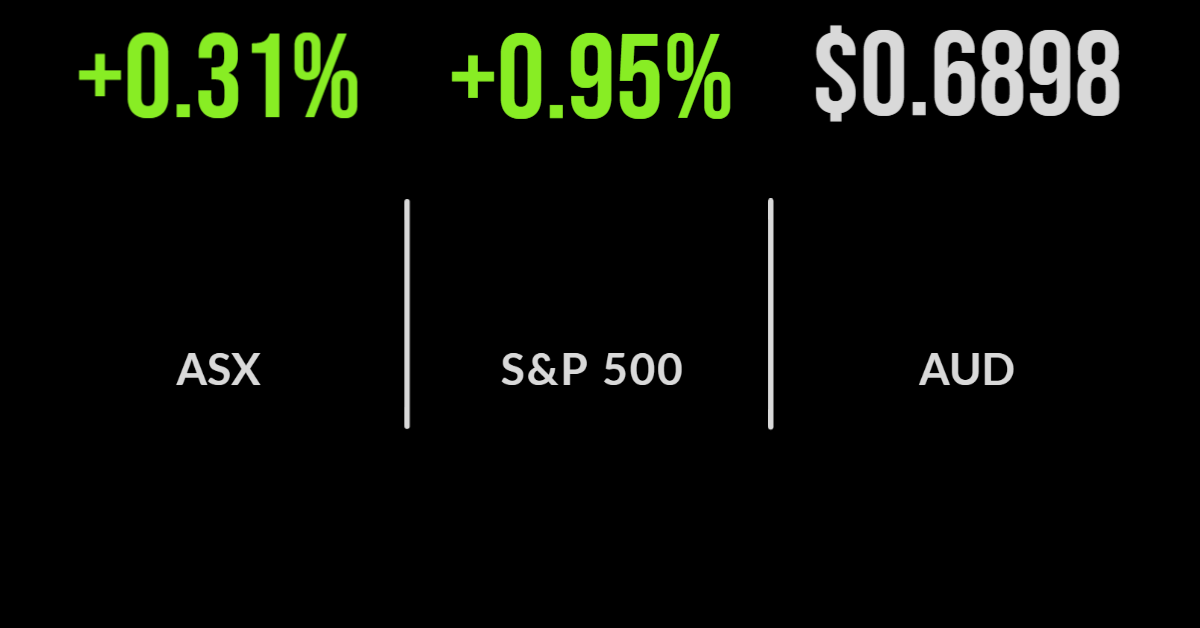

Market overcomes lithium rout, Lake Resources continues to tank, property outperforms

The selloff in lithium stocks has returned once again, with the likes of Pilbara (ASX: PLS) and Liontown (ASX: LTR) pushing the commodities sector to a 1.5 per cent loss.

Along with the energy sector which fell 2.1 per cent is now officially in a bear market, these were the only two sectors to post a loss on Thursday.

The property sector was a standout, gaining 2.6 per cent, with healthcare not far behind posting another positive day, up 2 per cent, behind a 2.2 per cent improvement in CSL (ASX: CSL).

The trigger appears to be an increasingly conservative tone from the RBA which suggests the currently expected rate hikes may never fully eventuate.

Interest rates are a key input into property valuations, hence the support for the property sector with Centuria (ASX: CIP) gaining 4.2 per cent and Goodman Group (ASX: GMG) another 4.9 per cent.

Growthpoint (ASX: GOZ) finished 3 per cent higher after management guided to a slight improvement in revenue and profits on the back of more positive revaluations of their portfolio.

Lake’s selling pressure, Pilbara delivers, PayGroup takeover offer

The lithium sector appears to be getting caught in concerns that higher rates and the threat of a recession will lead to lower car, and hence battery demand.

Among the biggest detractors in recent weeks has been Lake Resources (ASX: LKE) which has fallen by more than 50 per cent in the few short weeks since it was added to the S&P/ASX200 index.

It appears the managing director who unexpectedly resigned has dumped all 10 million shares he owned.

On the positive side, Pilbara (ASX: PLS) announced another cargo of 5,000 tonnes of spodumene concentrate had been sold at a price of US$7,017 per tonne, representing a 30 per cent premium to current pricing in China.

Shares in AGL (ASX: AGL) were down 1.3 per cent after management confirmed the timeline for their strategic review with final delivery due in September this year as they seek to move on from the failed demerger.

ASX minnow PayGroup (ASX: PYG) gained more than 155 per cent after receiving a takeover offer from global player Deel.

US market finished higher, Netflix brings ads, Walmart gains

The US sharemarkets benefit from a more dovish tone from the Federal Reserve, who highlighted the challenges of cutting inflation without sending the economy into a recession.

It is looking like one of those bad news is good news periods with unemployment benefits declining by just 2,000 and the private sector seeing a sharp slowdown in growth as higher prices hit demand.

The service sector also fell to a five-month low with a PMI reading of 51.6.

Netflix (NYSE: NFLX) was slightly higher after management finally confirmed they would release an ad-supported version at a lower price point, whilst Walmart gained more than 2 per cent in a broader rally for the staples sector.

The company confirmed they were rolling out healthcare coverage for women.

Occidental (NYSE: OXY) fell slightly, hit by the weakening oil price, despite Warren Buffett confirming he had increased his stake in the company.