-

Sort By

-

Newest

-

Newest

-

Oldest

Pandemics, invasions, and the return of inflation. If the last few years have shown investors anything, it’s that outrageous predictions can often be anything but.

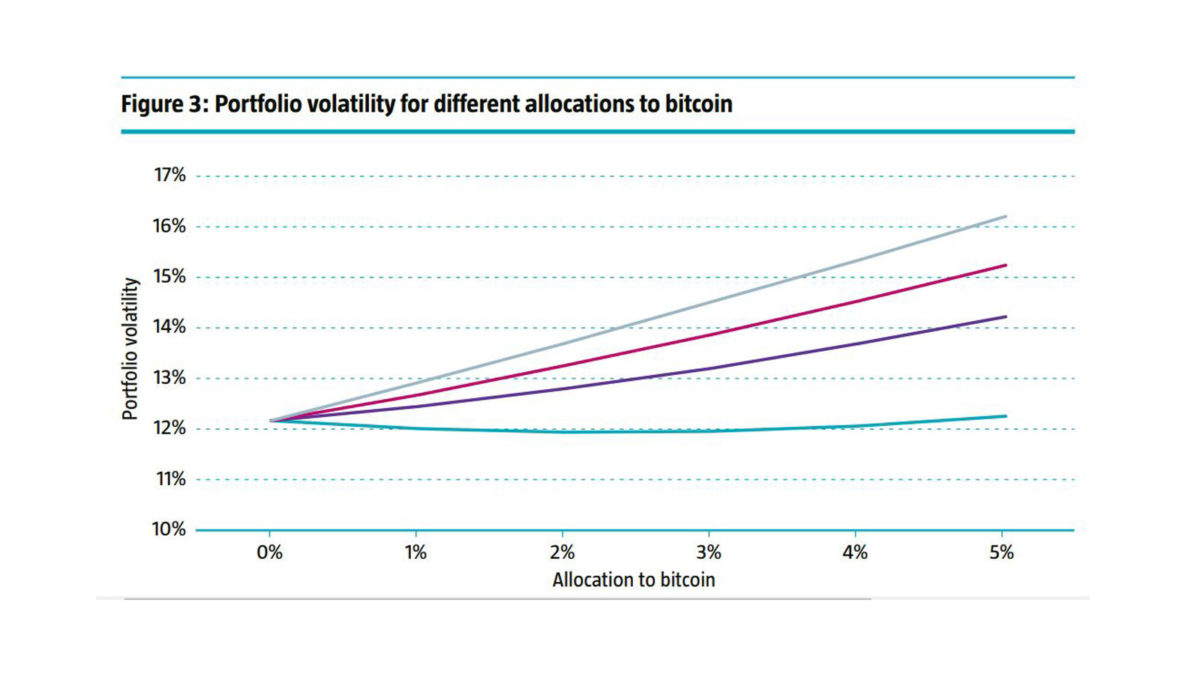

Institutions have another reason to resist the siren song of cryptocurrencies, with new research from PGIM refuting many of the arguments in favour of holding the highly volatile asset class.

While proponents believe that cryptocurrencies will inevitably disrupt traditional finance, it’ll be harder than it seems – and less lucrative than they think. As cryptocurrencies like Bitcoin and Ethereum have shot to prominence in the last several years, it’s now being taken as a given that they will eventually disrupt traditional finance. Blockchain technology offers…

Bitcoin’s volatility means that institutional investors have historically steered well clear. But the times are a-changing, and even skeptics believe the cryptocurrency will have its day. Cryptocurrency is clearly here to stay. While most investors watch its massive price swings with bemused detachment, a few have begun to think seriously about the role they can…

Volatile week ends at records, Star withdraws offer, Silverlake swimming The ASX 200 (ASX: XJO) managed to deliver another positive week, despite finishing just 0.1% higher on Friday. The benchmark added 0.6% over the week, pushed higher by a recovery in the healthcare sector, which added 4.7% behind CSL Limited (ASX: CSL) being 5.7% higher despite any real news….

Strongest day in four months, Fed backs off, lithium miners rally The ASX 200 (ASX: XJO) experienced its best session in four months, adding 1.5% on Tuesday, all but erasing Monday’s losses. Every sector but healthcare finished higher, with real estate and energy the biggest beneficiaries adding 2.2% respectively. The positive sentiment came from Fed Chair Jerome Powell’s written…

Shares bounce back, Victorian budget disappoints, mixed unemployment result The ASX200 (ASX: XJO) clawed back most of Wednesday’s losses, adding 1.3% on Thursday as the risk-on environment returned. The rally was powered ahead by the tech sector, 4.3% higher, along with property trusts, up 2.6%, and consumer discretionary stocks, up 1.7%. It was Qantas (ASX: QAN) that drove the…

Markets turn red, EML Payments dumped, China flags iron ore pressure The ASX200 (ASX:XJO) dropped the most in three months, finishing down 1.9% as a multitude of pressures hit the market. The materials and energy sectors both fell by around 3.0%, the former sold off after Chinese representatives flagged their intention to reduce the country’s reliance on…

ASX struggles to another record, Sims upgrades guidance, lithium giants to merge The ASX200 (ASX:XJO) struggled to another record close, finishing just three points higher as a sell off in the energy sector, down -1.4%, offset gains in the mining sector, +0.8%. The news of the day was the planned merger between Australia’s pureplay lithium miners, Orocobre (ASX:ORE) and Galaxy (ASX:GXY),…

Market volatility up as ASX finishes flat, Zip Co jumps 17%, Cleanaway’s new deal The ASX200 (ASX:XJO) finished flat for the day with gains in the IT sector, which was 2.2% higher, insufficient to offset weakness across cyclical businesses including energy, -0.7%, and utilities, -1.1%. The standout by far was Buy Now Pay Later firm Zip Co (ASX:Z1P) which…