Market down on inflation fears, AMP sells to Dexus, Life360 tanks

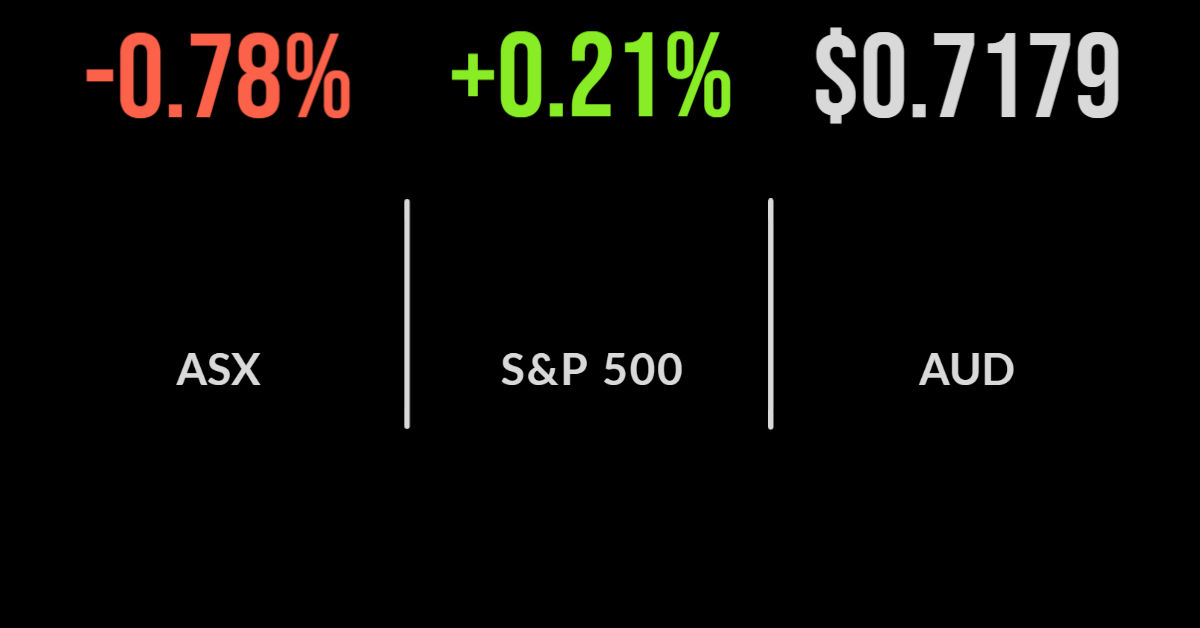

The local sharemarket followed a weak global lead, falling 0.8 per cent on Wednesday but with the fear spreading to broader sectors of the market.

In the opposite to yesterday’s trade, energy and utilities outperformed gaining 1 and 0.6 per cent respectively, with the materials sector also benefitting from a breather on Chinese selling.

Whitehaven Coal (ASX: WHC) was the standout, gaining 5.5 per cent as coal prices continue to surge.

Origin Energy (ASX: ORG) also gained 1.7 per cent as investors turned to higher quality utilities and regulated businesses following an unexpected surge in inflation.

Australian inflation hit the highest rate in several decades, rising 5.1 per cent in the 12 months to March, with economist forecasts once again well off the actual result, predicting 4.6 per cent.

The result was heavily driven by an increase in education, housing and transport costs, particularly fuel prices.

Whilst many of these issues are due to one-off or short-term events, many experts are now predicting the RBA will raise rates as soon as May.

The question remains how interest rate increases will fix supply-driven inflation that at this point has occurred over just a 12 month period.

Flocking to quality, Northern Star slips on higher costs

If there is one story that explains 2022 it is a flood to quality and the desertion of investors from lower quality, unprofitable ‘growth’ and technology businesses.

Today’s example was popular technology company Life360 (ASX: 360) which provides location tracking services, with the company falling 29.4 per cent after announcing plans to pull their planned Nasdaq listing and flagging a slower than forecast the shift to cash flow positive.

Gold miner Northern Star (ASX: NST) fell 5.4 per cent after delivering lower than expected production during the quarter, with investors more concerned about a jump in their expected costs on the back of labour and product shortages.

Shares in AMP (ASX: AMP) were down 1 per cent after the company announced the sale of its Collimate Capital funds management unit to Dexus (ASX: DXS) which gained 2 per cent on the news.

The deal will provide $250 million in cash and a further $300 million for the $60 billion asset manager.

Shares in Credit Corp (ASX: CCP) fell another 9.5 per cent as the company finally completed a recapitalisation.

Market up after worst day in two years, gas supplies cut, Tesla tanks

The Dow Jones and S&P500 managed to rebound following one of the weakest days in two years, as dip buyers re-entered the market and a number of key names delivered strong earnings results.

Tesla (NYSE: TSLA) held ground a day after losing more than US$100 billion in value, after falling 12 per cent on concerns that Elon Musk’s purchase of Twitter would divert his attention elsewhere; likely an exaggeration of existing fears.

Google parent Alphabet (NYSE: GOOGL) fell close to 4 per cent after reporting a small drop in profits but a 23 per cent increase in advertising revenue from 2021.

A number of drivers are increasing the cyclicality of advertising including Russia’s invasion of Ukraine but also a reduction in spending from other European companies during the uncertainty.

Cloud revenue kept pace with Microsoft (NYSE: MSFT) gaining 44 per cent, with Youtube ad sales also beginning to slow.

The US Trade Deficit hit a record US$125 billion as imports continue to surge amid a shortage of goods, whilst pending home sales declined for the fifth month in a row suggesting the housing market is beginning to cool.

Boeing (NYSE: BA) also underperformed, down 7 per cent, after seeing its loss double to US$1.2 billion with most units contracting during the quarter.