New highs for ASX as companies again defy COVID gloom

ASX hits 7,500, Wesfarmers’ record high, mining continues to bounce

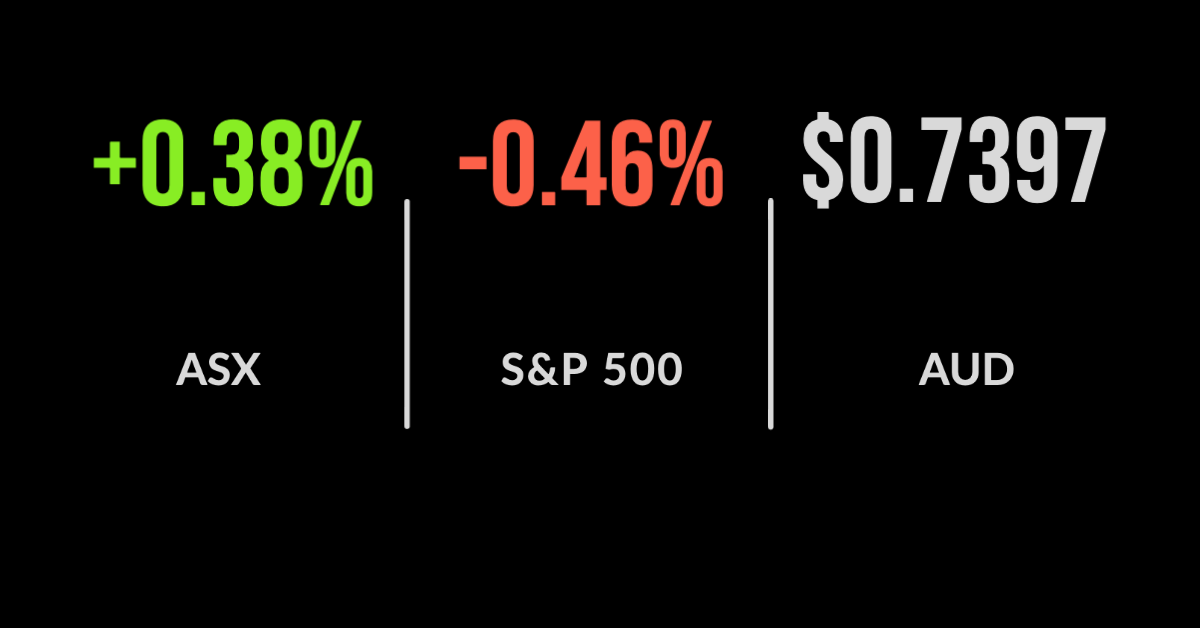

The ASX 200 (ASX: XJO) continued its strong recent run with the mining sector once again taking the mantle back from technology, jumping 1.2% behind another record from BHP Group Ltd (ASX: BHP) which jumped 2.1%.

This marks another record high with the benchmark closing above 7,500 points for the first time in history. The commodity rally is coming despite a seeming weakening in the outlook for the Chinese economy.

Rolling lockdowns have placed increasing pressure on the retail and hospitality sector, with net sales falling 1.8% in June, albeit up 2.9% on 2020 levels, Wesfarmers Ltd (ASX: WES) hit a new record high despite the result adding 0.6%.

Lithium and ‘green’ commodity companies including Pilbara Minerals Ltd (ASX: PLS) and Lynas Rare Earths Ltd (ASX: LYC) continue to dominate capital flows, with PLS adding another 4.6%.

Woodside Petroleum Limited (ASX: WPL) was able to overcome another blowout in its massive Scarborough gas project, costs are set to increase by another 5% to US$12 billion; shares jumped 1%.

Moratoriums benefit Genworth, Bunnings ups property valuations

Shares in insurance company Genworth Mortgage Insurance (ASX: GMA) rallied by 7.6% after the company reported a return to profitability.

The company provides insurance policies against home loans that step in when repayments are missed, hence the recovery was driven by a 51% fall in claims to just $49.3 million as lockdown-related moratoriums meant loan defaults remain on hold. The question is how long can this last?

Net profit hit $59.4 million in the half from a loss of $90 million in the prior year as new insurance policies jumped 14.7% to $15.5 billion on the back of a residential property boom. Despite this, revenue actually fell 12.3% to $208 million.

The Bunnings Warehouse Property Trust (ASX: BWP) has been forced to pivot away from Bunnings stores and is now focused on refurbishing assets that Bunnings has recently left as it seeks further diversification. The group has also seen significant bidding pressure for new Bunnings sites, having failed to buy a new site in several months.

Despite this, net profit jumped 25% to $263.2 million for the financial year, boosted by a $149 million increase in the valuation of their property portfolio, the cap rate or yield falling to 5.65%. The distribution was kept to 18.29 cents but management was forced to dip into retained profits and those same property revaluations to maintain it at this level.

Nasdaq outperforms as job gains slow, Alibaba reports, China pulls back rhetoric

The Nasdaq outperformed on Wednesday, adding 0.1%, with both the Dow Jones and S&P 500 falling, down 0.9% and 0.4% respectively.

Investors continue to flock back to quality, less economically exposed businesses including big tech after employment gains were far weaker than expected.

The private sector added half the level of jobs expected with some 6.5 million still out of the workforce since April, with the bigger threat of the end of unemployment benefits coming in September.

Alibaba Group (NYSE: BABA) delivered slightly weaker than expected earnings with revenue of US$31.8 billion for the quarter and a 5% drop in earnings.

Revenue growth is now printing at a pedestrian 34% from 64% in 2020, despite adding another 45 million customers during the quarter.

Cloud computing continues to grow strongly, up 29%, albeit with a thin margin as they seek to become the Microsoft Corporation (NYSE: MSFT) of China.

The Government stepped back on the ‘spiritual opium’ comments suggesting everyone had to work together to combat problem gaming. Shares in Electronic Arts Inc (NYSE: EA) rallied on the news, even as sales growth weakened to less than 10%.