Market rallies off lows, Asia turns, Magellan hires new CEO

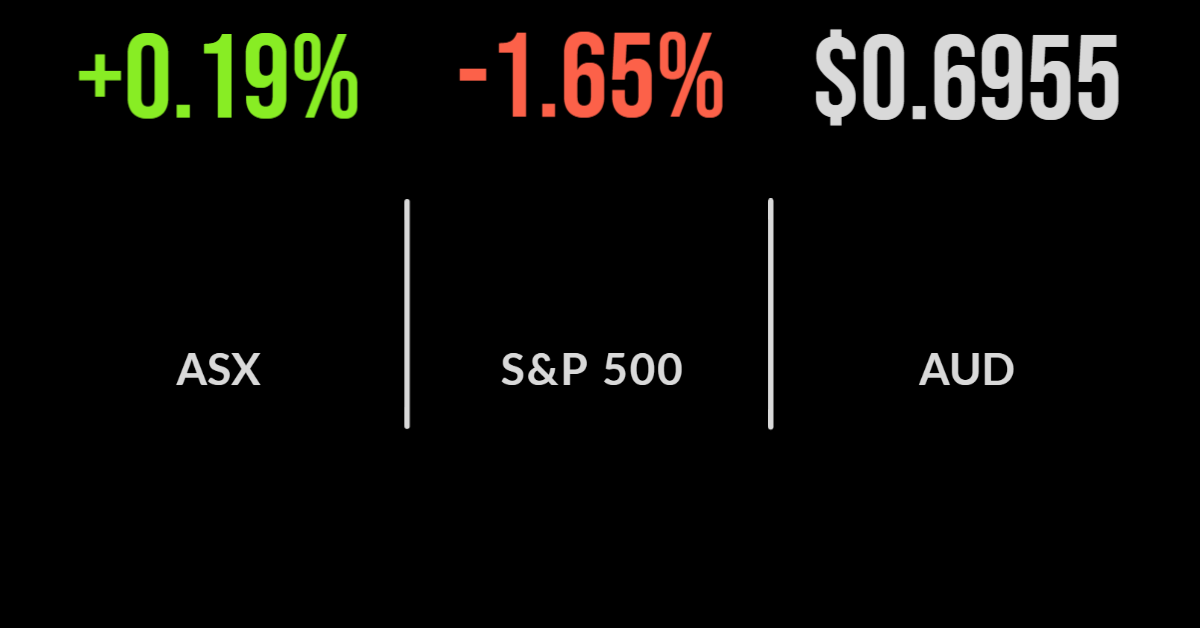

The domestic market managed to eke out a small gain, recovering from as much as 1 per cent down to send the S&P/ASX200 0.2 per cent higher on Wednesday.

Positive signs from Asia, including a broadly expected jump in Chinese inflation contributed to the settling of nerves with the materials sector recovering 0.9 per cent.

The standout was the healthcare sector, which gained 1.7 per cent after investors flocked to CSL (ASX: CSL) sending the share price 2.1 per cent higher. Real estate also gained, up 1.3 per cent.

Link Administration (ASX: LNK) was the biggest detractor, falling 15.1 per cent and entering a trading halt for a short period of time with management unable to explain the selloff.

The weakness came ahead of a $5.50 takeover offer, with the sellers obviously predicting something that market is not yet aware of.

Magellan (ASX: MFG) outperformed gaining 0.8 per cent after the group finally confirmed its new CEO, hiring the Future Fund’s ex-Chief Investment Officer David George for the role in what will likely be the first of a number of moves towards a more consistent and balanced business.

ASX CHESS replacement deferred, GrainCorp delivers record result

Shares in the ASX (ASX: ASX) gained 0.8 per cent despite management confirming the long-expected news that the “go-live” date for their blockchain-driven CHESS replacement system. It will no longer be ready for the April 2023 release date.

Nearmap (ASX: NEA) fell 1.3 per cent after the company confirmed they had extended court proceedings against a key competitor regarding their patents.

CSR (ASX: CSR) gained 0.5 per cent after the company reported a $193 million profit, up 20 per cent on last year’s result, on the back of another 9 per cent jump in revenue. The dividend was also increased to 18 cents per share.

GrainCorp (ASX: GNC) delivered a record half-year result, with profit nearly five times higher at $246 million from $51 million in the year prior.

The group is seeing massive demand for Australian grain, oilseeds and vegetable oil.

The group is benefitting from exceptional planting conditions on the back of La Nina and delivered a 12-cent special dividend.

Management also confirmed guidance for a profit of between $310 and $370 million, shares fell 1 per cent.

Losing streak extends to five days, China cases slow, Disney rallies on beat

The Dow Jones extended a five-day losing streak, falling 1 per cent overnight, after strong than expected inflation data was released.

A core inflation print of 6.2 per cent showed a marked slowing from the 40 year high of 6.5 per cent in the prior month but was ahead of forecasts.

The Nasdaq remained weak, falling 3.2 per cent as the likes of Apple (NYSE: AAPL) and Amazon (NYSE: AMZN) fell 5 and 3 per cent respectively.

The S&P500 was slightly better, falling 1.7 per cent after the US recorded a massive monthly budget surplus on tax receipts that could see the deficit fall below US$1 trillion for the first time in three years.

Oil rallied amid signs that COVID-19 cases in China were easing, suggesting lockdowns may come to an end soon.

Shares in Disney (NYSE: DIS) fell 2 per cent despite reporting a stronger than expected result for their streaming division.

Disney+ has hit 137.7 million subscribers after reporting a gain of another 7.9 million during the quarter, reversing the trend at Netflix. Revenue fell due to the cancellation of a content contract but managed a quarterly profit of US$470 million.