Records broken as ASX200 closes above 7400 points

ASX nears fourteen-year record, confidence slipping, OZ Minerals, BlueScope smash expectations

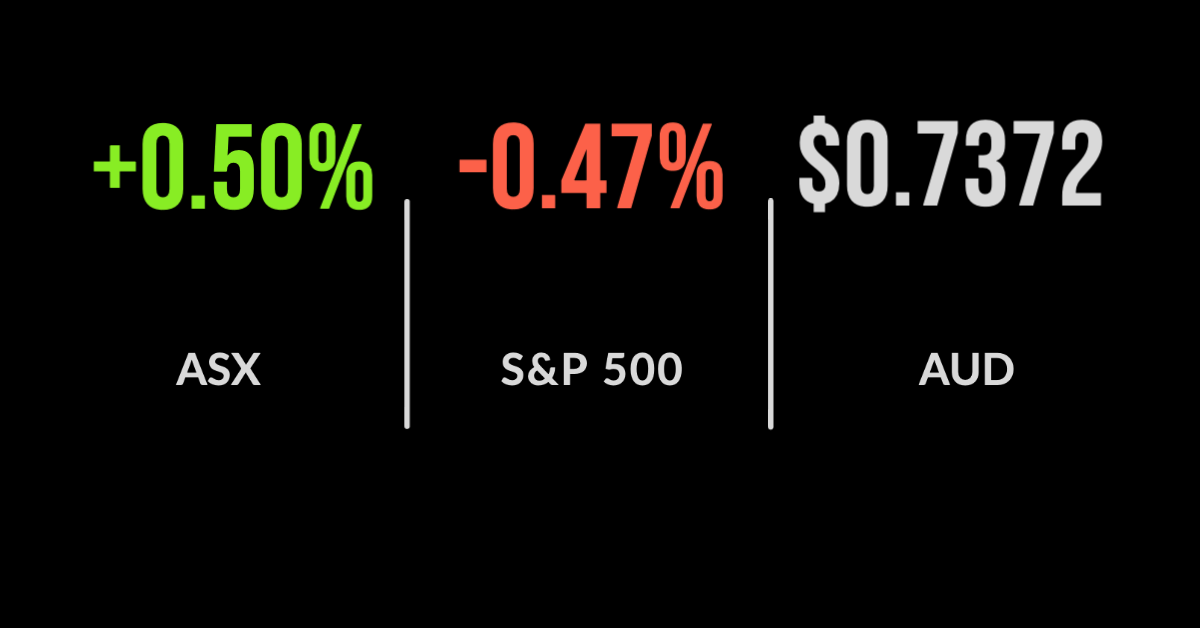

It was all about the mining sector on Tuesday, with the diggers and dealers finishing 1.6% higher and pushing the market up another 0.5%.

Across the board, it was an even split between those sectors that gained and detracted with energy also rallying but IT dropping another 1%. The market is closing in on a 10th consecutive positive month, which would be a 14-year record.

Copper and gold miner OZ Minerals Limited (ASX: OZL) was the highlight on Tuesday, jumping 6.5% as the group continues to benefit from a massive supply of copper coming from the renewable energy and battery sector.

Management announced a 22 percent lift in copper production which contributed to a 70% increase in revenue to $986 million. They cited the devastating floods in Henan province in China as a recent driver of the coal price, with the region an important global producer.

Lockdowns are clearly wearing on small businesses and the economy with consumer confidence hitting its lowest level since before the vaccine, down 3.5% in June. That said, Victoria’s positive news may see a slight recovery.

A2Milk continues to fall, Temple & Webster overcomes supply, BlueScope flags higher profits

Shares in A2 Milk Company Ltd (ASX: A2M) continued their difficult start to the financial year, falling 6.3%, likely attracting some selling pressure as the Chinese Government appears set to crack down on a number of sectors operating in the country.

Online furniture retailer Temple & Webster Group Ltd (ASX: TPW) jumped 7.4% after reporting an 85% increase in revenue to over $326 million for the financial year on the back of a 62% increase in active customers.

The group now has 778k active customers. For comparison, electronics retailer Kogan.com (ASX: KGN) sits about 3 million. Management also flagged a strong start to July with revenue up 39% compared to 2020.

BlueScope Steel Limited (ASX: BSL) has overcome pollution concerns to increase its previous guidance, now expecting $1.72 billion in earnings for the financial year after the second half beat its original forecast by over 10%.

The result was driven by strong demand for steel products in the US and Australia and the persistence of recent higher prices amid the global shortage.

Tech selloff ahead of earnings, China issues deepen, Microsoft smashes expectations

The Nasdaq constituents including big tech names dragged US markets lower ahead of a massive week for earnings reports, falling 1.2%.

The S&P 500 and Dow Jones fell 0.5% and 0.2% as investors get set to learn how the most popular companies are performing.

Alphabet Inc (NYSE: GOOGL) was the worst performer, down 2%, along with Amazon.com, Inc. (NYSE: AMZN), down 1.9%, with Microsoft Corporation (NYSE: MSFT) comparatively stronger, weakening by 0.9%.

Microsoft delivered another record-breaking year with profits exceeding US$60 billion on the back of US$165 billion in revenue, marking a near 30% increase in earnings for the final quarter.

Every sector delivered better growth than expected, with cloud software up to US$14.6 billion, a 50% increase on the previous quarter.

The Azure platform continues to deliver as companies are forced online as the pandemic entered a second year, growing 51%. Another incredible year for just the second US$2 trillion company in history.

United Parcel Service (NYSE: UPS) struggled in comparison, falling 7% as revenue rose 14.5% globally but just 10% in the US.