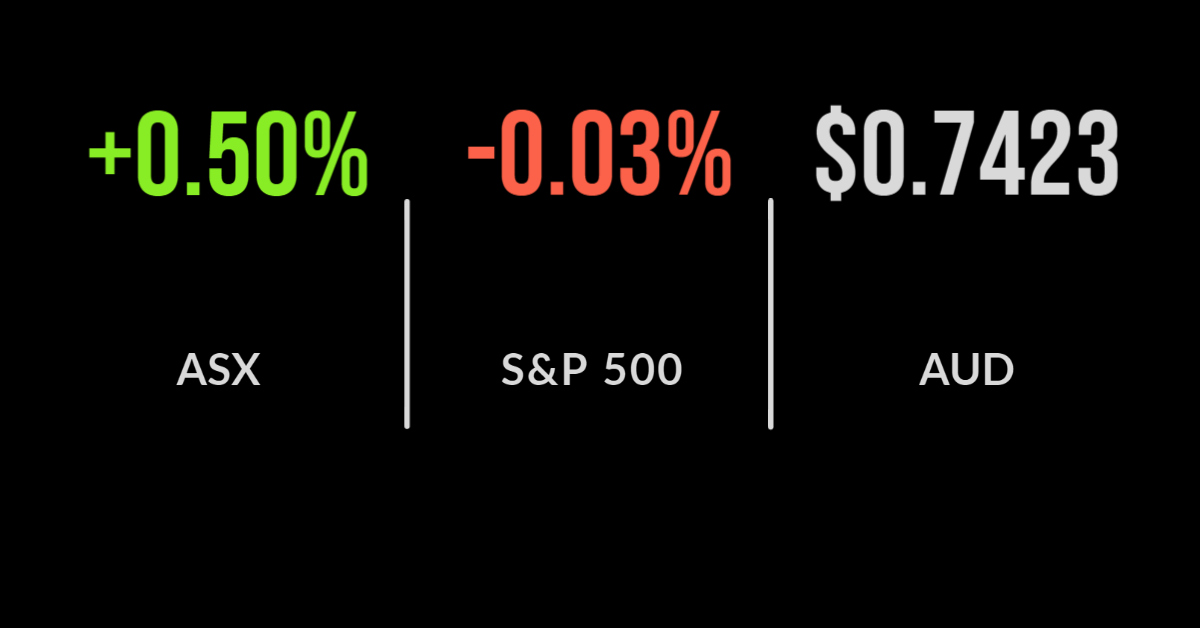

Miners and biotechs lift ASX 0.5%

ASX higher as dividends rain, three new highs, AMA in trading halt

The ASX200 (ASX: XJO) finished the week on a positive note, adding 0.5% with the market finish up the same amount of the five days.

On Friday it was all about resources and utilities, with Alumina (ASX: AWC) jumping 6.7% on a booming aluminium price and lithium miner Orocobre (ASX: ORE) doing the same, up 7%.

A number of less popular stocks finished the week strongly including Ramsay Healthcare (ASX: RHC), up 3% and Whitehaven Coal (ASX: WHC) 7% after a strong trade surplus was announced.

Over the five days both cyclicals and defensives staged a rebound, with real estate and energy both adding over 2% and outperforming their more popular growth counterparts.

The underlying trend, however, was all about the removal of dividends from the market making it difficult to get a true read on the direction of the market.

Motorcycle part retailer AMA Group (ASX: AMA) entered an unexpected trading halt amid speculation over their solvency but quickly corrected the market confirming they have over $60 million in cash.

The week also marked the end of August, with the market gaining for an 11th straight month, finishing 1.9% higher.

Real estate was the standout in August with the likes of Charter Hall and Vicinity Centres recovering despite the extended lockdowns in NSW and Victoria.

National Australia Bank (ASX: NAB), Macquarie Group and South32 all reached new 52 week highs this week, buoyed by the better than expected GDP result.

Mixed week in US market, Suga quits in Japan, job gains show weakening economy

US markets finished mostly lower with the Dow Jones falling 0.2% and the S&P 500 0.1% on the back of weaker than expected jobs data.

The Nasdaq continues to outperform as it did in 2020 with investors flocking to the COVID winners once again as the US economy is hit by the Delta outbreak that has seen border closures instituted once again.

Just 235,000 jobs were added to the US economy in August, meaning millions remain out of work since the pandemic.

This was well below the 720,000 expected by the market, actually a 300% difference. The unemployment fell to 5.2% but it is another sign of a slowdown in the economy which may force the Federal Reserve to hold off on tapering for the time being.

The biggest weakness has been coming from the leisure and hospitality sector, with many seeing this as a leading indicator for the economy, naturally sending the likes of Carnival Cruises (NYSE: CCL) down over 4%.

Over the week the Nasdaq delivered a 1.6% gain, the S&P 500 0.6 and the Dow Jones posted a small loss of 0.2%.

The big news however was the resurgence in the Japanese market with the TOPIX index hitting its highest point since 1991 and the Nikkei 225 adding 5% over the week following the resignation of Prime Minister Suga after just one year in office.

What to do with those dividends, GDP surprises, changing of the guard

As highlighted earlier this week, after a year of massive dividend cuts, management have once again rained cash on income starved shareholders.

On the one hand, this is a positive for those relying on this income for their lifestyle, on the other, it suggests these companies have little confidence in their ability to reinvest this capital. Either way, it leaves investors with a difficult decision; Reinvest? Diversify or Cash out?

With reporting season just finished in both the US and Australia, the market will now focus on economic data for direction, in which case volatility is likely to increase; for this reason, I’d be holding onto some cash for the time being.

This week saw another rebalancing of the ASX indices, the highlights being the inclusion of Resmed into the ASX50, and removal of two old-fashioned commodity businesses in Ampol and AGL Energy.

Pinnacle Investment Management finally re-joined the ASX200 after an incredible year, joined by EFTPOS terminal provider Tyro Payments, which replaced embattled tech company Nuix and G8 Education.

Australia’s GDP result was another surprise, gaining more than double the level predicted by economists’ courtesy of significant government support.

Despite the positivity it is clear that conditions are becoming more difficult for businesses meaning investors must choose wisely with their capital.