MAX Awards: the winners may well be…

The annual MAX Awards returns to a live-action dinner format at Sydney’s Luna Park on June 10, and this masthead’s tips and comments also return to assist voters’ deliberations.

The awards produced by Financial Standard, a part of Rainmaker Information, mark the 26th year as the only awards which focus on marketing and sales achievements in funds management, from big companies to small, from teams to individuals.

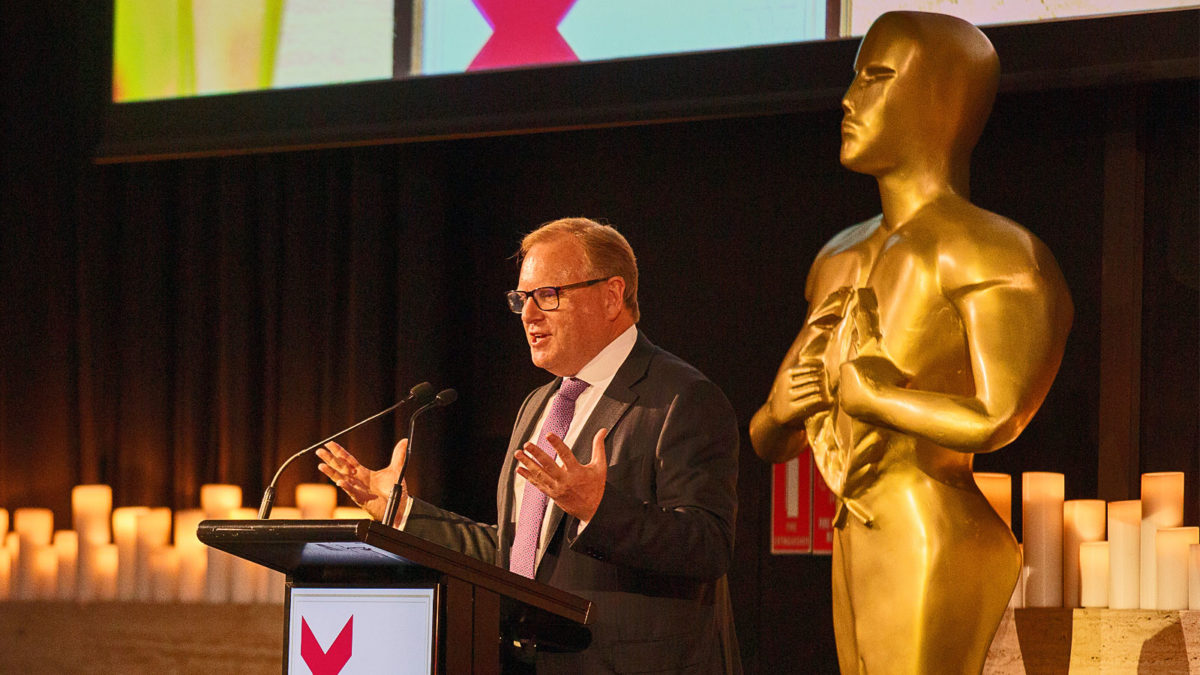

Comedienne Jean Kitson will again be the MC for the evening, which was considered one of the best of the virtual celebrations held during the worst of covid. It was produced at a studio in Parramatta, where Chris Page, Rainmaker’s and the Max Awards founder (pictured at last year’s virtual awards), was filmed in a carpark alighting from a car to introduce the event.

Page said that, for this year’s awards, the alumni of the firm’s Best of Breed research tour, which involves travel to the US and Europe (suspended at least until 2022), will be getting together at the MAX Awards dinner, which will bolster numbers. Plus, the Investment Leaders Awards winners, who pre-covid had their own event, will be announced and participants in that will be present at Luna Park.

As with previous years, Investor Strategy News is happy to venture where others fear to tread with our predictions and reasoning behind them. Notwithstanding multiple conflicts of interest and briefly putting aside the Journalists’ Code of Ethics (that’s the little book which says we should publish “without fear or favour”), here we go.

Note: We haven’t commented on all of the 22 awards, though; only those for which we think we have some additional expertise. The specialist press is, after all, the recipients of many of the award hopefuls’ messages, some of their budgets, and from time to time, what seems to be a lot of their ire.

A word of advice for newcomers to the MAX Awards. Voting is of a ‘people’s choice’ nature – open to the 30,000-odd readers of Financial Standard – backed by the ‘wisdom of crowds’ theory. The awards system naturally favours firms with greater market share and individuals with a lot of friends. The organisers, however, have taken steps to discount multiple votes from the same person or same IP address.

– Executive of the Year – Marketing. Trying to predict either of the most coveted awards for individuals, the executives of the year for distribution and marketing, is a bit like trying to predict the winners in the Melbourne Cup. They are the broadest of fields for contenders. But flush with our success last year, when we correctly tipped Felicity Nicholson for marketing, we are going to double down with Wayne Sullivan from Frontier this year.

Sullivan is a first-time finalist who was instrumental in changing the name of the company he works for, from Frontier Advisors. No-one else can claim to have done that.

Frontier has maintained its strong position in the industry even though it has eschewed offering investment product to its clients, unlike its main competitors. It has instead invested heavily in technology and a ‘partners program’ of alliances with like-minded organisations in the US and UK. It is no surprise, then, that Frontier is also a finalist in Max Awards’ newest award, ‘Digital Platform of the Year’, which will be presented for the first time, and ‘Website of the Year’.

Following her award last year, Felicity Nicholson’s career went from high note to higher note. Her company, Legg Mason, was taken over by a bigger company, Franklin Templeton, and she rose through the integration to become the head of marketing for the combined entity. Coincidence?

– Executive of the Year – Distribution. There are more differences than similarities between the jobs of the finalists in this category. Finalist Damien Otto, for instance, heads up distribution for little-known Futurity Investment Group, a mutual structure for its 75,000 members which sells education bonds. It was established in 1974 and has about $1.2 billion under management. Chris Mather, another finalist, on the other hand, heads up distribution for the three platforms offered by Westpac-owned BT, a big diversified retail manager with an enviable pedigree. Chris has been there for 12 years.

The other finalists are from smallish organisations which have been very successful in their respective sectors in the past couple of years: Stuart Devlin from Warakirri, James Martin from Hamilton Lane and Vinnie Wadhera from BetaShares. We’re taking an each-way bet (which in less civilised times was called a ‘ladies bet’) on Chris Mather, for his perseverance, which we see as good a reason as any. We’re comforted by the fact that last year’s winner was James Waterworth from BlackRock, the world’s biggest fund manager.

. Digital Platform of the Year. If any of the finalists got a lucky break with covid-19 – and there were a few who invented more ways to use the word ‘pivot’ than we cared to hear – it would have to be Link Group. Link’s virtual meetings service went gangbusters and to the marketing people’s credit, opened up a new potential client base among the big super funds which put a lot of effort into boosting their communications of all sorts, including holding virtual annual meetings or ‘town halls’.

Link produced 393 virtual meetings across its client base in Australia last year. The company uses a proprietary system and claims to have been the first to offer an “end-to-end inhouse virtual meeting service in Australia”.

Link has good form in digital communications, having won the ‘Financial Services App’ award in 2017. We think the company will be too strong for the rest of the field.

The other finalists are: BT Panorama, Frontier’s ‘Partners Program’, Aware Super for its app, and Commsec for the relaunch of its app. Frontier is also a finalist in the Website of the Year category where we think the team is a better chance.

– Digital Campaign of the Year. This is also being contested primarily by big companies: Allianz Retire+, Franklin Templeton for ‘MORE’, Colonial First State for its multi-affiliate manager Baillie Gifford, Praemium for ‘The platform of everything’, and Schroders for its PAYS ETF.

We’ll discount Praemium because they won this award last year and CFS’s campaign for Baillie Gifford because it was just too difficult due to the market’s mid-stream style rotation. Baillie Gifford is a top-notch growth manager but markets have been swinging belatedly behind value. Q: Where was this campaign a few years ago? A: It was probably not needed.

Allianz Retire+ has been putting a lot of effort into its retirement income product, befitting a new potential game changer, but it’s a long-term strategy and a complicated product. Franklin Templeton’s, a home-grown campaign following the Legg Mason takeover, was a simple single message efficiently executed. Modest budgets usually don’t win awards but if they did the MORE campaign should get a bonus point.

– Agency of the Year. The advertising and marketing agency sector of financial services is big and varied. Ptarmigan Media won this award last year and produced the best acceptance video of the night for the virtual event. This year, the staff-owned global firm is a finalist in the three main agency categories and has two entrants in one of those categories. If it was a stock, you’d probably be thinking of taking your profits.

But this is not all about investments; it’s all about the media. The other finalists are: Socialised, Fundamental Media (another UK-based global firm), In Marketing We Trust and Marketing Pulse.

Haissam Aoun, co-founder and managing partner of Marketing Pulse, is also a finalist in the Agency Executive of the Year category, up against Ptarmigan’s Michelle Reed, Media Six’s Nicole Smith, Fundamental Media’s Karlee Samuels and Benedictus Media’s Laura Cremona.

Aoun debuted as a finalist in the Agency Executive award last year, won by Claire Zipeure from Media Lab. We’re tipping him for one of the two awards – the other one. This may seem like a big call, but Agency of the Year is more likely to go to Ptarmigan for a third consecutive year. And we think that the biggest threat is probably Fundamental.

It’s therefore time for a little background. Ptarmigan’s chairman and founder, David Wiggin, started the agency in 1992 after a stint in the British military followed by corporate communications. The firm bills US$170 million annually.

He told us: “I have always liked the word Ptarmigan, with a silent ‘p’… As well as being a rare species of grouse that survives and thrives in high hostile terrain, it also changes its feathers throughout the seasons in order to gain protection. In the world of media buying, things can get quite tricky/hostile in discussions with media suppliers and it is also a very competitive market place. We are an agency that has survived these difficult conditions.”

‘Ptarmigan’ also happens to be the name given to an armed forces secure communication system used in the 1980s. The notion of secure communications was appealing for an agency with multiple financial services clients.

– Agency Executive of the Year. If we’re right about Agency of the Year, we’ll be right about the Executive of the Year – Haissam Aoun. Aoun started his media career in publishing. He headed up group sales for the listed Investor Info in the early 2000s, publisher of what are now Momentum Media titles Investor Daily, Investor Weekly, IFA, SMSF (now Nest Egg), a database business competing with Rainmaker, and conferences.

In recent years he has continued to provide freelance agency services while running Marketing Pulse, an advertising measurement service for fund managers in Australia and the UK. This year he also started a new agency as a separate entity, ‘We Are Better’, with business partner Laszlo Kertesz.

– Agency Campaign of the Year. Ptarmigan (remember the silent ‘p’) has two campaigns among the finalists – one for First Sentier Investors and the other for Franklin Templeton. Both campaigns came about because of industry takeovers. Commonwealth Bank sold Colonial First State Global Asset Management to Mitsubishi UFJ, completing the deal in August, 2019. The firm was renamed First Sentier Investors, while Franklin Templeton acquired the multi-affiliate manager Legg Mason. In both cases the acquired businesses had significant operations in Australia as well as a global presence.

Fundamental Media also has two campaigns in this finals list – one for Clearbridge Investments and the other for Macquarie’s affiliate Walter Scott and IFP Global Equities.

The third finalist agency for this award is BlueChip Communication, which is demonstrating its diversification beyond PR. BlueChip produced an integrated campaign for Hyperion Global Grown Companies Fund and may well prove to be a crowd favourite against the big UK-domiciled competitors. As is usually the case, BlueChip is a finalist and strong contender in the PR Agency of the Year category as well, which it won last year. While this is a long shot, we’re tipping BlueChip for its first Max award outside of PR.

– Marketing Campaign of the Year – Consumer. Banks and insurers tend to have more success in this category than fund managers. Last year, Suncorp was the winner and this year we’re tipping Budget Direct for its general insurance campaign. The campaign is bigger than the TV commercials, but they are so irritating they probably work. With an overuse of computer-generated graphics, the TVCs (as they are known in the trade) are reminiscent of early ads with the introduction of colour television, when every colour available was combined without regard for subtlety or taste. Throw in poor acting and a corny script and there you have it: an ad which sticks in your head like an unwanted earworm.

The other contenders are ANZ for financial advice, NGS Super, Fidelity and La Trobe Financial. While ANZ’s big-budget advantages should give it an edge, there is no reward for bravery post Royal Commission, so we’ll stick the Budget Direct earworm campaign.

– Public Relations Agency of the Year. Now, if anyone knows a thing or two about financial services PR it’s Investor Strategy News – our two dedicated journalists (new recruit Lachlan Maddock and myself) and a string of in-house contributors. Investor Strategy News is owned by The Inside Network, which is also the majority shareholder in Shed Connect, a previous winner of this award.

The finalists are: Honner, the recently renamed PritchittBland Communications, Mountain Media, Reverb Media and BlueChip Communications, which is last year’s winner. Ordinarily we’d say this is a toss-up between Honner and BlueChip, which it has tended to be over the years. But Honner was not a finalist last year, prompting us to then suggest a left-field candidate, Emma Cullen-Ward’s One Profile, who does not nominate herself, but was nominated by a client previously.

We’re sticking with that theme by backing Pritchitt Bland this year. The boutique firm, headed by Claudia Pritchitt and Leeanne Bland, also does not nominate itself – a client did. The partners also believe that asking others to vote for them is a bit unseemly, lengthening the odds of them ever getting to own a MAX.

But, like Emma Cullen-Ward, the firm consistently puts above-average effort into its press releases and other communications with journalists.

Neither Mountain Media nor Reverb Media are well known among funds management industry writers. Mountain Media, set up by Phil Davey in 2008, specialises in the not-for-profit sector. Reverb Media is a new firm set up in 2017 by journalist Keith Barrett who has worked on Professional Planner and Investment Magazine at Conexus Financial, where was managing editor for two years, and ASFA’s ‘Superfunds’ as well as generalist titles, over a 25-year period.