-

Sort By

-

Newest

-

Newest

-

Oldest

Fifteen years ago, Thomas Friedman said that globalisation had finally made the world “flat” and that a golden age of prosperity was upon us. A month ago, that stopped being true. Love him or loathe him (and many lean towards the latter), Thomas Friedman occasionally hits the nail on the head. In his 2005 book…

As merger activity continues apace, State Street – armed with its “unique” front-to-back solution – intends to take a dominant position as custodian of choice for the biggest end of town. The super industry and its custodians are now exiting a period of relative stability. The number of funds has more than halved in the…

Plenty of big super funds have announced their intention to dump their Russian assets, and the government wants them to. But saying do svidanya is harder than they thought. From a certain angle, there’s a lot of Russia in the super system. Once ruled by unapologetic socialists, they’ve both become capitalistic in the aftermath of…

BlackRock has a message for investors trying to navigate the confusion that has sundered markets in recent weeks: get used to it. Rising inflation was enough to give markets the jitters; tack on a war – and the prospect of an even bigger one, should the situation in Ukraine devolve further – and all the…

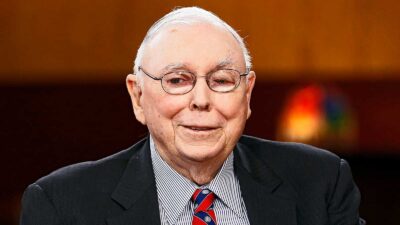

The near-centenarian investor believes that institutions like BlackRock and Vanguard will wield outsize power in the market, and that our latest period of “wretched excess” will end with a bang. As passive investing becomes the go-to for a new wave of dumb money, Wall Street’s masters of the universe have been replaced with the emperors…

Larry Fink wants to make capitalism a force for good. A new proxy advice initiative could be one step in the right direction. Stakeholder capitalism is not about politics,” writes BlackRock CEO Larry Fink in his 2022 letter to CEOs. in his It is not a social or ideological agenda. It is not “woke.” It is…

Big and traditional managers are encroaching further on the space of alternative managers, gauging by winners and finalists at the sector’s annual awards on Friday night. The Australian Alternative Investment Awards, held in conjunction with the Hedge Funds Rock charity night at the Sydney Hilton, December 10, represented a welcome live, and lively, event for…

BlackRock, the biggest investment house in the known universe, now holds sway over about a quarter of the NZ retail fund market after cementing a deal with ASB last week to oversee some $20 billion. The ASB move to outsource most investment decisions to BlackRock coincides with the transition of an estimated $10 billion of…

The asset management colossus believes three key themes will shape a post-covid world of rising climate risk and extraordinary economic imbalances. Ben Powell, the chief investment strategist for Asia Pacific at BlackRock’s Investment Institute in Singapore, said: “To state the obvious, the last 18 months have been rather unusual. It hasn’t been a normal slowdown…

Magellan Financial Group’s ‘FuturePay’, launched with a fanfare last week (June 1) after considerable pre-launch publicity, heralds an escalation in a retirement products arms race. Both big super funds and fund managers are scrambling for positions in the race, which is expected to have strong demographically driven growth for years to come. Magellan, arguably the…