-

Sort By

-

Newest

-

Newest

-

Oldest

The NZ Superannuation Fund has made half-a-dozen fresh investments over the previous few months across an eclectic range of strategies including US timber, a quant trend-follower and a life science specialist.

The NZ Superannuation Fund (NZS) has confirmed chief investment officer, Stephen Gilmore, has resigned after winning the same position at one of the world’s largest pension funds.

New Zealand’s biggest non-government fund manager, ANZ Investments, has made a pre-Christmas senior staff clean-out with two long-time employees set to leave the $30 billion plus business early next year.

The world’s state-owned investors (SOI) have made progress in leaps and bounds on governance and sustainability. Locally, the Future Fund and NZ Super lead the way.

The New Zealand Superannuation Fund has taken out the PRI ‘Stewardship Initiative of the Year’ award for its campaign against Facebook, Alphabet and Twitter to monitor and delete hate speech. The award, handed down on October 20 at the organisation’s annual conference produced from London, followed the action taken by the NZ$59.8 billion, as of…

Sir Michael Cullen, the political force behind the establishment of NZ Super and the KiwiSaver scheme, has died at 76 after a battle with cancer. The NZ Labour politician, deputy prime minister and finance minister, will likely be remembered more widely for his liberal views, including legalised euthanasia, and generosity of spirit towards the less…

An independent review has called for a governance and investment upgrade at the NZ Government Superannuation Fund after finding the fund’s management and board had been at odds over recent performance. In its five-year statutory review, the Australian arm of global consultancy Willis Towers Watson (WTW) found the GSF, a NZ$4.2 billion (A$4.0 billion) fund…

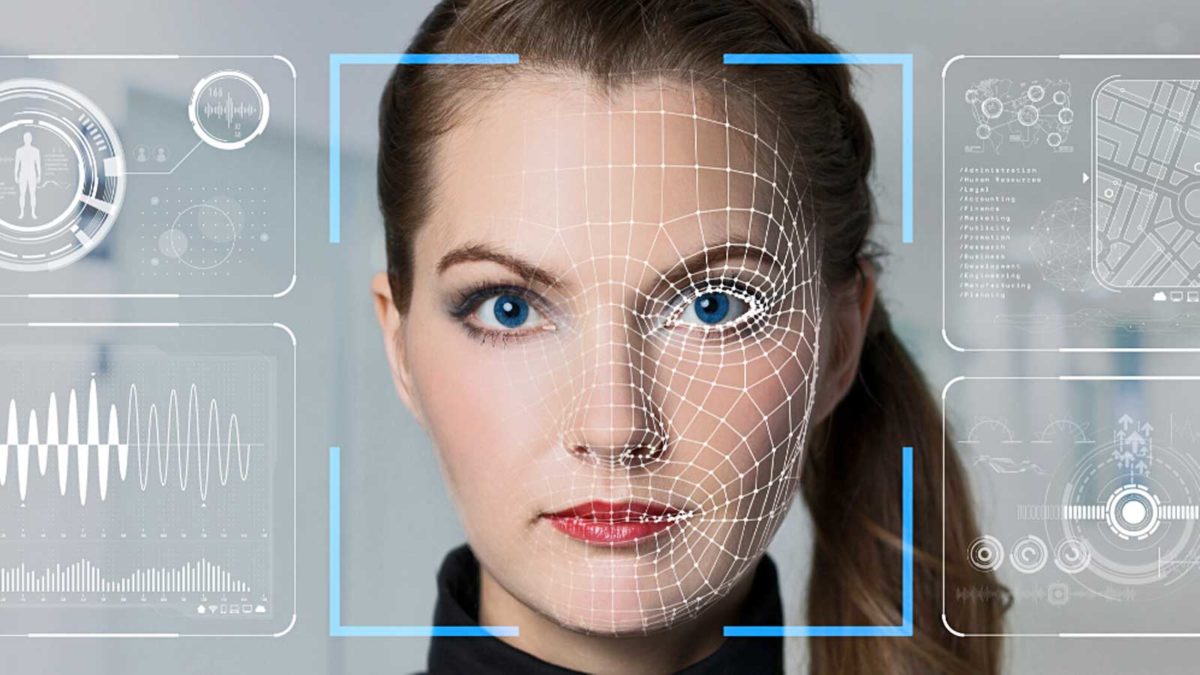

NZ Super and Australia’s Perpetual Investments have joined a group of global investors in an engagement program involving human rights and the use of facial recognition technology. They are the only Australasian members of a group of 50 fiduciary investors which speak for about US$4.5 trillion (A$5.9 trillion) under management. The initiative was launched by…

NZ Super’s guardians and management are used to their fair share of lobbying by special interest groups, but the latest, from an Israeli group on behalf of five of Israel’s banks, could have implications for all fiduciary investors. The Israeli lobby group in NZ, Israel Institute, and NZ Super are in an escalating battle over…

NZ Super, the Future Fund and Norway’s NBIM are among the top-performing government funds, as well as having the highest level of governance and sustainability, according to a study by SWF Global. The study, of 52 of the world’s largest funds, attempts to illustrate the connection between good governance with sustainability processes and investment returns….