Market rally extends, Block hits record, Uniti bidding war

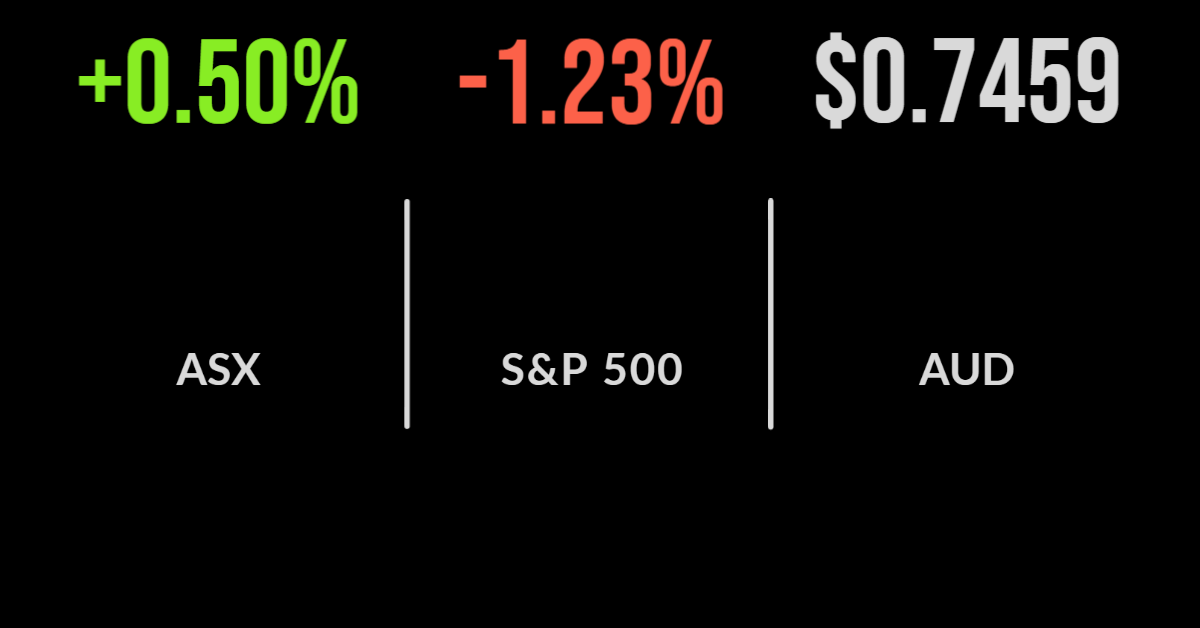

The run of positive days continues to defy expert predictions of market chaos as bond yields increase, with the S&P/ASX200 gaining another 0.5 per cent despite another bump in the 10-year government bond yield.

The technology sector tracked the gains of the Nasdaq adding 3.5 per cent as sector leader Block (ASX: SQ2) jumped 7.5 per cent to a record high in its short life since swallowing Afterpay (ASX: APT).

Every other sector was slightly higher, with financials the other standout, whilst the materials sector slumped on the back of another fall in the iron ore price.

BHP (ASX: BHP) shares were down 0.8 per cent. National Australia Bank (ASX: NAB) was boosted by research suggesting that the company may look to extend their buyback by another $2 billion due to their growing levels of excess capital.

But all eyes were on wireless and broadband roll up, Uniti Group (ASX: UWL) which jumped by more than 10 per cent before entering a trading halt in the afternoon.

The driver was a second bidder for the company, a joint partnership between Macquarie Asset Management and Canadian Pension Fund PSP, who bid $5.0 per share; shares were halted at $4.67.

Kathmandu sales struggle, Fisher & Paykal hit by transport costs, Viva delivers record month

The travel sector is showing signs of recovery, with Viva Leisure (ASX: VVA) reporting a record monthly revenue run rate of $8.6 million.

This was ahead of even pre-COVID trading and a 3.3 per cent improvement on December quarter numbers as member numbers jumped to 309 thousand.

Formerly Kathmandu, KMD Brands (ASX: KMD) gained 3.7 per cent despite reporting a weaker quarter of sales growth.

The adventure wear business saw a NZ$5.5 million loss for the first half with sales falling by 1 per cent.

Earnings were down 80 per cent to NZ$10 million, however, the group increased their interim dividend.

Surfwear division Rip Curl was a rare highlight, reporting 2.7 per cent sales growth over the first half.

Staying in New Zealand, Fisher & Paykal Healthcare (ASX: FPH), one of the winners of the pandemic due to their production of respirators, has warned about the impact of ballooning transport costs and reported falling profit margins.

Shares were down 7.8 per cent after management flagged as much as a 2 per cent reduction in their 65 per cent gross profit margin, with full-year revenue now expected to be NZ$1.675 to $1.7 billion, a slight downgrade.

On the positive side, their hospital consumables division is tracking at the same levels as 2021, in a sign that the impacts of the Omicron variant are expected to continue.

US markets oscillate on oil, two years since bottom, Okta falls on earnings

The up and down market of March continued overnight with all three US benchmarks finished lower, led by the Dow Jones and Nasdaq, down 1.3 per cent respectively and the S&P500 falling 1.2 per cent.

The primary on a daily basis remains sentiment, with the fluctuating oil price neatly driving day to day movements, jumping over US$115 per barrel in the session.

Quality continues to win out, with the likes of Apple (NYSE: AAPL) outperforming along with the continued resurgence in the Chinese market where Alibaba (NYSE: BABA) added another two per cent.

All eyes remain on Fed officials with more dissenters now suggesting a 50 basis point hike will be appropriate.

US home sales fell 2 per cent, worse than expected, in a precursor to an expected weakening in consumer spending due to energy prices whilst Moderna (NYSE: MRNA) fell 4 per cent despite announcing they will seek approval for their vaccine within children under six.

Today markets the two year anniversary of the COVID-19 selloff, with the S&P500 now having doubled, rising 100 per cent in the period since the Nasdaq has gained 105 and the Dow Jones 87 per cent rewarding those who stayed invested.

Shares in cybersecurity and identification firm Okta (NASDAQ: OKTA) fell 10 per cent after reporting a potential data breach.