The Future Fund already invests in Australia. Could it be asked to do more?

For those who have questioned the firewalls between the Future Fund’s Board of Guardians and its investment function, the Future Fund Management Agency (FFMA), the appointment of an industry super-linked former Labor warrior to one of the highest financial seats in the land has proven controversial.

Greg Combet’s appointment as chair comes at a time when the Albanese Government has been trying to get super funds on board with nation-building in an attempt to ease pressure on the Federal Budget as the enormous cost of infrastructural uplift and the transition to a low-carbon economy becomes clear. Now with a friendly chair, the grumbling goes, they might try and do the same with the Future Fund.

Alternative ideas for the Future Fund are thicker on the ground than usual. There’s Dimitri Burshtein’s plot to wind the whole thing up and use it to pay down government debt; the back-of-a-napkin plan to invest it in ‘decarbonisation’, an increasingly nebulous term that covers everything from venture capital to public equities, depending on who you’re asking and the day of the week; the Climate Capital Forum’s slightly more defined vision of revising the Future Fund’s mandate to include a “strategic national interest objective” alongside its risk-return mandate; and Andrew Bragg’s proposal to use the FFMA to manage a national default superannuation fund.

In all of this Treasurer Jim Chalmers never offered an unequivocal “no” to the idea that the Future Fund might operate differently in the future.

“We cherish the Future Fund’s independence and its commercial focus and we don’t want to mess with that,” Chalmers told media on Monday. “What we want to do here is make sure that the Future Fund is an important economic and financial institution into the future, the first step in ensuring that is to make sure we get fresh thinking and fresh leadership… and (the appointees) are well-placed to work with the government to consider the future role of the Future Fund, but to do that in a way that recognises its existing strengths.”

Is it likely that the Future Fund will be wound up so the government can splurge on wind and solar farms? No. Is it possible that the Future Fund will be asked to invest more in Australia? Yes.

Of course, investing in Australia is something it believes it already does by putting money into the public and private markets, a fair chunk of which finds its way to Australian companies; explicitly altering its mandate to do so would just mean the formalisation of an informal framework that much of the Future Fund’s management already believe they work within. And offsetting unfunded pension liabilities means there’s more money to be spent on the everyday Australian instead.

Still, it’s not a ridiculous notion that the investment expertise contained within the FFMA be put to work for the benefit of the everyday Australian in a more direct way. That’s probably why it’s already been put to work for the benefit of the everyday Australian in a more direct way with a host of ancillary funds, the proceeds of which are the responsibility of the government to direct.

You can still argue the toss on whether these ancillary funds are the best way of investing in their verticals, and whether it’s a good idea for the government to run what amount to leveraged funds. As David Murray wrote in his Centre for Independent Studies piece earlier this week, there’s perhaps a stronger case for winding them up given they represent a distraction from the Future Fund’s core mandate. But the establishment of many of those funds – which cover drought preparedness, housing affordability, and medical research among other things – was relatively uncontroversial, and the idea of another appears to be uncontroversial to Future Fund CEO Raphael Arndt.

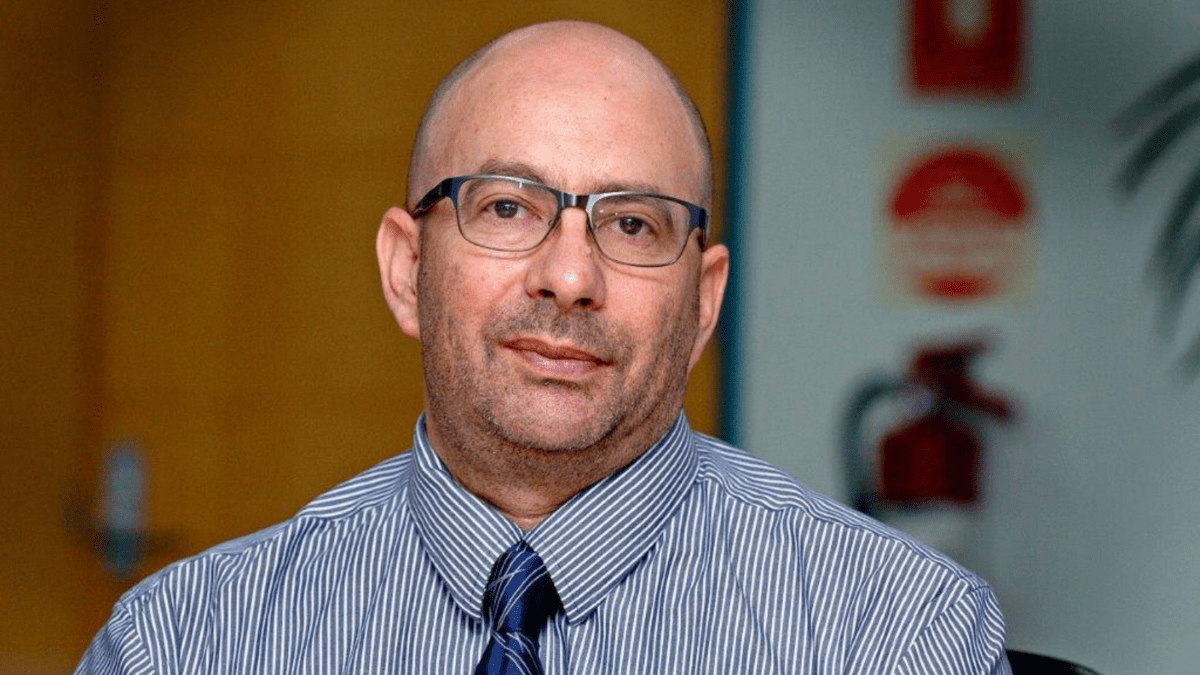

“I think it’s really important that the Future Fund mandate stays pure,” Arndt told media last week. “For almost 18 years the investment mandate has been very clear; it isn’t directive in terms of what we should invest in and it does focus on returns and risk management. And that’s very helpful as a long-term investor.

“Now, having said all of that, obviously the FFMA has the competency and skill and can and will assist the government in thinking about those things as a market practitioner. If the government was so inclined to give us a mandate to look at any particular area with a separate pool of money, we could do that.”