-

Sort By

-

Newest

-

Newest

-

Oldest

Shares bounce back, Victorian budget disappoints, mixed unemployment result The ASX200 (ASX: XJO) clawed back most of Wednesday’s losses, adding 1.3% on Thursday as the risk-on environment returned. The rally was powered ahead by the tech sector, 4.3% higher, along with property trusts, up 2.6%, and consumer discretionary stocks, up 1.7%. It was Qantas (ASX: QAN) that drove the…

Dip buyers emerge, ASX moves higher, EML Payments enters trading halt, Nuix continues to fall The ASX200 (ASX:XJO) fell throughout the day despite a positive open, finishing 0.1% higher as dip buyers emerged following last week’s unexpected sell-off. The IT and energy sectors were the stories of the day, with the former returning to normal heading 1.2% higher…

Seventh consecutive monthly gain, Beach Energy smashed, ANZ takes $817m profit hit The ASX200 (ASX:XJO) finished Friday on a weaker note, down 0.8% and 0.5% for the week, however was able to deliver a seventh consecutive monthly gain, finishing 3.5% higher for the month of April. The news of the day was the capitulation in Beach Energy’s (ASX:BPT) share…

Tech sell off weighs on ASX, Challenger downgrades earnings, Latitude finally lists The ASX200 (ASX:XJO) moved further from a record close as a weak global lead and a bevy of early earnings updates sent the market 0.7% lower. The only highlight was the telecommunications sector which added 0.2%, with IT and healthcare falling over 1% each as…

ESG investing continues to polarise institutional investors around the world, with a surprisingly large number considered ‘contrarians’ who tend to buck the trend to ESG’s adoption and integration. This is one of the outcomes from research by Nuveen, the NYSE-listed global funds management arm of big US-based TIAA (formerly TIAA-CREF), a profit-for-members financial services organisation….

ASX stronger, Greensill risk expands, Vocus (ASX:VOC) deal confirmed The ASX200 finished 0.5% higher in a mixed day for the market, with the IT and materials sectors remaining the primary drags on performance. The industrials sector which includes a number of infrastructure and more cyclical companies was the highlight, adding 1.1% with the likes of Transurban Group (ASX:TCL) and Sydney…

ASX higher, Commonwealth Bank (ASX:CBA) dividend boost, Lend Lease (ASX:LLC) CEO leaves, Crown Ltd (ASX:CWN) has an uncertain future The ASX200 (ASX:XJO) finished 0.5% higher, with every sector but consumer discretionary adding to returns. IT was once again the standout with both Afterpay Ltd (ASX:APT) and Zip Co (ASX:Z1P) hitting all-time highs as BNPL valuations took another leap forward. Whilst reported…

ASX down 0.7%, reality setting in, Reliance Worldwide (ASX:RWC) jumps on overseas sales The ASX200 (ASX:XJO) awoke from the long weekend falling 0.7% on the back of weakness in the materials and energy sectors. The iron ore price remains one of the key drivers of daily market performance with its 3% fall overnight sending Fortescue Metals (ASX:FMG) down 6.4% and BHP Group 3.4%…

While the active versus passive debate rolls on, and on, across the investment world, some active managers have gone to the ‘dark side’, at least partially, by adding more quantitative inputs for new strategies, such as thematic investing. The concept of ‘thematic’ investing, which describes the strategy of identifying sectors of the economy expected to…

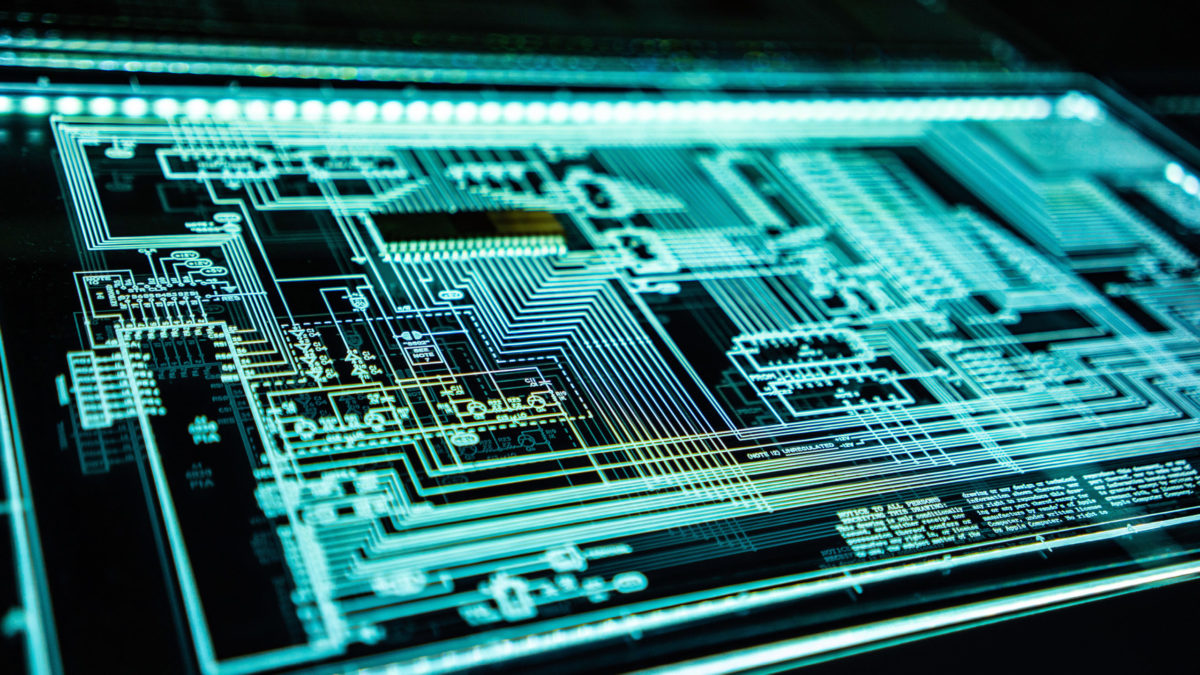

Semiconductors would have to be one of the most pervasive and critical pieces of technology in our daily lives – but they are usually not thought about very much. They certainly don’t seem to get the investment love like they should, or get talked about as much as, say, the FAANG stocks or electric vehicle…