Miners motivate market

Upgrades in expectations for lithium price growth helped to lift the Australian sharemarket on Tuesday, driving a strong day for miners. Broker UBS lifted its lithium price forecast as much as 50 per cent, and the lithium players saw plenty of green.

Pilbara Minerals gained 25 cents, or 5.2 per cent, to $5.08, while fellow producer Allkem was up 46 cents, or 3.4 per cent, to $13.80. Mineral Resources, which mines iron ore and lithium, was up $4.83, or 5.3 per cent, to $96.28, while nickel and lithium miner IGO rose 68 cents, or 4.5 per cent, to $15.84. of the project developers, Liontown Resources was the best showing, advancing 7 cents, or 4.8 per cent, to $1.54

Among the big miners, Rio Tinto closed with a gain of $1.06, or 0.8 per cent, to $127.44; BHP gained 36 cents, or 0.6 per cent, to $49.71; and Fortescue Metals advanced 13 cents, also 0.6 per cent, to $22.51.

Goldminer Evolution Mining was up 16 cents, or 4.9 per cent, to $3.41, while rare earths producer Lynas added 20 cents, or 2.3 per cent, to $9.00.

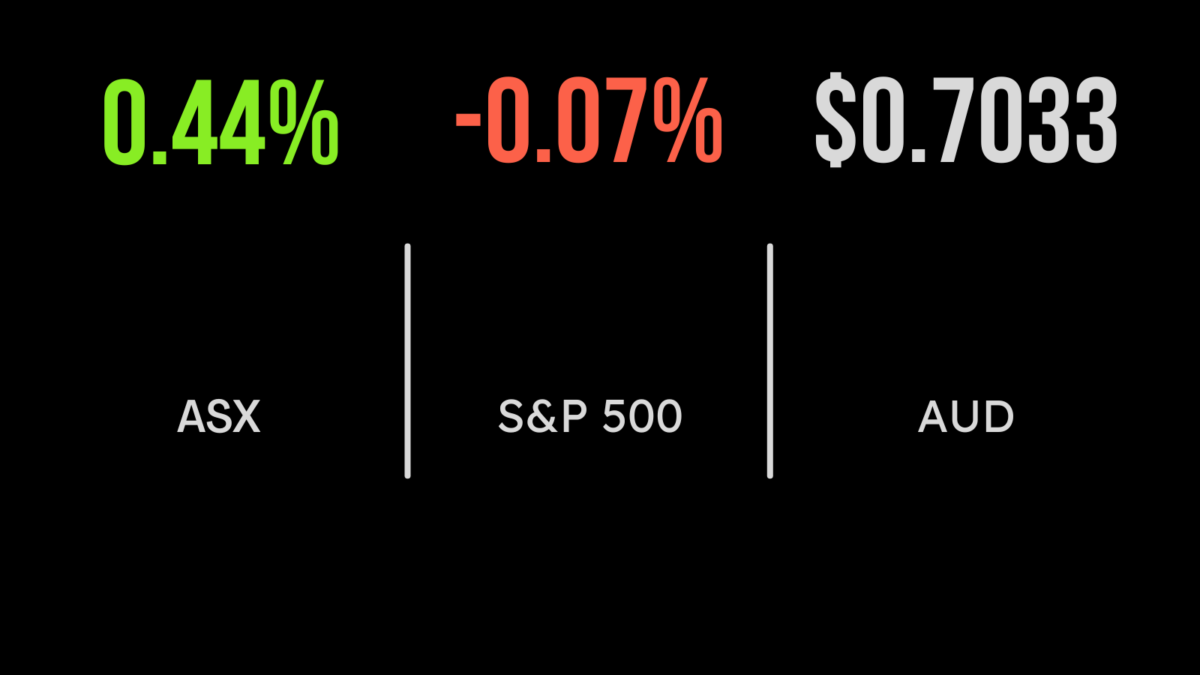

The mining action helped to lift the S&P/ASX 200 Index to its tenth straight rising day – and its 13th gain in 15 days – as it climbed 33.1 points, or 0.4 per cent, to a nine-month high of 7490.9 points. The Australian benchmark has added 7.8 per cent so far in 2023, and now sits just 1.8 per cent below its record high of 7628.9, reached in August 2021.

The broader All Ordinaries Index gained 36.3 points, or 0.5 per cent, to 7,710.5. The All Ords is off to an 8.1 per cent start to 2023.

BNPL a mixed bag

The buy-now, pay-later cohort were also actively traded, with US-based buy-now, pay-later outfit Sezzle giving up a big chunk of Monday’s gains, losing 6.5 cents, or 8.7 per cent, to 68 cents, while Zip Co was hammered 13 cents, or 15.6 per cent, lower to 70 cents, and Openpay Group was shredded 2.5 cents, or 11.4 per cent, lower to 20 cents. But it was a completely different story with Afterpay owner Block. Inc., which gained $6.18, or 5.7 per cent, to $114.69.

Among the big banks, Commonwealth Bank was down 56 cents, or 0.5 per cent, to $108.05; Westpac lost 24 cents, or 1 per cent, to $23.65; ANZ retreated 30 cents, or 1.2 per cent, to $24.62; and National Australia Bank eased 17 cents, or 0.5 per cent, to $31.34

Breville Group surged $1.57, or 7.5 per cent, to $22.39, despite the small appliances maker having no news to release.

Earnings season has US investors wary

On the US markets, the 30-stock Dow Jones Industrial Average managed a 104.4-point gain, or 0.3 per cent, to 33,733.96 as investors sifted through a mixed batch of earnings reports. The broader S&P 500 eased 2.9 points, to 4,016.95, while the tech-heavy Nasdaq Composite index lost 30.1 points over the day, or 0.3 per cent, to finish at 11,334.3. Microsoft was up 5 per cent after reporting second-quarter earnings that topped analysts’ estimates.

European markets closed lower despite purchasing managers’ indices (PMI) data showing a return to growth for the euro zone.

Gold was up US$5.70, or 0.3 per cent, to US$1,937.09 an ounce, while in oil, the global benchmark Brent crude grade shed US$1.94, or 2.2 per cent, to US$86.25 a barrel, and West Texas Intermediate oil lost US$1.44, or 1.8 per cent, to US$80.18 a barrel. The Australian dollar is buying 70.46 US cents this morning, steady with the domestic close on Tuesday.