Tech pushes market lower, Magellan jumps despite outflows, defensives the standout

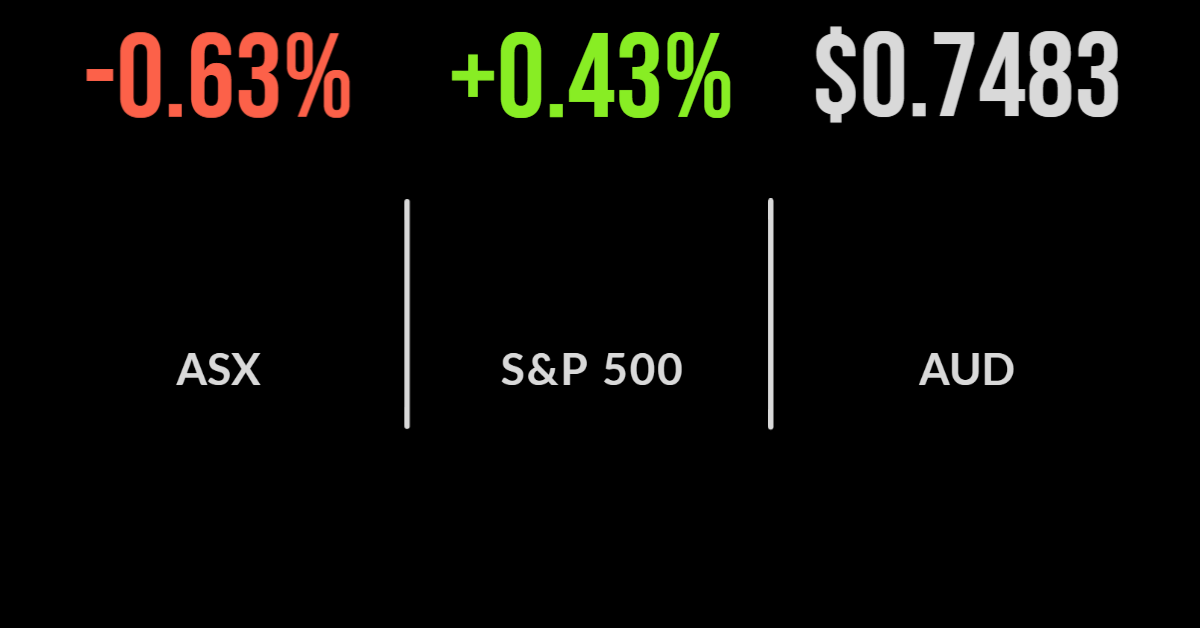

The threat of quantitative tightening extended to Australia on Thursday, with the S&P/ASX200 being dragged down another 0.6 per cent almost solely due to the technology sector.

Just three sectors finished higher during the session, being perceived defensive companies in the utilities and staples sector, with the technology sector falling another 3.4 per cent.

The majority of the top 10 losers on the day were from the sector, with WiseTech (ASX: WST) and Altium (ASX: ALU) down 6.6 and 3.8 per cent respectively.

The lithium sector appears to be tiring as well, as the likes of Novonix (ASX: NVX) and Liontown (ASX: LTR) fell by more than 6 per cent each despite little news flow.

Magellan (ASX: MFG) was the standout of the large caps, gaining 11.4 per cent after management confirmed only $1.1 billion in further redemptions were received in the final three weeks of March.

Assets remained at around $70 billion with the positive response likely to investors hopeful that outflows were beginning to slow.

Other companies perceived to provide ‘defensive’ earnings including Telstra (ASX: TLS) and Ramsay Healthcare (ASX: RHC) were beneficiaries of a search for safety gaining 0.8 per cent.

Ardent proceeds received, ASX competition coming, Virtus, Western Areas halted, GQG flows continue

Shares in theme park owner Ardent Leisure (ASX: ALG) gained more than 6 per cent after the group confirmed the sale of their US-domiciled Main Event business to Dave & Busters for US$835 million.

The company will use the proceeds to repay debt and return as much as $430 million of 90 cents per share to investors, compared to a current share price of $1.37.

The ASX (ASX: ASX) faced more pressure following another failure in 2022, with global leader CBOE announcing plans to further encroach on their exchange monopoly; shares were down close to 1 per cent.

Economists once again missed Australia’s trade surplus by a long way, with the surplus falling to $7.5 billion, around 30 per cent below the $11 billion predicted.

The driver was a jump in fuel imports and higher pricing and an associated reduction in exports.

GQG Partners (ASX: GQG) continued its stellar run of investment inflows following a strong quarter of outperformance by their global fund, US$3.4 billion was invested with Australian investors a key contributor.

Shares jumped 9 per cent but remain 25 per cent below their float price.

Both Virtus Health (ASX: VRT) and Western Areas (ASX: WSA) remain in trading halts with the former expecting another knockout bid and the latter looking at a renegotiation of the existing bid from IGO Group (ASX: IGO).

US markets stage mid-session rally, jobless claims lowest since 1968, Berkshire buys into HP

The US sharemarkets recovered as investors continue to digest the news that the Federal Reserve will seek to move rates about 3 per cent whilst reducing the size of their balance sheet by as much as US$1 trillion this year.

Bond markets don’t appear to believe comments that this will not trigger a recession, but equity markets were buoyed with the S&P500 outperforming, gaining 0.4 per cent, the Dow Jones 0.3 and the Nasdaq finished just positive.

10 and 30-year bond yields have moved beyond 2019’s highs ahead of an important earnings season ahead.

Shares in computer maker HP Inc. (NYSE: HPQ) jumped by close to 15 per cent after Berkshire Hathaway (NYSE: BRK.A) disclosed they had purchased an 11 per cent stake in the company, investing some of their massive cash holdings.

Challenger bank SoFi Technologies (NYSE: SOFI) fell by more than 7 per cent following the moratorium on student loan repayments, which will hit profits.

More defensive companies including Merck, Walgreens and Apple continue to outperform.