Resources plays boost local market

The Australian share market took a positive lead from US markets into Thursday and was also buoyed by Asia-Pacific news and earnings results.

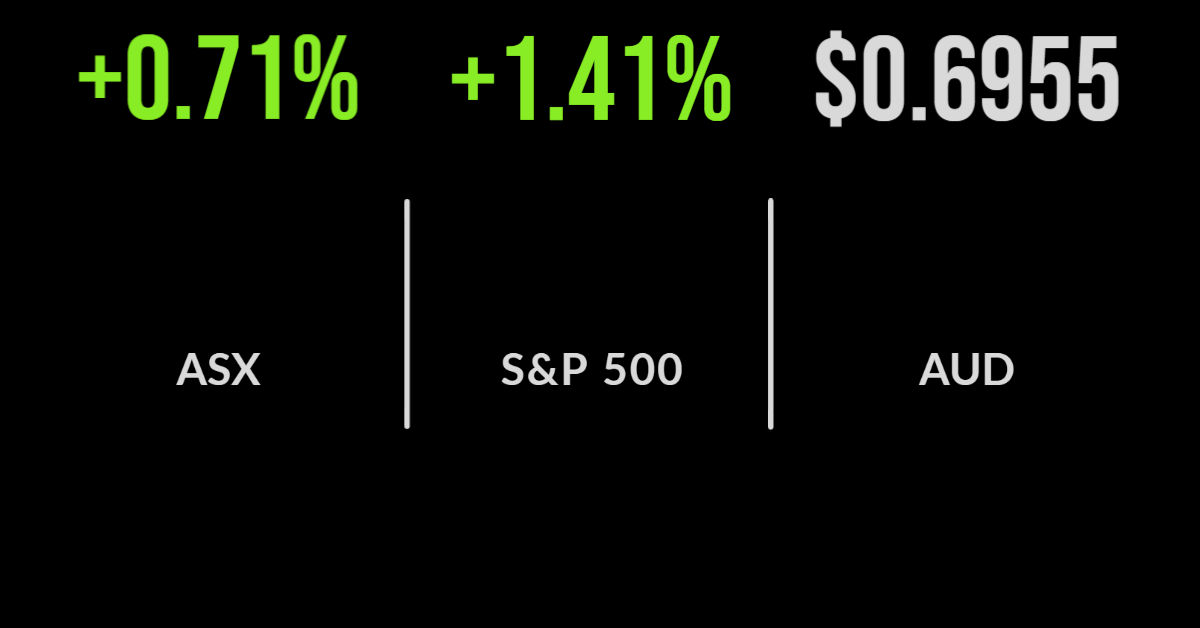

The benchmark S&P/ASX200 index gained 50 points, or 0.7 per cent, to 7048.1, while the broader All Ordinaries was up 49.6 points, also 0.7 per cent, to 7291.9.

The gains followed news of China ramping up its economic stimulus with a 1 trillion yuan ($209 billion) funding package to boost investment and consumption.

The energy sector led the market higher, up 1.6 per cent after Brent crude oil hit a four-week high of $US102 on potential supply cuts from the OPEC+ “supergroup,” which includes the 14 OPEC members plus ten non-OPEC nations, most notably Russia.

Woodside rose 69 cents, or 2 per cent to a two-year high of $35.51, while Beach Energy lifted 5.5 cents, or 3.2 per cent, to $1.76 and Santos gained 10 cents, or 1.3 per cent, to $7.82.

Among the coal miners, Whitehaven Coal eased 11 cents, or 1.4 per cent, to $7.79 after reporting a record $1.9 billion profit, a massive increase from the $543 million loss last year.

Revenue that more than tripled, to $4.9 billion. A fully franked final dividend of 40 cents per share will be paid on 16 September, taking the full year dividend to 48 cents per share, after no dividend was paid last year.

But the shares fell victim to profit-taking, having risen 182 per cent so far in 2022.

Uranium miners enjoyed the news that Japan would boost its nuclear energy use, with Paladin Energy gaining 8.5 cents, or 11.6 per cent, to 82 cents, Deep Yellow surging 14 cents, or 18.3 per cent, to 90 cents, and Boss Energy adding 13 cents, or 5.2 per cent, to $2.62.

In the heavyweight mining sector, BHP gained 28 cents, or 0.6 per cent, to $42.19, Rio Tinto advanced 16 cents, or 0.2 per cent, to $97.26, and Fortescue Metals added 2 cents to $19.14.

The big banks were all higher, with Westpac up 21 cents, or 1 per cent, to $21.59, National Australia Bank gaining 29 cents, also 1 per cent, to $21.59, CBA up 62 cents, or 0.6 per cent, to $97.82, and ANZ up 5 cents, or 0.2 per cent, to $22.86.

Qantas shocker headlines results

Qantas posted a massive underlying full-year loss of $1.86 billion for the financial year 2022, its third consecutive annual loss, and a reported net loss of $860 million, despite revenue jumping 54 per cent from the COVID-affected FY21 to $9.1 billion.

The result took the airline’s total pre-tax losses throughout the pandemic to almost $7 billion.

But Qantas says it is on track to achieve cost savings of $1 billion this year, and with the result in line with expectations, Qantas shares gained 32 cents, or 7 per cent, to $4.86.

Travel centre operator Flight Centre saw revenue surge 155 per cent, to just over $1 billion, but the company reported a net loss of $287.2 million for the year ended June 30, which was an improvement from the previous year’s $433.5 million loss.

The company said it had made an underlying profit in the six months to June 30. The company’s total transaction value (TTV) surged by 162 per cent, to $10.3 billion. Flight Centre shares fell 79 cents, or 4.6 per cent, to $16.55.

Woolworths posted a 9.2 per cent gain in annual revenue to $60.9 billion, as net profit surged 282 per cent, to $7.9 billion.

Excluding the spin-off of its drinks and hotels arm Endeavour Group last year, earnings were flat, up 0.7 per cent, to $1.5 billion.

CEO Brad Banducci told the market that rising inflation and interest rates are starting to have an impact on consumer shopping behaviour, as cost-of-living pressures see many customers trading down to cheaper food and groceries.Woollies shares slid $1.20, or 3.2 per cent, to $36.20.

Buy now, pay later company Zip Co reported a $1.1 billion loss on impairment charges related to its recent acquisitions and expected lower growth, despite revenue rising by 57.4 per cent, to $620 million, and cash profit before tax coming in at $203.7 million.

Zip shares eased 2 cents, or 2.1 per cent, to 95 cents.

Miner South32 announced a record full-year profit of $US2.7 billion ($3.8 billion), up from a loss last year of US$195 million.

The profit is the biggest for the Perth-based miner since it was created in 2015 from a collection of BHP’s unwanted assets.

Surging prices for aluminium and metallurgical (steelmaking) coal were a major factor, with underlying earnings boosted by $US3.7 billion ($5.3 billion) by higher realised prices, including $US1.5 billion from metallurgical coal and $US1 billion from aluminium.

The full-year dividend for the year almost quadrupled to US25.7 cents a share. South32 shares gained 4 cents to $4.27: they are up 48 per cent in the last 12 months.

Waiting for the thoughts of Chairman Powell

On the US market, stocks rose as central bankers from across the globe arrived in the Wyoming ski resort of Jackson Hole to kick off the Federal Reserve’s highly anticipated economic symposium.

With “Fedspeak” being perceived as hawkish late, markets are very keen for chairman Jerome Powell to give more detail on the Fed’s thinking in its battle against inflation.

Chairman Powell will take the stage tonight, Australian time.

But with all participants having arrived and settled into their lodges, the S&P 500 jumped 58.3 points, or 1.4 per cent, to 4,199.1, while the 30-stock Dow Jones Industrial Average added 320 points, or just under 1 per cent, to 33,291.8 and the tech-heavy Nasdaq Composite surged 207.7 points, or 1.7 per cent, to 12,639.3.

Brent crude reversed course, down US$1.88 to US$99.34 a barrel, while the key US crude grade, West Texas Intermediate, rose 50 cents to $US$93.02.

Gold is slightly weaker, at US$1,757.58 an ounce, while the Australian dollar is slightly higher this morning, buying 69.8 US cents.