Tech powers market higher, quality in focus, Zip raises $148 million

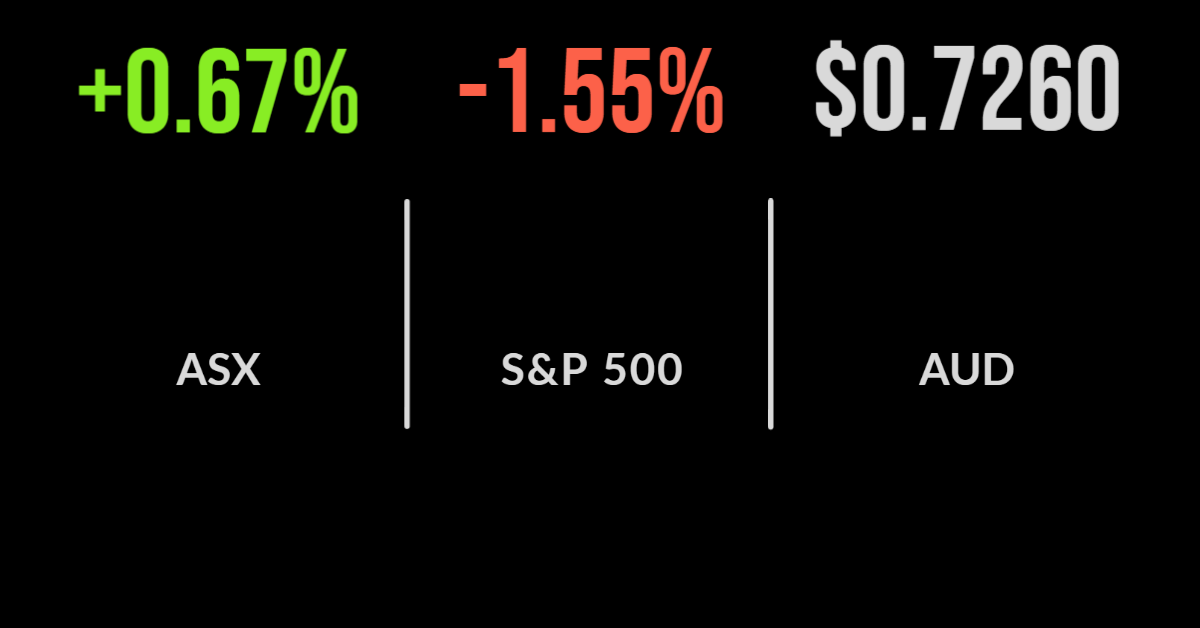

The Australian share market continued the post-invasion recovery, with the S&P/ASX200 gaining 0.7 per cent to begin the month of March; this comes after finishing February just 1.1 per cent higher.

The technology sector was the biggest contributor with Block (ASX: SQ2) gaining 12.7 per cent, sending the sector 5.7 per cent higher despite a 6 per cent fall in competitor Zip Co (ASX: Z1P).

Zip recommenced trading after successfully raising $148 million to fund the acquisition of Sezzle in their pursuit of US domination.

Four of the 11 sectors finished lower, with utilities down 2.2 per cent behind a 3.7 per cent fall in Origin (ASX: ORG).

Shares in insurer Insurance Australia Group (ASX: IAG) were flat after the company said it had received close to 7000 flood-related claims in Queensland and New South Wales but that it was ‘too early to determine the extent and financial impact’.

Fuel distributor Viva Energy (ASX: VEA) gained 1.2 per cent after announcing they would build a green hydrogen plant and the country’s first refuelling station at its Geelong refinery.

CapVest ups bid for Virtus, RBA bullish but conservative, ALS upgrades testing profits

Shares in healthcare provider Virtus (ASX: VRT), which offers reproductive, diagnostics and day hospitals gained another 4.7 per cent after CapVest upped their bid for the company to $7.80.

This is above the $7.65 offered by private equity firm BGH reflecting the massive growth opportunity that private market investors are seeing in the healthcare sector.

Crown (ASX: CWN) shares were broadly flat after AUSTRAC announced they would be pursuing the company over alleged non-compliance with anti-money laundering and know your customer laws.

But all eyes were on the Reserve Bank which once again held the cash rate at 0.1 per cent as they have indicated for months.

The board highlighted Ukraine as a new source of uncertainty, alongside inflation which they say has been driven by energy price increases and supply chain disruptions caused by the pandemic.

The Australian economy remains resilient, picking up after the Omicron shadow lockdown with unemployment still at a 14 year low, but wages growth still hovering around the relatively low rates that prevailed before the pandemic.

So effectively, ‘nothing to see here’ in terms of future rate hikes.

Testing provider ALS (ASX: ALS) upgraded guidance for financial year profit by 6.5 per cent, the group citing capacity investments as being behind the surge.

No progress in Ukraine talks, bombing escalates, financials tank on yields

All three US benchmarks pushed lower on the first day of March as Russia ramped up its attacks on Ukraine’s biggest cities, with the Dow Jones the hardest hit falling 1.8 per cent.

The primary driver was a selloff in financial stocks and banks, with American Express (NYSE: AXP) down 8 per cent and JP Morgan (NYSE: JPM) down 3 per cent as bond yields continued to fall.

These companies traditionally benefit from higher interest rates, but with the market now predicting the Fed will hold off on rate hikes profit growth may be challenged.

The Nasdaq outperformed, falling 1.6 per cent, but shares in Zoom (NASDAQ: ZM) continued their retreat, down 3 per cent, after the company reported more than 20 per cent growth in sales but flagged a significant slowdown in profits as WFH orders end.

The S&P500 lost 1.6 per cent, with Target (NYSE: TGT) a key contributor as retail sales continue to surge and the company invested heavily in their supply chain; shares gained more than 9 per cent.

Same-store sales are smashing Australian businesses, up 8 per cent, despite the mature nature of the business, with 95 per cent of sales fulfilled by stores and not warehouses.