-

Sort By

-

Newest

-

Newest

-

Oldest

Another winning day despite Sydney lockdown, Boral offer increased, US infrastructure boosts commodities The ASX 200 (ASX: XJO) delivered another strong day, finishing 0.5% as it followed a strong US lead. This time it was news of President Biden receiving approval for his infrastructure package, which pushed the materials sector 1% higher. Every sector barring consumer staples (-0.8%) and…

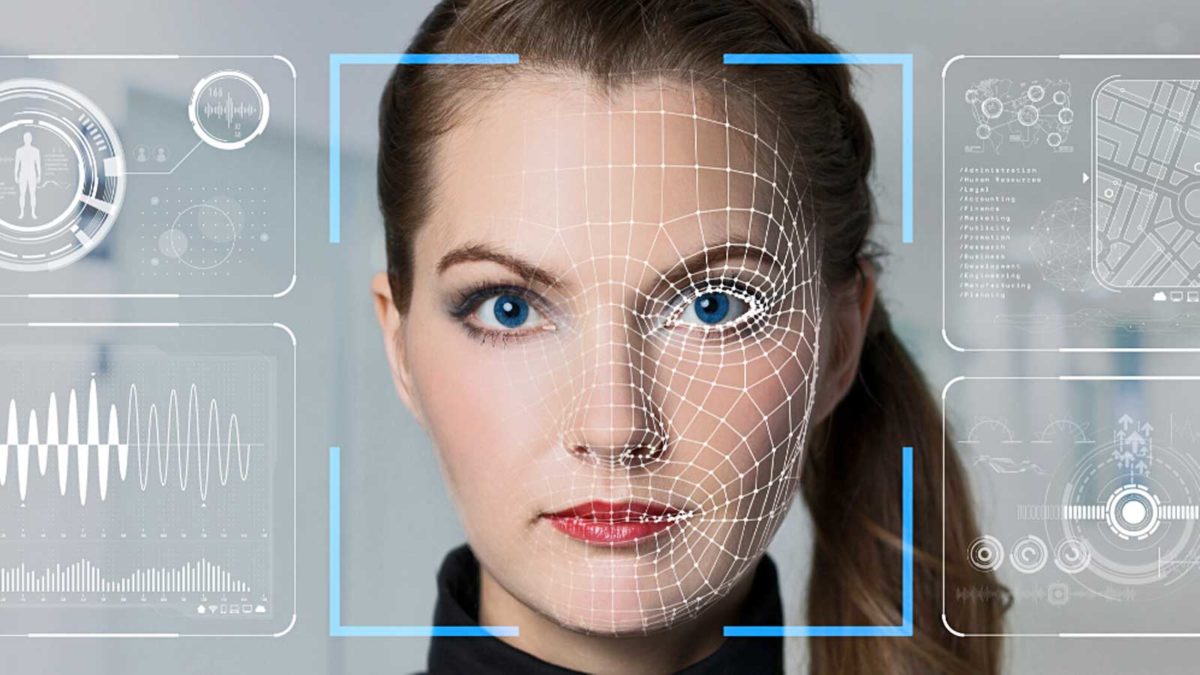

NZ Super and Australia’s Perpetual Investments have joined a group of global investors in an engagement program involving human rights and the use of facial recognition technology. They are the only Australasian members of a group of 50 fiduciary investors which speak for about US$4.5 trillion (A$5.9 trillion) under management. The initiative was launched by…

The main focus for ESG investors, as with many of world’s policy makers and influencers, over recent years has been on the ‘E’. The ‘S’, though, is far from forgotten. The impact of climate change and the measures aimed at achieving net zero carbon emissions will also cause massive disruptions to societies as a whole,…

Martin Currie has launched an inhouse institute to broaden research and the exploration of ideas around asset management stewardship. Super funds and other clients will have input into the topics studied. The global equities manager, a subsidiary of Franklin Templeton, has about US$22 billion (A$28.5 billion) under management across various products, including a big Australian…

Adopting a robo-advice platform will increase member contributions as well as investment-option performance, while improving diversification, according to a study of French savings plans. While the buzz surrounding its introduction just over 10 years ago has abated, an increasing body of research is building on the value of robo-advice. More than a marketing tool for…

The discussion about the best way to build and manage an appropriate exposure to China is becoming more urgent. Mercer has helped investors with some new research. In a paper entitled: ‘Positioning Your Portfolio for the Future of Emerging Markets – the case for a dedicated China equity allocation’ the global advisory and funds management…

Eaton Vance has mounted a case for both investors and governments to better appreciate the benefits of economic transparency on sovereign bonds. In a research paper, ‘Economic Transparency Means a Creditworthy Sovereign’, the global manager looks at economic transparency as it correlates to yield spreads, credit ratings, stock price volatility, and trust in government across…

Sovereign Wealth Funds are embracing more active roles in domestic economies and sustainability while building on relationships with the private capital industry, according to research by Preqin and Baker McKenzie. A study, ‘Sovereign Wealth Funds in Motion’, was published last week (June 2) by alternative assets data provider Preqin, in partnership with global law firm Baker McKenzie. The prominence of sovereign wealth…

NSW’s Local Government Super has launched a sweeping rebrand as part of a bid to win new members. Can funds of a similar size – $13 billion – survive in a new world of mergers? Local Government Super will be renamed ‘Active Super’ in a move that was considered “very carefully” as part of its…

Super funds are under increasing pressure to do more on ESG but have been warned to keep their noses out of the climate debate. Super funds need to “close the gap” between commitment and implementation of ESG principles, with only a quarter of funds having a quantifiable performance target in place to ground the implementation…