-

Sort By

-

Newest

-

Newest

-

Oldest

It’s not just about the higher yields, although that helps. It’s also about the correlation between hard and local currencies. And Australian investors are in pole position. In a series of discussions with the firm’s Australian investors and others recently (August 23 – September 3), Grant Webster, head of Ninety One’s emerging markets ‘blended debt’…

An Australian super fund has seeded a boutique emerging market debt (EMD) fund as instos look overseas for yield. But challenges for the asset class abound. As Argentina approached its presidential primaries in August 2019, the team at EMD boutique Finisterre grew wary. The primaries would take place during a low liquidity month; they were…

It’s difficult enough for big investors to decide on a China strategy, even after they recognise the necessity of having one. And then there’s the throng of implementation options to sift through. In the melee, one China manager stands out: China AMC. According to a landmark report by bfinance – Rethinking China’s Role in Emerging…

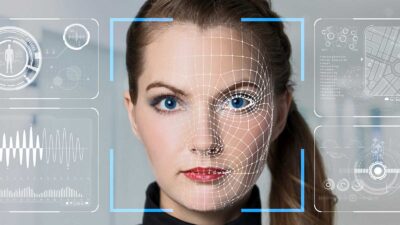

NZ Super and Australia’s Perpetual Investments have joined a group of global investors in an engagement program involving human rights and the use of facial recognition technology. They are the only Australasian members of a group of 50 fiduciary investors which speak for about US$4.5 trillion (A$5.9 trillion) under management. The initiative was launched by…

Recently hitting its two-year anniversary, Paradice Investment Management’s emerging markets strategy has been on a “rollercoaster ride”. Co-portfolio managers Edward Su and Michael Roberge have spent the last two years navigating the frenzied market volatility of covid-19, the fallout of mass protests in Hong Kong, and trade wars with China as they pursue opportunities in…

Markets rally on weak inflation data, Link deal pulled, JB Hi-Fi CEO stepping down The ASX200 (ASX:XJO) managed to deliver another 0.4% gain with the materials sector the only detractor falling 1.0%. The fall came despite the iron ore price hitting a record of US$193, marking a long recovery from the US$50 lows of 2015. JB HiFi (ASX:JBH) was among…

Markets weaken, Webjet raises $250m, lithium jumps as production ramps up The ASX200 (ASX:XJO) fell 0.3% to begin the week, struggling to overcome a weak overseas lead with a lack of material announcements for the local market. All eyes were on Federal Reserve Chair Jerome Powell’s 60 Minutes interview overnight in which he highlighted that the US economy is…

Second quarter off to strong start, AMP’s CEO departs, Boral announces buyback The ASX200 (ASX:XJO) finished the week and commenced the new quarter on a strong note, finishing 0.5% higher with both IT, up 2.3%, and materials, 1.3%, contributing. It was a day for stock specific news with the worst kept secret in finance being confirmed, AMP’s CEO Francesco…

ASX up 1.7% for the week, all action at the CEO-level of AMP and TPG, battery stocks on the charge The ASX200 (ASX:XJO) finished the day 0.5% higher, with every sector but healthcare delivering a positive return. Telecommunications and IT were the highlights, finishing 1.3% and 1.2% higher, with a 2.4% jump in Telstra (ASX:TLS) offsetting a 6.7% fall…

Mine Super has taken a big step towards commercialising its majority interest in Recreo Financial, the administration systems provider it partnered with in 2015. It has been a rocky road for many of the participants. Recreo is to merge with two complementary businesses acquired by Certane, a new market player that bought the remnants of…