Super fees climb with age, but devil is in the detail

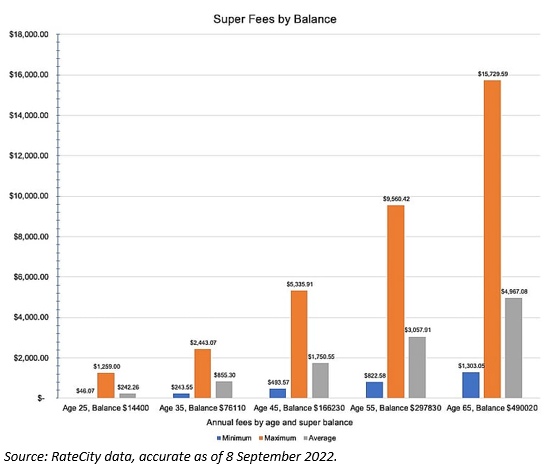

New research from RateCity reveals that older superannuants are, the more they pay on fees in absolute terms, though it is the youngest who are hit the greatest as a proportion of their savings balance.

RateCity has crunched the numbers to reveal the minimum, maximum and average fees paid by Australians across different age groups, according to their superannuation balance. The graph below shows the outcome of that research.

On average, fees for super fund members across all age groups range from 1 per cent to 1.7 per cent of their total balance. While Australians aged 35 years and over are paying the maximum amount in fees each year, they are only sacrificing 3.2 per cent of their total balance. In contrast, young Australians aged 25 years, who possess significantly lower super savings, would give up more than 8.7 per cent of their balance if paying the maximum amount in fees.

The lowest amount of fees a 45-year-old with a super balance of $166,230 can expect to pay is $493.57, while the maximum costs can exceed 10 times that amount. Individuals aged 65 years, possessing a super balance of $490,020 can pay as little as $1,303.05 in annual fees but typically pay an average $4,967.08, which equates to approximately one per cent of their balance.

Joshua Lowen, a market insights analyst with SuperRatings, says there are a range of factors that determine the fees a superannuation member will pay. Most funds will charge members a combination of a fixed fee and a percentage of their account balance which means members can potentially minimise fees depending on their account balance.

“For example, if a fund only charges members a fixed fee, members with a higher balance will pay less than if they were in a fund that charges both a fixed and percentage-based fee,” he says. “Similarly, members with a lower balance may want to invest in a fund that only charges them based on their balance and doesn’t charge a fixed amount. Most funds, however, will charge both at varying levels, so members need to take this into account when choosing a fund.”

Another factor that impacts the level of fees a member pays is the investment option they are in. Many funds offer a range of investment options to meet different member needs including different investment styles.

“Passive investing, where funds seek to track a benchmark return rather than outperform, are often lower cost than active options, however members need to consider if they are willing to potentially forgo higher returns when active options do well, for the safety of knowing they will be paying lower fees,” Lowen explains.

From 30 September, super funds will be required to disclose a cost of product for each investment option they offer, allowing members to compare the fees for each investment within their fund as well as across different funds.

“Just remember to compare investment options with the same style and expected level of return when looking at different funds. Members who are unsure of what investment option is suitable for them should speak with their fund or a financial adviser.”

Amanda Cassar, a financial adviser at Wealth Planning Partners, says advisers can help investors compare costs of funds based on their individual goals and circumstances. Comparison website too such as RateCity or Canstar can help, she says, as well as reading up about their superannuation products.

“Most product disclosure statements [of super funds] now include an example of what it would cost if you invested $50,000 in a standard diversified/balanced option in their fees section, so that’s a good place to start to compare what different funds would cost,” she says. “Always be careful if looking to switch though that you aren’t losing valuable insurance that you might not be able to get elsewhere, especially if your health has changed.”

Compared to regular super funds, setting up a self managed superannuation fund (SMSF) can add considerably to costs. Cassar believes SMSFs are certainly not for everyone, and fees are just one consideration in whether to set one up or not.

“For many people the main consideration is control,” she says. “They want much more say over where the funds are invested and often want non-traditional products, such as direct residential or commercial properties,”

“At a bare minimum, you’ll need to account for your annual tax return and audit. There can be large differences in these fees, based on whether you use on online service, an adviser and or/accountant and the assets that the fund holds. Investment management fees, stock brokerage, insurances, property costs and taxes and advice can all add up when managing your own fund,” she says.

While setting up a fund yourself online might cost around $1,100, involving professionals to set up a fund could see charges up to $4,400 and above for tax returns and audits only, explains Cassar. “Advice fees can vary from a few thousand dollars to tens of thousands of dollars.”