Market rides NAB profit, keeps February rise going

After a bruising 6.4% loss in January, the Australian share market is trying to pick up the pieces, with Thursday being its sixth positive session in eight trading days so far in February, and a third straight gain.

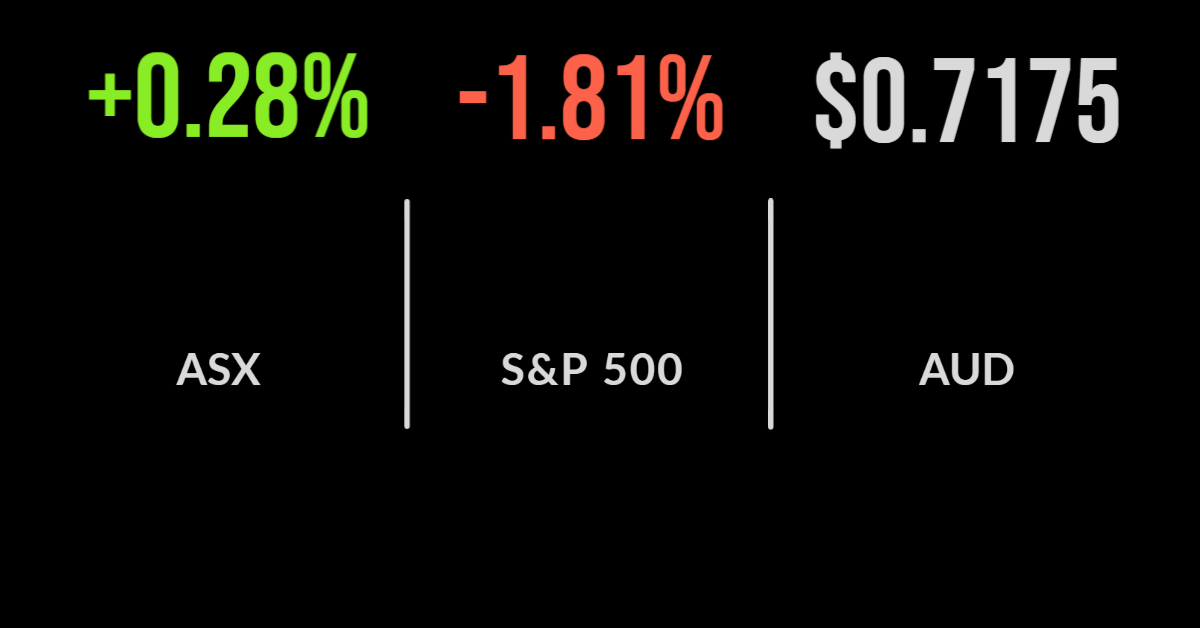

The benchmark S&P/ASX 200 index gained 20.2 points, or 0.3 per cent, to 7,288, while the broader All Ordinaries also closed about 0.3 per cent higher, at 7,595.

National Australia Bank (ASX: NAB) was one of the major drivers, with cash earnings for the first quarter beating expectations, as the bank gained market share in home loans and deposits.

Cash earnings in the first quarter were 9.1 per cent higher than a year ago, at $1.8 billion, and analysts said the lift was likely to bring upgrades to consensus earnings estimates.

NAB’s net interest margin eased by 5 basis points over the quarter to 1.64 per cent, while costs rose by 2 per cent, including pressure from higher salaries.

Revenue increased by 8 per cent, which NAB said came on the back of higher volumes across housing and business lending and a recovery in the contribution from its treasury operations.

Exchange operator ASX (ASX: ASX) fell by 3.8 per cent to $83.41, as chief executive Dominic Stevens announced his departure, saying he could not commit to leading the company for another six years as it implements seeks an ambitious technology transformation.

Stevens and chairman Damian Roche decided that a new CEO should take the reins before ASX flicks the switch on its world-first project to replace its CHESS settlement system with a blockchain-based distributed ledger technology (DLT) system.

AMP, Magellan rise, while Killi kills it

AMP (ASX: AMP) shares rose by 5.9 per cent, to $1.07, after reporting a net loss of $252 million loss for 2021, on the back of revenue that was 3 per cent lower, at $3.3 billion.

Investors focused on an underlying annual profit rise 53 per cent to $356 million, driven by a 38 per cent earnings increase in the AMP Bank division, and an 18 per cent rise in profit at the flagship AMP Capital asset management division.

Automotive services group Bapcor (ASX: BAP) surged by 10.3 per cent, to $7.15, after falling out of bed to the tune of 8 per cent the day before, after the company reported a 14.7 per cent fall in half-year net profit, to $57.7 million.

Embattled funds management group Magellan Financial (ASX: MFG) gained 46 cents, or 2.5 per cent, but is still down by 11 per cent year-to-date.

Meanwhile, gold and copper explorer Killi Resources (ASX: KLI) made the share market look easy, more than doubling its value on its first day of trading, turning its 20-cent issue price into a 52-cent price at the end of the day.

The resources junior raised $6 million through its initial public offering, issuing 30 million new shares.

The Australian dollar was down 0.1 per cent, buying 71.72 US cents.

Inflation, Fed double whammy belts Wall Street

The January US inflation figure surprised on the upside, rising by 7.5 per cent over the year to January, beating consensus expectations of 7.2 per cent and picking-up pace from the 7 per cent annual rise posted in December.

It was the highest inflation figure since 1982. The market was annoyed enough at the higher-than-expected figure – which by itself implied that the next rate hike would not be the standard 25-basis-point rise, but more like 50 basis points – but really got in a funk afterwards when St. Louis Federal Reserve President James Bullard told Bloomberg News that he would like to see the benchmark lending rate hit 1 per cent by July.

The broad S&P 500 index lost 83.1 points, or 1.8 per cent, to 4,504.1, while the 30-stock Dow Jones Industrial Average slid by 526.5 points, or 1.5 per cent, to 32,241.6 points, and the tech-heavy Nasdaq Composite index lost 304.7 points, or 2.1 per cent, to 14,185.6 points.

Dow Jones component Disney (NYSE: DIS) bucked the trend, rising by 8 per cent in extended trading.

Disney’s revenue rose by 34 per cent to US$21.8 billion in the quarter ended January 1, beating the analysts’ consensus estimate of US$20.9 billion.

Net income from continuing operations was US$1.15 billion, or 63 cents per share, in the quarter, compared with a net income of just US$29 million, or 2 cents per share, a year earlier.

In Europe overnight, London’s FTSE-100 index rose by 29 points, or 0.4 per cent, to 7,672.4, while the Euro Stoxx 50 index eased 4.8 points, or 0.1 per cent, to 4,199.3.