Market weakens on Chinese lockdowns, commodity demand, Uniti jumps on bid

It was another difficult day for the domestic market with the Nasdaq entering a bear market and Chinese technology continuing to selloff putting further pressure on sentiment and the ASX’s position as a ‘risk on’ market.

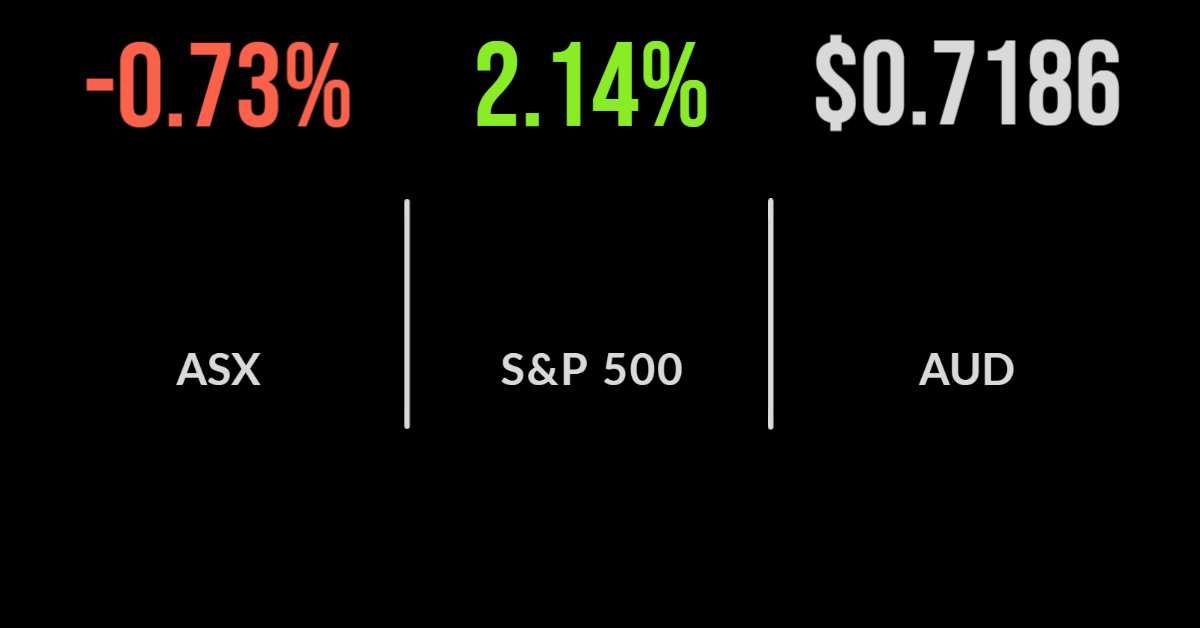

Ultimately the S&P/ASX200 fell another 0.7 per cent on Tuesday with energy and materials the biggest detractors, down 2.9 and 3.7 per cent.

The materials sector was hit heavily by the announcement of lockdowns throughout Shanghai and Shenzen with market reminded that both supply and demand have a role in setting commodity prices.

BHP (ASX: BHP) and Rio Tinto (ASX: RIO) were among the hardest hit, falling 4.2 and 3.9 per cent respectively.

On the positive side, the financials and communications sector joined three others in posting positive returns of 1 and 0.7 per cent with a bid for Uniti Wireless (ASX: UWL) sending the shares more than 27 per cent higher.

The bid came from NZ-based infrastructure group Morrison & Co, who put a $4.50 value on the company when launching a non-binding, conditional bid for one of the fastest growing broadband networks in the country.

Rio lobs offer for Mongolian asset, Zip freefall continues, Healius begins buy back

Shares in Zip Co (ASX: Z1P) fell another 9.3 per cent as the technology selloff showed no signs of slowing down, with concerns about their access to cheap capital in the US overcoming their still significant growth.

Private hospital group Healius (ASX: HLS) gained 3.3 per cent after announcing a $100 million on market share buyback that suggests they view the business as being undervalued by the market.

The highly difficult and increasingly expensive Oyu Tolgoi copper mine part-owned by Rio Tinto in Mongolia is in focus once again, with the group lobbing a bid to purchase the asset outright for $3.7 billion; analysts have viewed this as a positive given the outlook for copper and difficulties with their partners in the project.

The takeover of underperforming long-short manager VGI Partners (ASX: VGI) by Regal has been extended to the end of March as the two parties try to agree on terms at a time when equity performance continues to struggle.

In positive news for the tourism sector, the cruise ship ban was lifted this week.

Market rallies as oil enters bear market, airlines jump, inflation holds

Global markets appeared to be regaining steam after another strong session in the US, supported primarily by a sharp fall in the oil price.

The price of crude has fallen from over US$140 to below US$100 in the space of a few days entering a bear market on threats of a slowdown in Chinese demand.

The news sent all three US benchmarks higher with the Nasdaq outperforming, up 2.9 per cent, the Dow Jones 1.8 per cent and the S&P500 up 2.1 per cent.

Whilst the headlines were concerning, with business inflation up 10 per cent year over year, the rate held at last month’s level and when excluding food and energy was just 0.2 per cent.

Energy prices were 8 per cent higher month over month. Shares in most major airlines gained with United Airlines (NYSE: UAL) up 9 per cent and Delta (NYSE: DAL) 8.7 per cent after both raised this quarterly revenue forecast on surging demand for travel.

The Federal Reserve rate decision lies ahead with expectations of a 0.25 per cent hike.