Market weakness continues on bond yields, Suez Canal blocked again, BHP goes ex

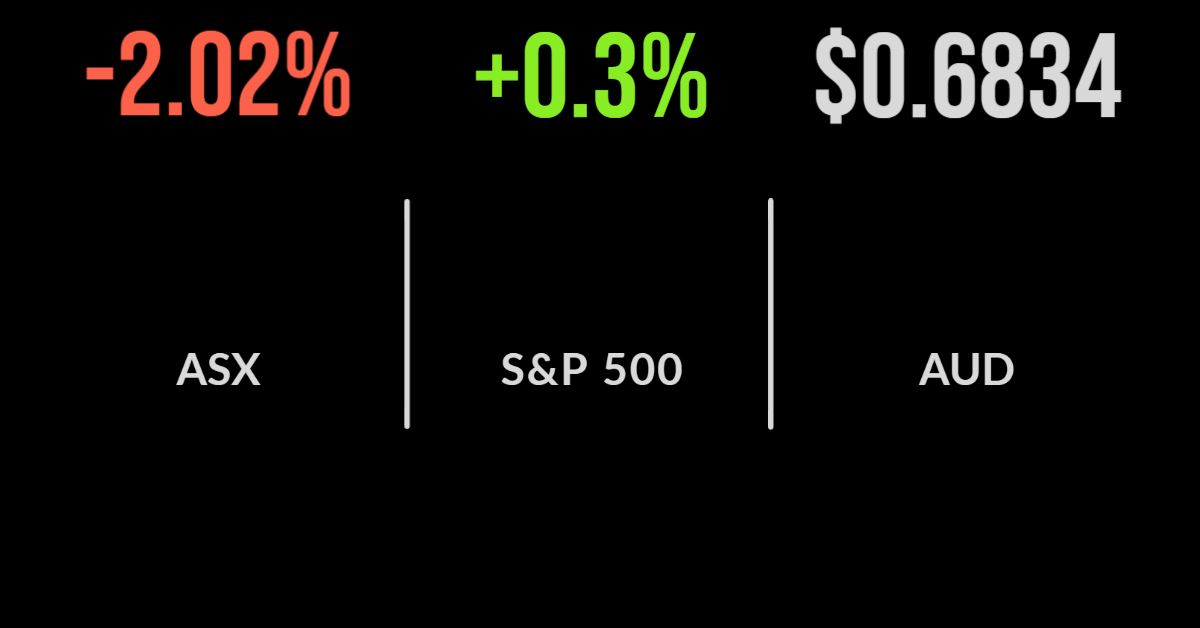

The local sharemarket continued its recent weakness, falling another 2 per cent for the first day of spring.

Australia’s largest company, BHP (ASX:BHP) was the biggest detractor falling 7.6 per cent, or $3.09 cents as the stock went ex-dividend.

This is a regularly forgotten impact of the payment of dividends, which totalled $2.56 plus franking credits, as the payment of cash leaves the business worth less the day after.

This dragged the materials sector down 4.9 per cent, with Sandfire (ASX:SFR) falling 12.1 per cent as the threat of an economic contraction hit the price of copper.

Technology companies Pointsbet (ASX:PBH) and Zip Money (ASX:ZIP) were the other major losers, down 15.9 and 7.9 per cent.

Shares in Rio Tinto (ASX:RIO) also fell 2.1 per cent after the company won the approval of the board of Torquise Hill which allows them to move forward with the development of the struggling Mongolian copper mine.

Housing bears return, auditor under fire, Money Me slumps

With reporting season nearing an end, the focus once again turns to merger and acquisitions along with economic data.

Today it was all about the fastest fall in house prices in decades, with Sydney and Melbourne falling a ‘whopping’ 2.3 and 1.2 per cent in August.

Clearly some reversal was due, but many expert forecasters are now predicting 15 to 20 per cent corrections, not unlike they did during the pandemic.

Negative sentiment impacted REA Group (ASX:REA) and Domain (ASX:DHG) which fell 2 and 4.8 per cent respectively, while Dexus (ASX:DXS) fell 3.1 per cent.

Another tanker has run aground in the Suez Canal, causing concern about energy exports once again.

In the US, the two year treasury yield just exceeded 3.5 per cent for the first time since 2007, which has been the key driver of recent market weakness.

Consumer credit business Money Me (ASX:MME), which ones peer to peer lender Society One, fell 27 per cent after announcing a $20 million capital raising.

Market mixed as semiconductors hit, Chinese lockdowns and economic data, Meta announces paid products

US markets rebounded from a four day losing streak with the S&P500 posting a 0.3 per cent gain, behind the Dow Jones, which was 0.5 per cent higher.

While the continued strength in bond yields and the US dollar pushed the Nasdaq to another small loss of 0.3 per cent.

Among the biggest detractors were semiconductor stocks, including NVIDIA (NYSE:NVDA) and Advanced Micro Devices (NYSE:AMD) which fell 7 and 3 per cent respectively after the US Government announced its intention to ban the export of certain data centre-related chips to China.

Shares in identity checking platform Okta (NYSE:OKTA) fell by more than 33 per cent after the company indicated it was having issues integrated and extracting efficiencies from their acquisition of Auth0.

While Meta Platforms (NYSE:META) gained 1.5 per cent after management announced their intention to launch a number of paid products on the platform.