Tech rallies despite inflation data, unemployment hits 40 year low, assets fall at Netwealth and AE

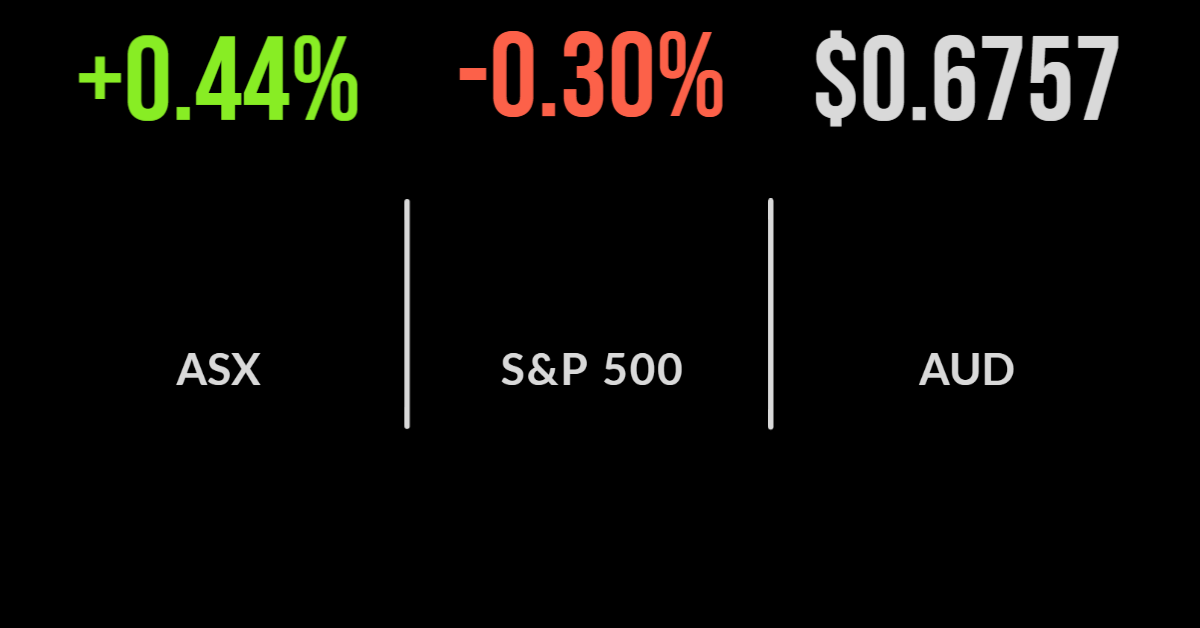

The local market managed another positive finish, gaining 0.4 per cent backed by an unexpected rally in the technology sector.

Nine of the 11 sectors gained, with technology 2.1 per cent higher, with only real estate and financials detracting, down 1.1 and 0.8 per cent each.

Shares in Netwealth (ASX: NWL) bucked the trend gaining 4.7 per cent after announcing a 3 per cent fall in assets under management for the quarter, primarily due to markets falling $4.5 billion.

Assets finished at $55.7 billion with record inflows of $13 billion for the financial year.

It was a similar story to Australian Ethical (ASX:AEF) which gained 1.3 per cent after reporting a 9 per cent fall in assets over the quarter to $6.2 billion, which was driven by market performance with the group bringing another $943 in inflows across the financial year.

EML Payments (ASX: EML) was the top performer of the day, reversing recent losses to finish 12.3 per cent higher with Lake Resources (ASX: LKR) still feeling the brunt of a short report, falling 10.4 per cent.

Unemployment boost, Telstra deal done, Aurizon deal waived through

Another 88,422 found jobs last month sending the unemployment rate to a 48-year low of 3.5 per cent with the participation rate also increased to a multi-year high of 66.8 per cent.

This likely comes as somewhat of a surprise with many concerns about recession, though it was met with calls for more rate hikes that continue to challenge the economy.

Telstra (ASX: TLS) has finally signed off on the USD$1.6 billion purchase of Digicel Pacific in partnership with the Australian Government following an uncertain political period in PNG. The company is contributing just US$270 million of equity.

Bega Cheese (ASX: BGA) delivered a long rumoured earnings downgrade, flagging higher milk prices in June and July as the key reason for a more than 10 per cent cut in earnings expectations to $160 to $190 million.

Management confirmed some costs had been passed onto customers but a 30 per cent rise in the cost of milk was too much to handle.

Aurizon (ASX: AZJ) fell 1.6 per cent after the ACCC confirmed it would not challenge the acquisition of One Rail’s coal hauling business on the east coast, this came at the same time that Whitehaven Coal (ASX: WHC) hit a 4 year high.

Markets mixed, banks drop on recession fears, JP Morgan cans buyback US markets were mixed after falling heavily at the open with the Nasdaq finished 0.03 per cent higher but the S&P500 slumping to a fifth straight day of losses, down 0.3 and the Dow Jones falling 0.5.

The latter was due to a continued selloff in the energy sector, down 3.9 per cent, turning what was the most popular sector into the most challenged.

Most of the focus was on JP Morgan (NYSE: JPM) and Morgan Stanley (NYSE: MS) the first of the banks to report.

The former recorded a 25 per cent fall in profit in the June quarter despite flat revenue and a jump in net interest income of 19 per cent.

Costs continue to bite and news that CEO Jamie Dimon had paused the buyback suggested the company is battening down the hatches in preparation for a weak economic environment.

Investment bank fees fell 54 per cent and the share price finished 4.1 per cent lower. Morgan Stanley had a similar issue, with profit down close to a third and revenue down less than 10 per cent as loan and fee income reduced.

Producer price inflation hit a record high above 11 per cent but when food and gas margins were excluded this fell to just 6.4 per cent.