-

Sort By

-

Newest

-

Newest

-

Oldest

Everybody loves a good story – investors particularly so. But sometimes a good story can lead to a crowded trade, or one that defies reality. “In finance, behaviour is driven by expectations of future returns, and expectations are often driven by stories, particularly during times of heightened uncertainty,” Charalee Hoelzl, investment manager at Ruffer, wrote…

From Tulip Mania to the Tech Wreck, the history of bubbles shows that they’re harder to spot than investors might think. As Ruffer investment director Lauren French notes in the latest Ruffer Review, even the smartest can fall prey to a market bubble. Isaac Newton, one of the most brilliant mathematicians in history, still lost…

While proponents believe that cryptocurrencies will inevitably disrupt traditional finance, it’ll be harder than it seems – and less lucrative than they think. As cryptocurrencies like Bitcoin and Ethereum have shot to prominence in the last several years, it’s now being taken as a given that they will eventually disrupt traditional finance. Blockchain technology offers…

For investors trying to figure out how to navigate inflation volatility, an infamous shipwreck might hold the answers. The question of whether inflation is transitory or structural is likely the wrong question to be asking.UK-based investment house Ruffer believes that it’s both: that the inflation tide will come in and go back out repeatedly, bringing…

The tide is coming in for inflation – but that doesn’t mean there won’t be significant volatility along the way. Investors need to figure out which parts of the economy will catch fire first. “Views on the direction of inflation can be quite fascinating, but only ‘quite’ since no one really knows what they are…

A profound shift in the investment environment demands a revolution – not an evolution – in thinking, according to Ruffer. It might be the only way to defy gravity. The analogy that Ruffer uses for investor behaviour over the last 40 years is that of crabs. The humble crustaceans evolved to fill their niche from…

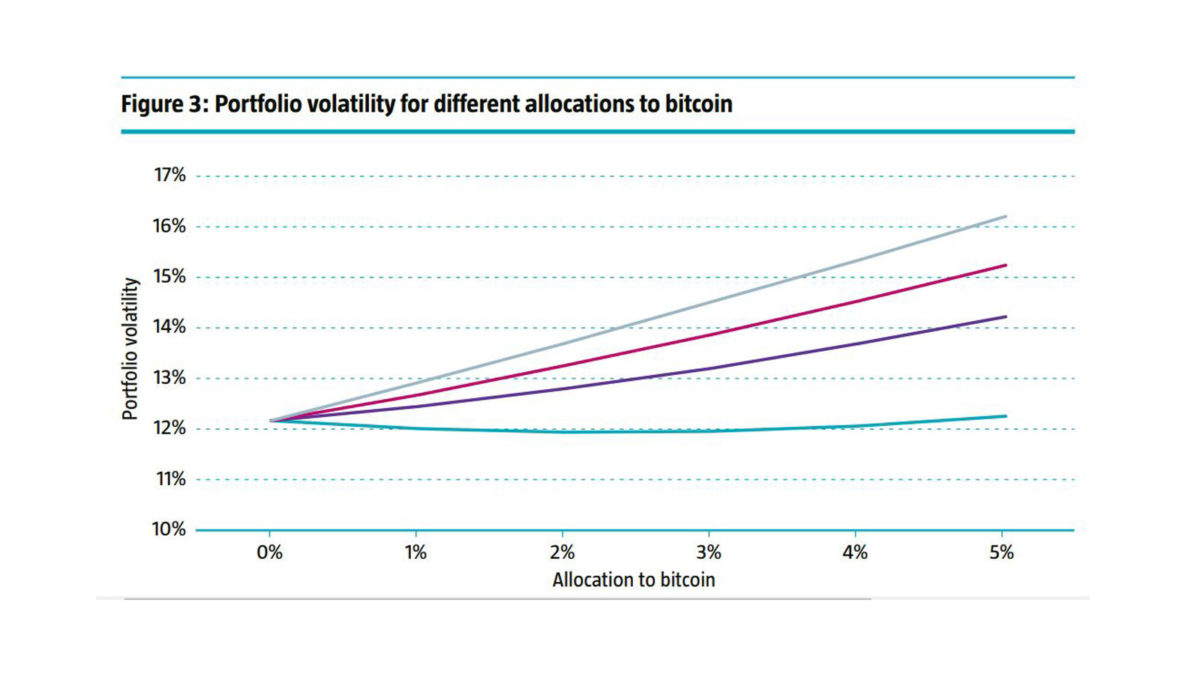

Bitcoin’s volatility means that institutional investors have historically steered well clear. But the times are a-changing, and even skeptics believe the cryptocurrency will have its day. Cryptocurrency is clearly here to stay. While most investors watch its massive price swings with bemused detachment, a few have begun to think seriously about the role they can…