1.7 per cent, to $5.34.

Gold miners followed the bullion price higher: Gold Road Resources advanced 8.5 cents, or 4.7 per cent, to $1.88; Evolution Mining gained 12 cents, or 3.5 per cent, to $3.56; and St Barbara added 2 cents, or 3.5 per cent, to 60 cents.

In lithium, producer Allkem shed 40 cents, or 3.4 per cent, to $11.33, and fellow producer Pilbara Minerals lost 25 cents, or 5.9 per cent, to $3.98. Mineral Resources, which mines iron ore and lithium, plunged $7.77, or 9.7 per cent to $72.59 after slashing full-year production guidance for its core mining services division. IGO, which produces nickel as well as lithium, dropped 57 cents, or 4.1 per cent, to $13.40. Among the lithium project developers, US-based Piedmont Lithium added 3.5 cents, or 4.4 per cent, to 84 cents, and Core Lithium gained 2 cents, or 2.1 per cent, to $1.00. Rare earths specialist Lynas Rare Earths shed 6 cents, or 0.9 per cent, to $6.66.

In energy, Woodside Energy spiked 38 cents, or 1.1 per cent, to $33.92; Santos gained 3 cents to $7.13; and Beach Energy added 2.5 cents, or 1.7 per cent, to $1.48.

On the industrial screens, Telstra rose 3 cents, or 0.7 per cent, to a five-and-a-half-year high at $4.33. Online retailer Kogan jumped 26 cents, or 7.2 per cent to $3.86 after reporting three consecutive months of positive group adjusted EBITDA, and that it intends to mount a share buyback.

In the big-bank world, Westpac advanced 6 cents to $22.31, and National Australia Bank put on 5 cents to $28.84, but Commonwealth Bank slid 22 cents, or 0.2 per cent, to $99.89 and ANZ gave up 1 cent to $24.21. Global investment bank and wealth manager Macquarie Group eased 20 cents, or 0.1 per cent, to $181.25.

Infant formula group the A2 Milk Company followed a profit downgrade by its contract supplier, Kiwi-based Synlait Milk (of which A2 owns nearly 20 per cent) earlier in the week with a warning that FY23 revenue growth will likely be at the low end of its previous expectations.A2 Milk fell 29 cents, or 5.1 per cent, to $5.42, while Synlait Milk, sank a further 52 cents, or 26.5 per cent, to $1.44, and has now lost 29 per cent since Thursday.

Banking jitters jinx Wall Street

In the US, worries over regional bank First Republic seemed to outweigh increasing positivity around big tech stocks. The 30-stock Dow Jones Industrial Average slid 228.96 points, or 0.7 per cent, to end at 33,301.87, after being up more than 100 points at one stage.

The broader S&P 500 index eased 15.64 points, or 0.4 per cent, to close at 4,055.99, while the technology-heavy Nasdaq Composite Index gained 55.19 points, or 0.5 per cent, to finish at 11,854.35.

The latest US banking crisis belongs to San Francisco-based First Republic Bank, which is in turmoil after an outflow of more than US$100 billion in deposits in the March quarter. First Republic and its advisers are trying to stabilise the bank but a report overnight saying that the US government was unwilling to intervene in the rescue process poured gasoline on the fire. Trading in First Republic’s shares was halted multiple times, with the last down nearly 30 per cent at $5.66, giving it a market value of US$886 million – for context, First Republic’s market capitalisation peaked at more than US$40 billion in November 2021. That’s a fall of 97.8 per cent.

European markets mostly closed lower, as the banking jitters resurfaced.

In the bond market, the US 10-year Treasury yield was down 4.5 basis points, at 3.45 per cent, while the 2-year yield, considered more sensitive to Fed monetary policy, gained 4.2 basis points to 3.945 per cent.

On the commodities front, gold was down US$10.71, or 0.5 per cent, to US$1,989.63 an ounce, while the global benchmark Brent crude oil grade sank US$3.08, or 3.8 per cent, to US$77.69 a barrel, and US West Texas Intermediate light crude advanced 3 cents to US$74.33.

The Australian dollar is buying 66.05 US cents, well down from 66.69 US cents at the local close on Wednesday.