Market sinks on contagion fears, technology, energy hit, Computershare sinks

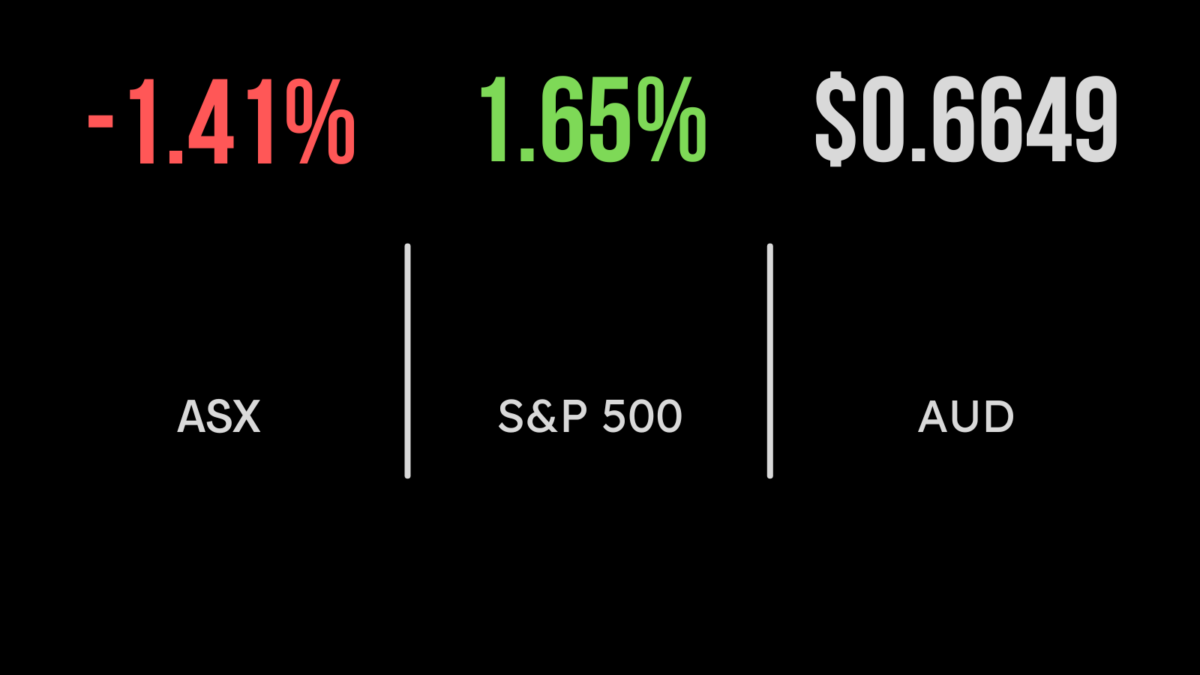

The local market has now given back most of the gains achieved in 2023, falling 1.4 per cent on Tuesday as concerns of further bank runs spread around the world. The threat was triggered by the bankruptcy and subsequent bailout of Silicon Valley Bank after it’s many accountholders sought to withdraw a significant amount of cash at the same time. Markets were calmed by moves from the Federal Reserve to backstop the company, but concern has grown around the hundreds of other regional banks. The immediate impact has been a significant fall in bond yields, resulting in a large jump in their values, rewarding those who added to their duration positions. On Tuesday, every sector finished lower led by technology, which fell 3.4 per cent, on concerns of a further weakening on availability of cash. Energy also fell 2.8 per cent on recession concerns, while Computershare (ASX:CPU) fell by 7.7 per cent as investors expect the interest the company makes on client cash to fall significantly.

Gold miners shine, lithium tanks, Newcrest up strongly, rate hikes ‘off the board’

The property and utilities sectors outperformed, while still posting a -0.3 per cent return, joining every other sector in the red. The standout was gold miners, within the materials sector, as the gold price once again moved past US$1,900 per ounce on concerns of another financial crisis. Newcrest (ASX:NCM) gained 3 per cent, Silverlake (ASX:SLR), 4.4 per cent and Ramelius (ASX:RML) 5.8 per cent to top the market. Lithium miners remain on the nose, with Lake Resources (ASX:LKE) losing another 8.5 per cent. Shares in Intellectual Property Holdings (ASX:IPH) entered a trading halt after disclosing a cyberattack on the business. In a sign of how swiftly things can change, the ‘market’ or those who speculate on bond yields and interest rate movements is now suggesting the Reserve Bank and Federal Reserve will no longer increase interest rates, and may well be forced to cut them before the financial year is out.

Global markets recover on lower inflation, US bank recovery, Meta cuts more jobs

Global markets staged an initial recovery overnight, as concerns about bank run contagion began to dissipate. The Dow Jones gained 1.1, the S&P500 1.7 and the Nasdaq 2.1 per cent as fear slowly subsided. All 11 sectors of the economy finished higher, led by telecommunications and energy, while shares in First Republic Bank (NYSE:FRC) a regional group, gained more than 30 per cent after falling close to 80 per cent in the prior session. In more positive news, inflation data was received in line with expectations, with the rate of price increases falling from 6.4 to 6 per cent in February. Similarly, stripping out food and energy it fell to 5.5 per cent, with hopes growing that rate hikes may finally be nearing an end. Shares in Meta (NYSE:META) gained more than 5 per cent after the company reported another 10,000 job cuts in the pursuit of efficiency.