Local stocks fight back, weight of numbers push market lower, Pendal’s surprise

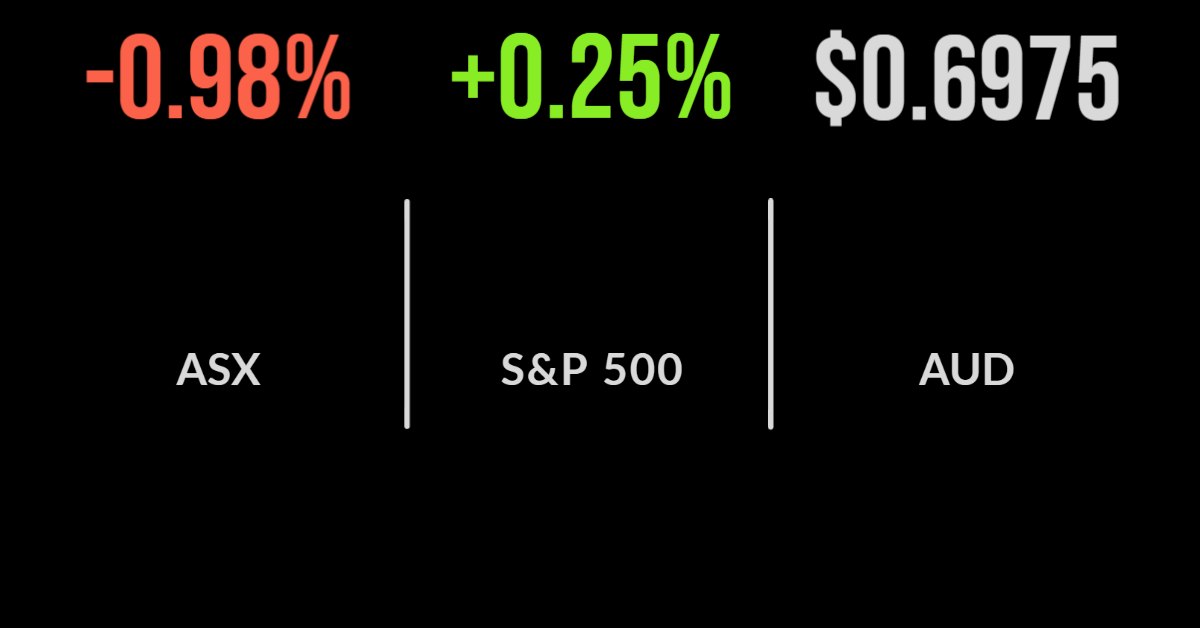

The local sharemarket followed global markets lower, with the S&P/ASX200 opening as much as 2.5 per cent lower.

The day’s trade was a story of the weight of numbers, with every sector barring communication finishing lower, but more companies gaining than falling.

The size and scale of weakness in energy and commodities, down 2.1 and 2.4 per cent respectively, was enough to drag the market down 1 per cent on the day.

Investors are dealing with a flurry of concerns ranging from energy crisis to Chinese lockdowns and higher interest rates.

Insurance broker AUB Group (ASX: AUB) was the biggest laggard, falling 10.6 per cent after completing a $350 million capital raising to fund the purchase of UK group Tysers.

Ampol (ASX: ALD) also outperformed, falling just 0.7 per cent after the company confirmed the acquisition of NZ-based Z Energy was now complete.

Shares in everything commodity-related were hit, even gold and lithium, but Rio Tinto (ASX: RIO) was among the worst falling 3.6 per cent.

The focus on China has seen the AUD fall to a multi-year low, hitting 69 cents in today’s session, which will likely provide somewhat of a buffer against falling overseas markets as it has in past corrections.

Pendal, Polynovo top the market, retail sales hit record levels, Atlas to restructure

Toll road operator Atlas Arteria (ASX: ALX) announced they will need to restructure the struggling Washington-based toll road which has cost shareholders some $300 million in write-downs in the last few years.

Weak traffic growth which is just 64 per cent of pre-COVID levels means the successful European roads continue to subsidise the struggling motorway; shares were down 0.6 per cent.

The standout was fund manager Pendal (ASX: PDL) which reported an unexpected 7.5 per cent increase in profit in the first half, boosted by the successful acquisition of US fund managers Thompson, Siegel and Walmsley.

Profit hit $96.7 million on the back of a 30 per cent jump in fee revenue to $326.6 million as the company stands out among the other struggling ASX-listed fund managers.

The result was a significant jump in the dividend of more than 40 per cent to 17 cents per share.

The key driver of operational performance was the value investing focus of both Pendal and their recent acquisitions, which are seeing strong returns amid a selloff in growth and technology stocks.

Australian retail sales beat expectations in April, hitting a record of $93 billion, 4.9 per cent higher than this time last year and 1.2 per cent higher than the previous month, however, this trend may turn following the RBA’s rate hike.

Market turns ahead of inflation data, oil below USD$100, Peloton weakness continues

US benchmarks appeared to reverse a three-day losing streak that neared the levels of March 2020, with the likes of the S&P500 falling by as much as 7 per cent.

The Dow Jones was down 0.3 per cent after the oil price fell below USD$100 for the first time in two weeks, with the Nasdaq outperforming, gaining 1 per cent, and the S&P500 up 0.3.

Markets are in a holding pattern ahead of more inflation data with sentiment clearly turning towards the threat of a recession due to an aggressive rate hike cycle.

The USD and gold price have remained resilient throughout, along with health and staples stocks, but expensive technology continues to be sold off heavily.

Connected exercise equipment business Peloton (NYSE: PTON) continued its torrid run falling another 8.7 per cent after reporting a USD$757 million loss, worse than the USD$8.6 million in the prior quarter.

Revenue fell by 30 per cent and users remain stuck at around 2.08 million.

Tesla (NYSE: TSLA) gained 1.6 per cent even after the group reported they would be pausing production in Shanghai due to growing shortages of key inputs.