Market reverses early gains, bond yield hits 3 per cent, GrainCorp jumps

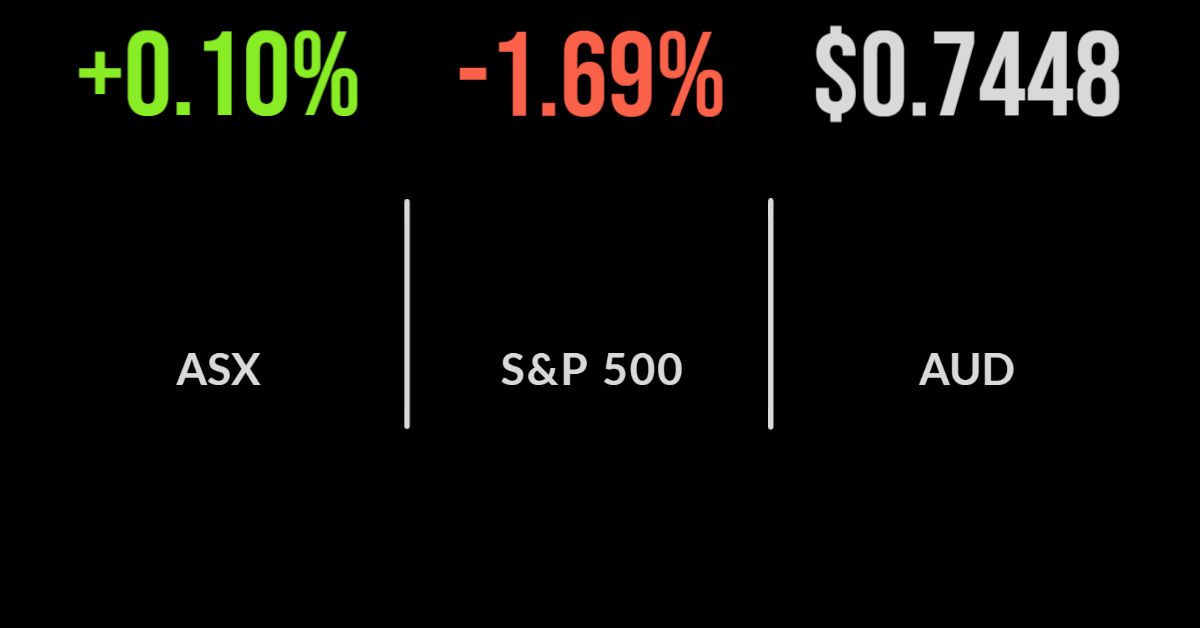

It was another volatile day for the S&P/ASX200, with the market trading significantly higher before reversing gains to finish up just 0.1 per cent.

The market and individual sectors continue to diverge on a daily basis as the pressure of the 10-year Australian government bond yield impacts valuations very differently.

The financial and banking sector benefits from higher rates via the ability to extract a larger margin on their loans, with Commonwealth Bank (ASX: CBA) and National Australia Bank (ASX: NAB) up 1.4 and 1.5 per cent contributing to a 0.8 per cent return.

Staples also outperformed as investors once again turn to the likes of Woolworths (ASX: WOW) to protect capital.

The technology and discretionary sectors are the first to sell off whenever yield spike, with both down 0.8 per cent today.

Mining outperformed despite Australia’s top lithium miners selling off on commentary from one of the leading battery mineral miners.

Pilbara (ASX: PLS), Novonix (ASX: NVX) and Mineral Resources (ASX: MIN) were all down more than 3 per cent.

GrainCorp (ASX: GNC) remains the highlight as brokers upgrade earnings and dividend expectations on the back of the Russian disruption.

Virtus deal upgraded, Western Areas bid increased, Pfizer bids for ResApp

There was no lack of corporate activity today, with IVF and fertility business Virtus (ASX: VRT) deciding to back an improved $8.15 per share offer from CapVest, whilst private equity group BGH remains in the wings.

Shares in Western Areas (ASX: WSA) jumped another 5.5 per cent after bidder IGO Group (ASX: IGO) were forced to increase their takeover offer by 15 per cent to $3.87 per share.

The price now trades in line with what is perceived to be fair value.

Shares in microcap biotech company ResApp (ASX: RAP) which claims to be able to detect COVID-19 through recordings of a cough have jumped 22.2 per cent after Pfizer announced a $100 million bid for the company, a 27 per cent premium to the last traded price.

On the other side, Adore Beauty (ASX: ABY) shares fell to an all-time low today as the e-commerce led beauty products business fell 8.7 per cent. This takes the loss from the $6.75 float price to around 73 per cent.

BlueScope Steel (ASX: BSL) is also utilising strong prices to bulk up, agreeing to a US$500 million deal to buy metal painter Coil Coatings in the US.

All sectors lower, bond yields move beyond 2.75 per cent, Musk waives board seat

It was another rough day for the US markets with every major sector falling on the back of a combination of factors.

Primarily, markets remain focused on the threat of higher bond rates and the outlook for the economy after the US 10 year yield reached 2.75 per cent, the highest since 2019.

Concerns are also growing over the impact of Shanghai’s lockdowns, with car manufacturer Nio (NASDAQ: NEO) flagging a suspension of production in the region due to labour and supply shortages.

The result was every sector finishing lower, led by technology and energy, with the Nasdaq off 2.2 and the Dow Jones 1.2 per cent.

The S&P500 was also down 1.7 per cent as even mega-cap tech started to weaken.

That said, investors are seeing value in both healthcare and financials amid the uncertainty. Twitter (NYSE: TWTR) shares gained 1.7 per cent after Elon Musk confirmed he would not be taking a board seat with the business following a number of media comments.

Finally, dominant e-commerce provider Shopify (NYSE: SHOP) shares gained 2.5 per cent after the company became the latest to announce a 10 to 1 stock split to make their share price more palatable.