Markets weaken on threat of recession, commodities, energy tank, Vicinity upgrades

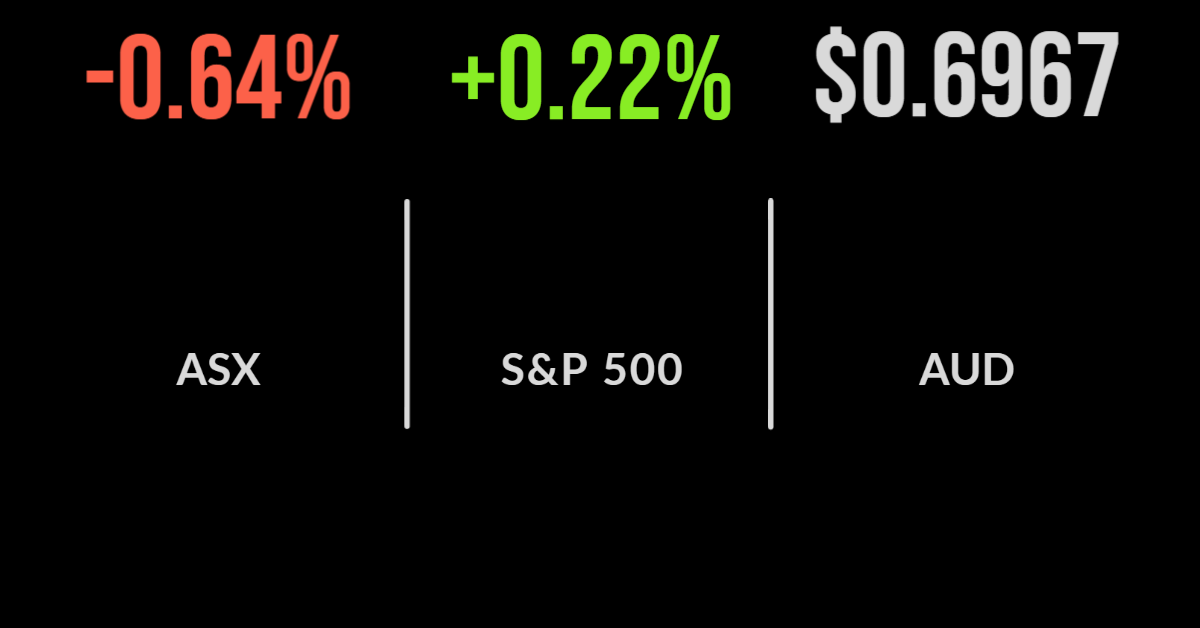

The local market open on an unexpectedly positive tone but ultimately finished 0.6 per cent lower as commodity and energy prices fell across the board.

The selloff in energy and materials finished at 5.1 and 4.6 per cent respectively, amid growing concerns about the outlook for the global economy.

Uranium miner Paladin (ASX: PDN) was the worst-performing company falling 13.1 per cent, whilst Fortescue (ASX: FMG) and Rio Tinto (ASX: RIO) was down 8.6 and 5.1 per cent.

A number of banks and economists are now pricing in a US recession due to recent rate hikes, a near-seamless shift away from technology valuations.

Healthcare and property were the standout sectors, gaining 2.4 and 3.5 per cent on hopes bond yields may have already peaked.

Vicinity (ASX: VCX) upgraded its earnings guidance for the year, now expecting 12.6 cents per share on the back of the strength in retail sales.

Management cited improved outcomes with rent negotiations and strong cash collections as key drivers behind a $245 million increase in their property values; shares finished 6.3 per cent higher.

PointsBet gets US backing, Cooper to buy Orbost plant, InfoMedia opens books

Online sports betting company PointsBet (ASX: PBH) surged by more than 18.6 per cent after confirming they had issued $94 million in new shares to SIG Sports Investment Corp, a group backed by Susquehanna.

This represents 12 per cent of the listed shares in the company and perhaps a floor for the company that has been in freefall this year.

After-market software provider InfoMedia (ASX: IFM) is the centre of a bidding war, with three interested parties granted access to their books in order to undertake due diligence.

This includes TA Associates, Battery Ventures and Solera, shares gained 7.4 per cent.

The biggest news was Cooper Energy (ASX: COE) entering a trading halt in order to announce the acquisition of APA Group’s (ASX: APA) Orbost Gas Processing Plant.

The asset had struggled to reach nameplate capacity for several years and this was a long-awaited deal that would allow the gas producer to move up the production chain.

The deal with come at a cost of $270 million, slightly above the $236 million book value, with Cooper undertaking a $244 million capital raise to fund the deal.

US markets closed for Juneteenth holiday