Miners move local market

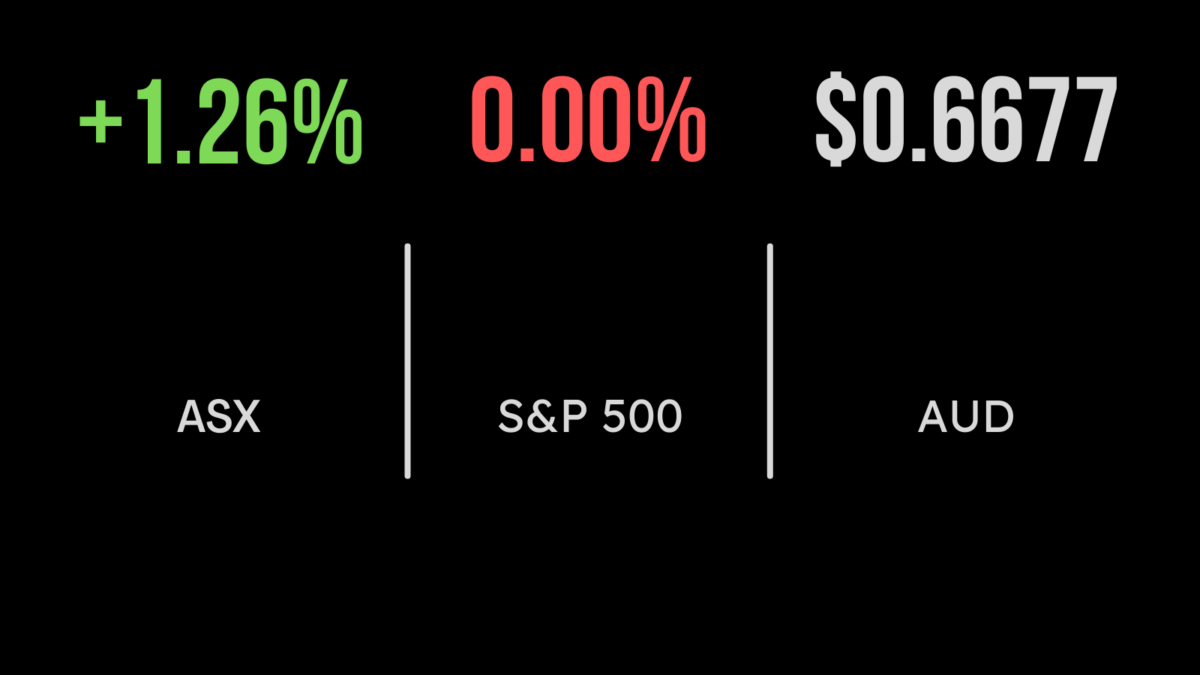

Broad gains across the materials sector drove a 2.2 per cent rise in the sub-index on Tuesday, which in turn flowed into an advance in the main Australian indices. The S&P/ASX 200 advanced 90.9 points, or 1.3 per cent, to 7,309.9, while the 500-stock All Ordinaries index gained 92.2 points, or 1.2 per cent, to 7,504.2. Ten of the ASX’s 11 sectors gained on Tuesday.

At the top of the materials sector, among the mining behemoths, BHP rose 93 cents, or 2.1 per cent, to $45.98, after Vietnam’s Competition and Consumer Authority approved its proposed acquisition of Oz Minerals; Rio Tinto was up $2.23, or 1.9 per cent, to $118.54; and Fortescue Metals gained 62 cents, or 2.9 per cent, to $22.19.

In the gold sector, Newcrest jumped $1.46, or 5.2 per cent, to $$29.74 after Newmont revealed a revised takeover offer for the company. Newmont has offered Newcrest shareholders more shares and a short-term cash sweetener under the improved bid, that Newcrest said valued its shares at $32.87. Newcrest said the deal represented a 46.4 per cent premium to Newcrest’s share price on February 3, before the first offer was made. Evolution Mining added 13 cents, or 3.9 per cent, to $3.51, after updating its guidance because of the heavy rain that hit its Ernest Henry operations on March 8., which saw water enter the mine.

The lithium sector welcomed a new player, with Evergreen Lithium hitting the screens. Evergreen’s flagship Bynoe project in the Northern Territory adjoins the Finniss lithium mine owned and operated by Core Lithium, which produced its first lithium ore concentrate this month. Evergreen shares, issued at 25 cents in the prospectus, closed at 30 cents, up 20 per cent. Core Lithium advanced 2 cents, or 2.3 per cent, to 89 cents.

Producer Allkem gained 29 cents, or 2.7 per cent, to $11.12, and fellow producer Pilbara Minerals rose 8 cents, or 2.2 per cent, to $3.69. Mineral Resources, which mines iron ore as well as lithium, was up $2.71, or 3.6 per cent, to $78.87, while IGO, which produces nickel and lithium, lifted 31 cents, or 2.5 per cent.

Namibia-based uranium producer Paladin Energy lifted 3 cents, or 5 per cent, to 63 cents, while rare earths miner Lynas Rare Earths firmed 23 cents, or 3.8 per cent, to $6.29, and mineral sands and rare earths producer Iluka Resources closed 33 cents, or 3 per cent, higher at $11.41.

In energy, Woodside Energy was up 28 cents, or 0.8 per cent, to $34.17; Santos gained 8 cents, or 1.1 per cent, to $7.22; Beach Energy rose 4 cents, or 2.7 per cent, to $1.54; and Brazilian-based producer Karoon Energy surged 14 cents, or 6.2 per cent, to $2.41.

In the big banks, Westpac was up 38 cents, or 1.8 per cent, to $22.15; ANZ gained 37 cents, or 1.6 per cent, to $23.56; National Australia Bank added 37 cents, or 1.3 per cent, to $28.25; and Commonwealth Bank advanced 75 cents, or 0.8 per cent, to $99.76. Local biotech giant CSL was up $1.57, or 0.5 per cent, to $301.75.

Wall Street awaits inflation figure

In the US, investors seemed to sit on the sidelines ahead of the inflation report that is due out tonight. The 30-stock Dow Jones Industrial Average lifted 98.27 points, or 0.3 per cent, to 33,684.79, while the S&P 500 “lost” a barely perceptible 0.17 points to end at 4,108.94, and the tech-heavy Nasdaq Composite Index shed 52.48 points, or 0.4 per cent, to 12,031.88. European markets were mostly higher.

In the bond market, the US 10-year yield was unchanged at 3.432 per cent, while the more policy-sensitive 2-year yield was also flat, at 4.033 per cent.

Talking commodities, gold was down 10 cents at US2,003.60 an ounce, while in oil, the global benchmark Brent crude grade rose US$1.43, or 1.7 per cent, to US$85.61 a barrel, but US West Texas Intermediate eased 16 cents, to US$81.37 a barrel.

The Australian dollar is buying 66.52 US cents this morning, down from 66.69 US cents at the local close on Tuesday.