Megacaps fire ASX to new record high

ASX, Comm Bank, and Mineral Resources close at records, Austal sold off

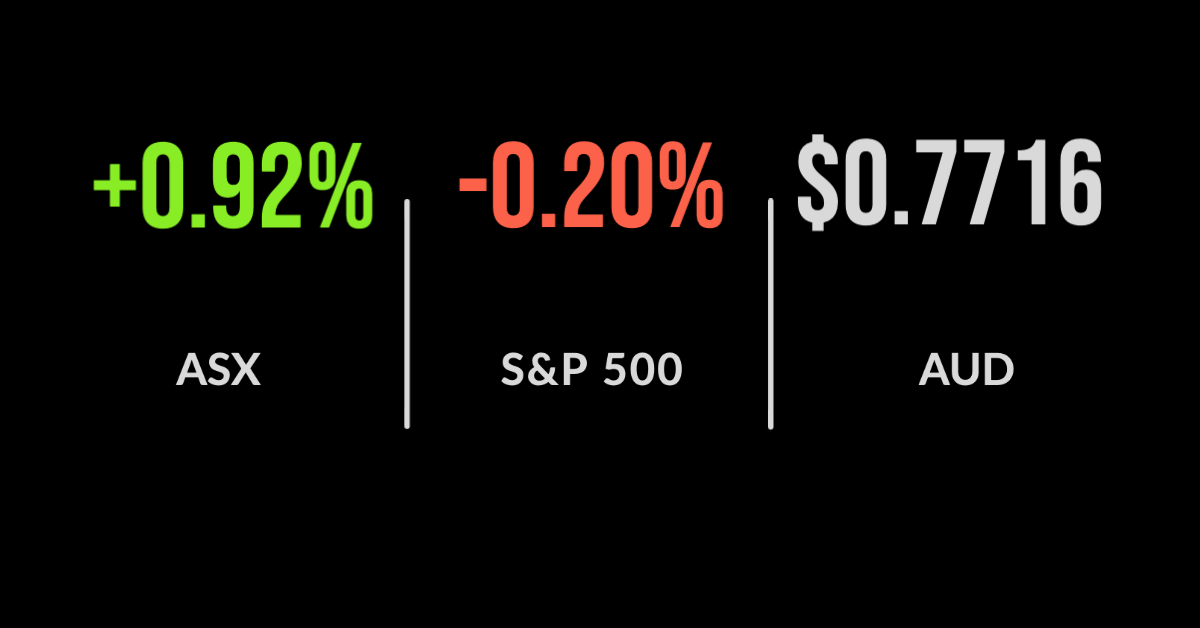

The ASX 200 (ASX: XJO) continues to hit new records, moving 0.9% higher on Tuesday, with pent-up Queen’s Birthday demand behind the surge.

Every sector in the market moved higher but it was healthcare behind CSL Limited (ASX: CSL), up 1.7%, and IT behind Afterpay Ltd (ASX: APT) up 2.1%, which were the biggest beneficiaries.

The Reserve Bank’s latest update confirmed the ‘steady as she goes’ approach with little change and the board suggesting most bosses outside of the public service are not willing to increase wages, preferring to pay bonuses or reduce their trading hours.

Shipbuilder Austal Limited (ASX: ASB) was the worst-performing company on Tuesday, falling 9% after flagging a difficult finish to the year in which earnings are set to land between $112 and $118 million, down from $125 million initially expected.

Management highlighted labour issues, border closures, and resourcing as key influences on the poor result.

On the other hand, metal recycler Sims Ltd (ASX: SGM) jumped 1.8% after upgrading its forecasts as excellent third-quarter pricing extended into the current quarter.

Earnings will now land between $360 and 380 million, up from $260 to $310 million initially forecasted. Both margins and recovery in volumes were behind the result.

Nuix CFO, CEO dumped, Oaktree offers clarity on Crown bid, Fortescue heads to Congo

Nuix Ltd (ASX: NXL) is showing the first signs of recovery after announcing the departure of both its CEO and CFO.

This follows one of the highest-profile and worst-performing IPOs in recent years. The Nuix share price reacted positively to the news, adding 4.2%.

Sticking with the embattled moniker, Crown Resorts Ltd (ASX: CWN) received more detail on Oaktree’s offer to support the business, with the proposal offering an insight into how deals are down in the world of distressed debt.

Oaktree plans to take a 9.9% ownership of the company via a convertible note whilst providing the group with a $2 billion seven-year loan which will have the purpose of buying back shares owned by the James Packer controlled CPH Group.

The interest rate will begin at 6% before moving to 6.5% and offers a clear path to exit for both Crown and Packer. Crown shares were unmoved, falling 0.6%.

Fortescue Metals Group Limited (ASX: FMG) announced its intention to step into the Democratic Republic of Congo and offer support to a massive hydroelectric project expected to deliver US$80 to $100 billion in investment.

This seems an interesting move by the company in what remains a difficult region for foreign investors. Fortescue shares finished the day 0.5% higher.

Stocks down on retail sales, Oracle beats expectations, Fed meeting ahead

US markets broke their three-day winning streak with the Nasdaq falling 0.7% on Tuesday, and both the Dow Jones and S&P 500 down 0.3% and 0.2%, respectively.

Signs of a mixed economic recovery continued after retail sales fell twice as much as expected, down 1.3% in May as stimulus cheques ran out. When car sales were excluded, the figure was a more reasonable 0.7% fall.

On the other hand, the producer price index, a measure of business inflation was 0.7% higher, excluding food and energy, yet inflation expectations remain muted.

Elsewhere, the UK and Australian governments announced an important free trade deal with hopes that it will assist businesses to overcome their growing reliance on China.

Shares in cloud computing solution provider Oracle (NYSE: ORCL) fell despite blowing away expectations, with sales hitting US$11.2 billion from US$10.4 billion.

Importantly, earnings were significantly better at US$1.54 per share, up from $US$1.20 in the prior year. Oracle shares finished the day 1.2% lower.