Three reasons the UK market could be headed for better times

The Labour Party’s 1997 election theme song feels like a timely nod to the current attractions of the UK equity market, for so long the wallflower at the global equity party.

The UK stock market is cheap – if you focus solely on valuation rather than growth. Sitting on about a 12x price/earnings ratio, compared to 17x for global equities and 21x for US markets. But the UK has been ‘cheap’ for many years. So what’s different now?

First, other investors are noticing the attractions of UK equities. In the first five months of this year we’ve seen over £60bn of bids for UK listed companies. A threefold increase in M&A activity compared to the whole of 2023, with an average bid premium of over 30 per cent. And for once it’s not just private equity, corporate bidders represent more than two thirds of this year’s bid activity by value.

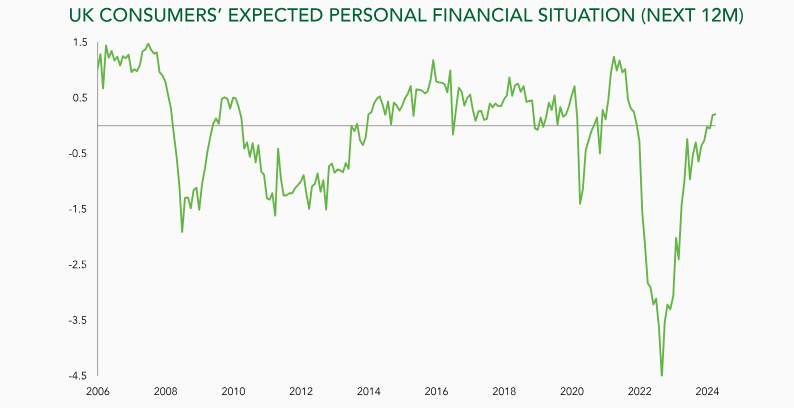

Second, the outlook for the domestic economy looks like it’s improving. This chart shows UK consumers’ perceptions of their likely financial position over the next 12 months. Two things standout immediately. Just how catastrophically the cost of living/inflation/mortgage crisis hit consumers – perceived as far worse than either the 2008 financial crisis or covid, and then quite how rapidly perceptions have improved recently. The outlook for the domestic economy does appear to be brightening, driven largely by rising real wages. This should be good news for UK companies, and sterling too, though it does raise doubts over how quickly the Bank of England should be cutting interest rates.

Finally, for many years a key disadvantage for the UK stock market has been its high exposure to commodities and financials, rather than growth or technology. Might this now turn into an advantage? Our research suggests commodities are the best performing asset class in periods of elevated inflation. If we are right in predicting a more inflationary future, then commodities may be the next big thing. Copper, gold and silver have all outstripped the S&P 500 so far this year, with silver up over 25 per cent since the end of March. Meanwhile global commodity giant BHP has (now unsuccessfully) bid over £37bn for fellow miner Anglo American. Could this be the start of a new trend?

At the same time, normalised interest rates accompanied by a better-than-expected economic outlook, both domestically and internationally, have delivered a boost to beleaguered bank stocks. NatWest and Barclays are both up over 40 per cent year to date.

A recovery in the relative fortunes of the UK stock market has been predicted many times before, but almost always based solely on valuation grounds. Today we can see additional catalysts that could boost the UK market. We have a very cautious view on global equities at Ruffer but have been adding to our UK exposure which now represents about 40 per cent of our equity allocation.