-

Sort By

-

Newest

-

Newest

-

Oldest

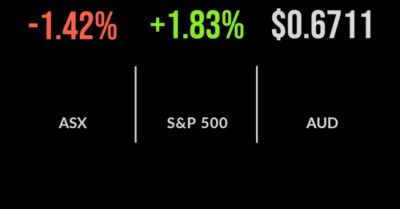

The Reserve Bank of Australia’s aggressive pursuit of a neutral interest rate policy setting has offered a challenging backdrop to the sharemarket this week, with the S&P/ASX200 falling 1.4 per cent on Wednesday. It wasn’t rates alone, however, with the oil price falling to levels not seen since January 2022 as concern grows about the…

After a positive start, the local market turned tail after the Reserve Bank board lifted the cash rate target by 50 basis points to 2.35 per cent, its highest level since December 2014, at its meeting yesterday. The central bank has now raised interest rates for five months in a row, in its most aggressive…

The local sharemarket continued its recent weakness, falling another 2 per cent for the first day of spring. Australia’s largest company, BHP (ASX:BHP) was the biggest detractor falling 7.6 per cent, or $3.09 cents as the stock went ex-dividend. This is a regularly forgotten impact of the payment of dividends, which totalled $2.56 plus franking credits, as…

The S&P/ASX200 continued a recent strong run gaining another 1.1% on Wednesday with Commonwealth Bank (ASX: CBA) a key contributor. The financial and technology sector are seeing strong support as earnings season steps up another gear, they gained 2.6 and 4.2% respectively. In an about-face from recent weeks, the energy and material sectors underperformed after BHP (ASX: BHP) fell due to another warning…

The S&P/ASX200 opened the day reasonably well despite growing negativity in the markets ahead of the Federal Reserve’s impending rate decision. But the release of Australian CPI data reversed that trend with the market trading more than 3 per cent lower but ultimately finished 2.5 per cent or 180 points down. At this point, it is important to keep the…

The S&P/ASX200 (ASX: XJO) managed a small gain, finishing 0.1 per cent higher despite 7 out of the eleven sectors finishing underwater today. The highlight of the session was the materials sector, which gained 3.1 per cent behind a massive surge in gold miners. The biggest detractor was the communications sector with the likes of Seek (ASX: SEK) and TPG Telecom (ASX: TPG) falling by more than…

The S&P/ASX200 finished 0.1% lower as consumer confidence dropped over 7% to the lowest point since the vaccination announcement in November 2020. The market remains mixed with cyclical sectors including energy and materials, up 0.2 and 0.6% respectively, whilst the more defensive healthcare sector underperformed, falling 1.2%. All eyes were on the retail sector, however, with JB HiFi (ASX: JBH) jumping 6.9% and overcoming…

Investor concerns about the pandemic are fading. All eyes are now on the burgeoning threat of cyber-attacks, and what they mean for financial system stability. The Depository Trust and Clearing Corporation (DTCC) risk barometer was launched in 2013, and provides a handy insight into what’s worrying investors in any given year. And after two years…

The Australian financial regulator has urged institutional investors trading on the ASX to better prepare for future market blackouts in the wake of a meltdown on the exchange last November. In a new report charting a series of ASX operational incidents during the week starting November 16 last year, ASIC (chaired by Joe Longo, pictured)…

No records today, Suncorp smashes expectations, Transurban’s problem tunnel It was a flat day for the market despite a strong positive start, with the S&P/ASX 200 (ASX: XJO) giving up its initial 0.5% gain slowly throughout the afternoon. The majority of sectors were lower, or more broadly flat, with the financials sector the only real positive contributor…