-

Sort By

-

Newest

-

Newest

-

Oldest

Inflation is likely in a transitory phase, yet remains stuck on high settings. Sovereign funds around the world are adjusting accordingly, Invesco says, with 5 major themes charting the course of institutional investors.

Riding the equity market rally and significant diversification in its alternatives portfolio has delivered Australian Retirement Trust a 10 per cent return as it keeps both eyes on the end of the rate cycle.

Income arrives in many shapes and sizes The first half of 2022 has been challenging for investors across all asset classes, and the uncertainties plaguing markets remain-particularly with regard to inflation, interest rates and the possibility of recession. Stephen Dover, Chief Market Strategist, Franklin Templeton Investment Institute says: “As we look toward the second…

Central bankers are hoping to subdue the inflation beast by the end of the calendar year. But it will likely be around for decades to come.

The tide is coming in for inflation – but that doesn’t mean there won’t be significant volatility along the way. Investors need to figure out which parts of the economy will catch fire first. “Views on the direction of inflation can be quite fascinating, but only ‘quite’ since no one really knows what they are…

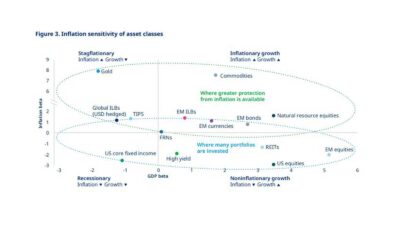

Mercer has urged investors to consider a wider range of inflation scenarios in portfolio design plans as price uncertainty ramps up across the world. In a new paper, the global multi-manager and consultancy firm says investors now face more complicated decisions amid confusing inflation signals. “Adding a less predictable inflation environment now increases complexity for…

PIMCO, the world’s largest fixed income manager, believes that there is more risk in the current inflation bogey than the market is anticipating. It has published what is likely the most authoritative look at the current inflation concerns and suggested what investors should be doing about them. The PIMCO paper, ‘Assessing Inflation: Theories, Policies and…

ASX retakes 7,000, iron ore falls, CBA hits new record, dispersion grows The ASX200 (ASX:XJO) finished the week on a positive note, moving 0.5% higher and retaking the 7,000-point level. Every sector was higher barring materials, with Fortescue (ASX:FMG) and BHP Group (ASX:BHP) falling 2.8% and 1.5% respectively after the iron ore price dropped 9.5% during the day. On the positive side, the…

Sell off continues despite budget, Qantas tanks on flight delays, CBA delivers The ASX200 (ASX:XJO) fell 0.7%, the second straight negative session, pushed lower by utilities and energy companies, down 2.2% and 2.0% respectively. The Federal Budget which offers little in the way of future spending or policy direction was broadly in line with expectations, the deficit lower than…

ASX gains on travel boost, inflation expectations tempered, but confidence key The ASX200 (ASX:XJO) finished the week strongly, adding 0.8% on Friday, enough to deliver the second straight week of gains. Stimulus was at the top of the agenda this week, with a combination of comments by the Reserve Bank of Australia and the Federal Government setting the direction of markets….